Archive for February, 2019

Friday, February 22nd, 2019

Despite increasing development costs, IC manufacturers continue to make great strides.

The advancement of the IC industry hinges on the ability of IC manufacturers to continue offering more performance and functionality for the money. As mainstream CMOS processes reach their theoretical, practical, and economic limits, lowering the cost of ICs (on a per-function or per-performance basis) is more critical and challenging than ever. The 500-page, 2019 edition of IC Insights’ McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2019) shows that there is more variety than ever among the logic-oriented process technologies that companies offer. Figure 1 lists several of the leading advanced logic technologies that companies are presently using. Derivative versions of each process generation between major nodes have become regular occurrences.

Figure 1 (more…)

Tags: Foundry Market, global foundry, globalfoundaries, intel, McClean Report, samsung, Semiconductors, smic, tsmc, umc

No Comments »

Thursday, February 14th, 2019

China shows biggest increase, nearly matching North America with 12

IC Insights recently released its new Global Wafer Capacity 2019-2023 report that provides in-depth detail, analyses, and forecasts for IC industry capacity by wafer size, process geometry, region, and product type through 2023. Figure 1 shows the world’s installed monthly wafer production capacity by geographic region (or country) as of December 2018. Each number represents the total installed monthly capacity of fabs located in that region regardless of the headquarters location of the company that own the fab(s). For example, the wafer capacity that South Korea-based Samsung has installed in the U.S. is counted in the North America capacity total, not in the South Korea capacity total. The ROW “region” consists primarily of Singapore, Israel, and Malaysia, but also includes countries/regions such as Russia, Belarus, and Australia.

Figure 1 (more…)

Tags: McClean Report, Semiconductors, wafer, Wafer Capacity

No Comments »

Friday, February 8th, 2019

However, China’s indigenous IC production is still likely to fall far short of government targets.

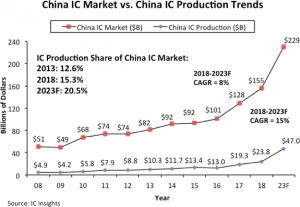

China has been the largest consuming country for ICs since 2005, but large increases in IC production within China have not immediately followed, according to data presented in the new 500-page 2019 edition of IC Insights’ McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2019). As shown in Figure 1, IC production in China represented 15.3% of its $155 billion IC market in 2018, up from 12.6% five years earlier in 2013. Moreover, IC Insights forecasts that this share will increase by 5.2 percentage points from 2018 to 20.5% in 2023.

Figure 1 Currently, China-based IC production is forecast to exhibit a very strong 2018-2023 CAGR of 15%. However, considering that China-based IC production was only $23.8 billion in 2018, this growth is starting from a relatively small base. In 2018, SK Hynix, Samsung, Intel, and TSMC were the major foreign IC manufacturers that had significant IC production in China. In fact, SK Hynix’s 300mm China fab had the most installed capacity of any of its fabs in 2018 at 200,000 wafers per month (full capacity).

(more…)

No Comments »

Friday, February 1st, 2019

3D die-stacking technologies, manufacturing barriers, and growing complexities in end-use systems among the technical challenges that are expected to lift R&D growth rates through 2023.

The semiconductor business is defined by rapid technological changes and the need to maintain high levels of investment in research and development for new materials, innovative manufacturing processes for increasingly complex chip designs, and advanced IC packaging technologies.

However, since the 1980s, the long-term trend has been toward a slowdown in the annual growth rate of research and development expenditures according to data presented in the new, 2019 edition of IC Insights’ McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2019). Consolidation in the semiconductor industry has been a big factor contributing to lower growth rates for R&D expenditures so far this decade. In the most recent five-year span from 2013-2018, semiconductor R&D spending grew by CAGR of 3.6% per year, essentially unchanged from the 3.3% experienced from 2008-2013 (Figure 1).

Figure 1 IC Insights expects new challenges such as three-dimensional (3D) die-stacking technologies, growing complexities in end-use applications, and other significant manufacturing barriers to raise semiconductor R&D spending to a slightly higher growth rate of 5.5% per year in the 2018-2023 forecast period.

(more…)

No Comments »

|