EDACafe Editorial Roberto Frazzoli

Roberto Frazzoli is a contributing editor to EDACafe. His interests as a technology journalist focus on the semiconductor ecosystem in all its aspects. Roberto started covering electronics in 1987. His weekly contribution to EDACafe started in early 2019. EDA in geopolitical tensions; new fabs and plants; processor market updatesAugust 26th, 2022 by Roberto Frazzoli

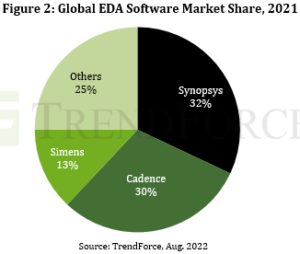

Catching up on some of the latest news after a summer break, two significant updates concern EDA as the subject of geopolitical tensions between China and the Western countries. More news in this week’s article includes new fab and packaging plant announcements – some of which spurred by the recently passed U.S. ‘CHIPS and Science Act’ – as well as updates concerning the processor market. U.S. export controls on EDA tools for GAA transistor design On August 12 the U.S. Commerce Department’s Bureau of Industry and Security issued a rule that establishes new export controls on four “emerging and foundational technologies” that are considered essential to the national security of the United States. Among them, two substrates of ultra-wide bandgap semiconductors – gallium oxide (Ga2O3) and diamond – and electronic CAD software specially designed for the development of integrated circuits with Gate-All Around Field-Effect Transistor structure. Ban on GAA design tools a potential problem for China, says TrendForce According to market research firm TrendForce, this new U.S. EDA software ban may actually affect China’s advanced IC design. The analysts observe that the three major U.S. EDA players (Synopsys, Cadence, and Siemens) account for a total 75% market share, and that Empyrean Technology – the leader of China’s EDA industry – has not yet touched upon GAA research and development. TrendForce also notes that even if China purchased a large amount of authorized EDA software before the current sanction takes effect, the United States could block its use by remotely denying license updates. In conclusion, according to TrendForce, without U.S. EDA tools, Chinese IC design – as well as Chinese foundries – will experience difficulties developing advanced 3-nanometer process design.

Chinese company blocked from acquiring UK-based Pulsic The UK government has reportedly blocked Shanghai-based Super Orange HK Holding from buying UK-based EDA vendor Pulsic, on the grounds of national security. Research conducted by Bloomberg showed that Super Orange is controlled by Shanghai UniVista Industrial Software Group, backed by China’s National Integrated Circuit Industry Investment Fund. Reportedly, UniVista’s co-CEOs are the former head of Cadence’s Chinese business, and the former head of Synopsys’ China and Asia-Pacific business. New fabs and packaging plants: Intel, Micron, SK Hynix According to a Reuters report, Italy is close to signing a deal initially worth $5 billion with Intel to build an advanced semiconductor packaging and assembly plant in the country. Intel and the government have reportedly shortlisted possible sites in two Italian regions, Piedmont and Veneto. Intel has announced a Semiconductor Co-Investment Program (SCIP) that introduces a new funding model to the capital-intensive semiconductor industry. As part of its program, Intel has signed an agreement with the infrastructure affiliate of Brookfield Asset Management, which will provide the processor vendor with a new, expanded pool of capital. The companies will jointly invest up to $30 billion in Intel’s manufacturing expansion at its Ocotillo campus in Chandler, Arizona, with Intel funding 51% and Brookfield funding 49% of the total project cost. Intel will retain majority ownership and operating control of the two new chip factories. U.S. memory maker Micron Technology has announced its plans to invest $40 billion through the end of the decade to build leading-edge memory manufacturing in multiple phases in the U.S. The company plans to use the anticipated grants and credits made possible by the ‘CHIPS and Science Act’. Micron expects to begin production in the second half of the decade. Fab locations have not been disclosed yet. South Korea’s SK Hynix reportedly aims to select a U.S. site for its advanced chip packaging plant, and start construction around the first quarter of next year. The plant, whose estimated cost would be “several billions,” would ramp up to mass production by 2025-2026 and employ about 1,000 workers. The packaging facility would package SK Hynix’s memory chips with logic chips designed by U.S. companies for machine learning and artificial intelligence applications. The sources quoted by Reuters said the chip packaging plant would qualify for funding provided by the U.S. ‘CHIPS and Science Act’. Qualcomm reportedly planning return to server market Qualcomm is reportedly considering a return to the server market with a new chip, aiming to decrease its reliance on smartphone applications. The chipmaker is seeking customers for a product stemming from its purchase of processor startup Nuvia. Amazon Web Services (AWS) has reportedly agreed to take a look at Qualcomm’s offerings. Second quarter 2022 results: Intel vs AMD A new competitor in the server processor market could be an additional problem for Intel, which has recently reported unsatisfactory results for the second quarter of 2022 – with a GAAP revenue of $15.3 billion, down 22% year over year, and a net quarterly loss. Main reason for these numbers was the decline in revenues from the Client Computing Group (PC business), down 25%, and from the Datacenter and AI Group, down 16%. In contrast, for its corresponding business units – client segment and datacenter segment – AMD reported second quarter revenue growth of 25% and 83% year over year, respectively. Overall, in the second quarter of 2022 AMD posted a revenue of $6.6 billion – up 70% year over year – and a net income of $447 million. As for Intel results, comments from CEO Pat Gelsinger and CFO Dave Zinsner on second quarter 2022 earnings can be found here. Acquisitions Infineon has acquired the Berlin-based startup Industrial Analytics, specializing in artificial intelligence for predictive analysis relating to machinery and industrial equipment. Navitas Semiconductor, a provider of gallium nitride power ICs, has acquired GeneSiC Semiconductor, a provider of silicon carbide power devices. According to the two U.S.-based companies, GaN and SiC devices are often complementary, targeting different power applications. Recent and upcoming events An interesting review of the recent Flash Memory Summit has been posted by TechInsights’ memory expert Dr. Jeongdong Choe. Below, a quick summary of upcoming events. TSMC Taiwan Technology Symposium, August 30, Taiwan. D&R IP SoC China 22, virtual event, September 7. AI Hardware/Edge AI Summit, September 13 – 15, Santa Clara, CA. IESF Automotive Conference 2022, September 14, Plymouth, MI. 2022 RISC-V Taipei Day, September 15, Taipei. SPIE Photomask Technology/Extreme Ultraviolet Lithography, September 25 – 29, Monterey, CA. |

|

|

|||||

|

|

|||||

|

|||||