EDACafe Editorial Roberto Frazzoli

Roberto Frazzoli is a contributing editor to EDACafe. His interests as a technology journalist focus on the semiconductor ecosystem in all its aspects. Roberto started covering electronics in 1987. His weekly contribution to EDACafe started in early 2019. AV market consolidation; Indy AV race; solid-state batteries; acquisitionsNovember 1st, 2021 by Roberto Frazzoli

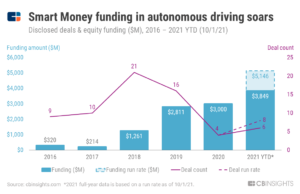

Global scrutiny of the Nvidia-Arm deal continues: adding to a list of other authorities, European Union regulators have reportedly opened an investigation over concerns of limited competition. The EU Commission said Nvidia had offered concessions to address preliminary concerns, but that they weren’t enough. A decision from European regulators is expected within March 15. As for the other news updates this week, several of them concern autonomous vehicles – including two acquisitions of radar specialist companies. Autonomous driving tech market is consolidating According to market intelligence firm CB Insights, a few key players are emerging in autonomous driving technology, and the market is consolidating around major companies like Waymo and Aurora. Every round backed by top venture capital firms in the AV market over the last two years has been Series C or later. This indicates that – as the AV market consolidates – the top VCs monitored by CB Insights “are focusing on the winners, seeing stronger potential for leading self-driving developers rather than early-stage companies.” Another sign of consolidation is the move from many deals to just a few big ones: total funding to autonomous driving companies spiked in 2018, but “since then, deal count has declined significantly as total funding continues to rise.” The majority of the funding by top VCs in AVs over the last two years “has come from just two mega-rounds ($2.25B in 2020 and $2.5B in 2021) to Waymo.” According to CB Insights, the top venture capital firms are now backing companies working on simulation and training, developing the full self-driving stack, enhancing mapping and localization, and more. “Total equity funding to the space has already eclipsed $12B in 2021, up more than 50% from all of 2020,” the analysts elaborated. The selected top VCs monitored by CB Insights “have participated in a record-breaking $3.85B of total funding to autonomous driving companies so far in 2021, with the total projected to be above $5.1B by year end if the trend continues.”

Autonomous driving racecar reaches 218 kilometers per hour Technische Universität München (TUM) has won the Indy Autonomous Challenge, the first autonomous racecar competition at the Indianapolis Motor Speedway. TUM competed in a field of nine teams from twenty-one universities to win the $1 million grand prize. The rules of the challenge required each team to compete in a fastest lap competition that included an obstacle avoidance component. The winning team recorded the fastest 2-lap average speed of approximately 136 mph, or 218 kilometers per hour. According to a media report, the race committee originally hoped that the teams could achieve a multi-car, head-to-head race. However, there just wasn’t enough testing time during the 2021 event to reach this goal. As a result, the race committee changed the rules for the final event to be a time trial and obstacle avoidance contest. All teams had been provided with identical cars built by Dallara; also identical were LiDAR, radar, vision cameras, etc. Key to the competition, then, was the software ability to perform sensor fusion for a vehicle moving at high speed. Three teams crashed their vehicles, and two teams didn’t make it out of the pits. Always fun to see – in this short video – a Boston Dynamic’s robot waving the checkered flag. SK Innovation planning to deliver solid-state batteries by 2025 SK Innovation reportedly plans to get two years or more ahead of its rivals and deliver solid-state batteries by 2025. The company intends to use a nickel-cobalt-manganese cathode and anode based on silicon or graphite. It also seeks to deliver a battery with a lithium-metal anode by 2030. In a separate announcement, South Korean SK Group has reportedly disclosed its intention to build a factory in Covington, east of Atlanta, to make glass substrates for chips, using a technology developed at Georgia Tech. The company expects to invest $473 million and hire 400 workers. TileLink NoC silicon IP for Risc-V Indian verification IP vendor Truechip has introduced a network-on-chip silicon IP supporting the TileLink protocol, targeted at Risc-V-based designs. Current version supports TileLink UL and UH conformance levels; the next version of the silicon IP will also include support for TL-C (cache coherency) conformance level. Acquisitions Ambarella has entered into a definitive agreement to acquire Ohio-based Oculii. Oculii’s adaptive AI software algorithms are designed to enable radar perception using current production radar chips to achieve significantly higher (up to 100X) resolution, longer range and greater accuracy. According to the company, these improvements eliminate the need for specialized high-resolution radar chips. Oculii’s software can be deployed on Ambarella’s existing CVflow SoCs. indie Semiconductor (Aliso Viejo, CA) has executed a definitive agreement with Analog Devices to purchase Symeo, ADI’s Munich-based radar division consisting of approximately 35 team members specializing in radar hardware and software development for applications such as ADAS and autonomous vehicles. Renesas has acquired Celeno, an Israel-based supplier of wireless communication solutions, including Wi-Fi chipsets and software, for home networks, smart buildings, enterprise and industrial markets. Celeno’s Wi-Fi Doppler Imaging technology tracks and analyzes the motion and location of people and objects using standard Wi-Fi. According to the company, this eliminates the need for multiple cameras or sensors in home environments and commercial buildings. Japanese ATE manufacturer Advantest has entered into an agreement to acquire US based R&D Altanova (South Plainfield, New Jersey), a supplier of consumable test interface boards, substrates and interconnects for high-end applications. The company offers simulation, design, layout, fabrication and assembly of test interface boards which are used by testing equipment in the testing of advanced integrated circuits. R&D Altanova will become a wholly owned subsidiary of Advantest America. Upcoming events Si2 will launch its Titan initiative with a virtual event on November 3rd. Titan (Technical Interoperability Trajectory Advisory CouNcil) is a collaborative group of industry thought leaders that will help enable silicon-to-systems solutions for critical vertical markets. The event will feature presentations from select Titan founding members: Si2, Globalfoundries, Intel, Ansys, Qualcomm. |

|

|

|||||

|

|

|||||

|

|||||