Catching up on some of the latest news after a summer break, two significant updates concern EDA as the subject of geopolitical tensions between China and the Western countries. More news in this week’s article includes new fab and packaging plant announcements – some of which spurred by the recently passed U.S. ‘CHIPS and Science Act’ – as well as updates concerning the processor market.

U.S. export controls on EDA tools for GAA transistor design

On August 12 the U.S. Commerce Department’s Bureau of Industry and Security issued a rule that establishes new export controls on four “emerging and foundational technologies” that are considered essential to the national security of the United States. Among them, two substrates of ultra-wide bandgap semiconductors – gallium oxide (Ga2O3) and diamond – and electronic CAD software specially designed for the development of integrated circuits with Gate-All Around Field-Effect Transistor structure.

Ban on GAA design tools a potential problem for China, says TrendForce

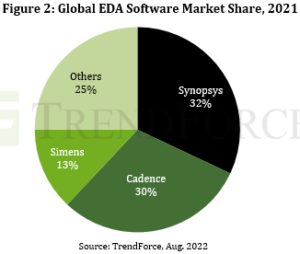

According to market research firm TrendForce, this new U.S. EDA software ban may actually affect China’s advanced IC design. The analysts observe that the three major U.S. EDA players (Synopsys, Cadence, and Siemens) account for a total 75% market share, and that Empyrean Technology – the leader of China’s EDA industry – has not yet touched upon GAA research and development. TrendForce also notes that even if China purchased a large amount of authorized EDA software before the current sanction takes effect, the United States could block its use by remotely denying license updates. In conclusion, according to TrendForce, without U.S. EDA tools, Chinese IC design – as well as Chinese foundries – will experience difficulties developing advanced 3-nanometer process design.