Chinese companies log fastest growth since 2010 and now hold a 13% share of fabless IC sales.

IC Insights published its updated 2019-2023 semiconductor market forecasts and top-40 IDM and top-50 fabless IC company sales rankings in its recently released March Update, the first monthly Update to the 500-page, 2019 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry.

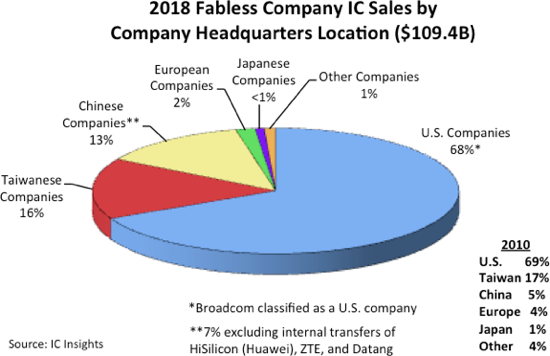

Figure 1 depicts the 2018 fabless company share of IC sales by company headquarters location. With 68%, the U.S. companies continued to hold the dominant share of fabless IC sales last year, just one percentage point less than in 2010.

2018 Fabless Company IC sales by company HQ location