EDACafe Editorial Roberto Frazzoli

Roberto Frazzoli is a contributing editor to EDACafe. His interests as a technology journalist focus on the semiconductor ecosystem in all its aspects. Roberto started covering electronics in 1987. His weekly contribution to EDACafe started in early 2019. IC market forecasts; new edge AI chips; automotive softwareNovember 30th, 2020 by Roberto Frazzoli

The so-called ‘semiconductor renaissance’ is tightly related to the artificial intelligence boom, so this week the latest IC market growth figures fit well with the updates about new edge AI chips from well-funded startups. Automotive software is also making news, along with some last-minute additions to the virtual events calendar. Intel still number one semiconductor supplier in 2020 According to the latest forecast from market research firm IC Insights, Intel will keep its number one semiconductor supplier ranking in 2020. As noted by the analysts, this year the Covid-19 pandemic spurred an acceleration of the worldwide digital transformation resulting in a robust semiconductor market growth. In total, the top-15 semiconductor companies’ sales are forecast to jump by 13% in 2020 compared to 2019. In contrast, in 2019 the top-15 semiconductor suppliers registered a collective 15% decline in sales. IC Insights expects two new entrants into the top-15 semiconductor sales ranking for this year: MediaTek and AMD. Forecasted sales increases for these companies are 35% and 41%, respectively. Peculiar to this list is the inclusion of Apple – which uses its chips only in its own products – and of foundries like TSMC – which mean that some sales are double counted.

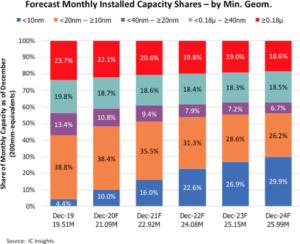

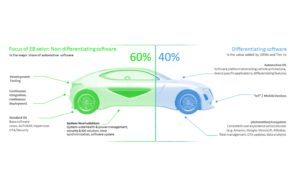

Advanced node wafer capacity growing fast Another research from IC Insights forecasts wafer capacity for leading-edge (<10nm) processes to grow and become the largest portion of monthly installed capacity across the industry beginning in 2024. At the end of 2020, <10nm capacity is expected to account for 10% of the IC industry’s total wafer capacity. IC Insights, however, warns that “what constitutes a [technology] generation and how to measure the minimum process geometry gets more difficult every year.” Other findings from the same report include that South Korea, with 66% of its capacity dedicated to <20nm process technology, remains significantly more leading-edge focused than the other regions or countries, mainly due to Samsung and SK Hynix. Edge AI accelerators update: Deep Vision, Innatera, Mythic A startup called Deep Vision (Los Altos, CA) has recently emerged from stealth mode and launched its ARA-1 inference processor, targeted at AI vision applications at the edge such as cameras, sensors, as well as edge servers. The ARA-1 processor is based on a patented ‘Polymorphic Dataflow Architecture’, aimed at minimizing on-chip data movement. The architecture supports instructions within each of the neural network models, which allows for optimally mapping any dataflow pattern within a deep learning model. The compiler automatically evaluates multiple data flow patterns for each layer in a neural network and chooses the highest performance and lowest power pattern. According to the company, the new processor has a two watts typical power consumption and runs Resnet-50 at a 6x improved latency than Edge TPU and 4x improved latency than MyriadX. Deep Vision also claims that its software development kit simplifies the migration process from the training model to the production application, reducing the need for code writing. The company has raised $19 million from multiple investors, including Silicon Motion, Western Digital, Stanford, Exfinity Ventures, and Sinovation Ventures. A new Dutch neuromorphic processor company called Innatera Nanosystems, a spin-off of the Delft University of Technology, has raised €5M in seed funding to develop a processor targeting sensors and sensor-based devices for pattern recognition applications at the edge. Besides choosing the neuromorphic (spike-based) approach, the startup is using analog-mixed signal computing circuits. Innatera claims an unprecedented combination of ultra-low power and ultra-short recognition latency, with up to 10,000x higher performance per watt than typical digital processors and conventional AI accelerators. The €5M seed investment round was led by German investors MIG and btov Partners. And Mythic (Redwood City, CA) has recently announced what it claims to be “the industry’s first Analog Matrix Processor” (AMP), also targeting edge AI applications. Key feature of the product is an Analog Compute Engine that eliminates the memory bottlenecks by performing matrix multiplication directly inside the flash memory array itself. Called M1108, the new processor integrates 108 AMP tiles, each with an Analog Compute Engine featuring an array of flash cells and ADCs, a 32-bit Risc-V nano-processor, a SIMD vector engine, SRAM, and a Network-on-Chip router. The M1108 claims up to 35 TOPS, a typical power consumption of approximately four watts, and a significant cost advantage over comparable digital architectures being fabricated in a 40-nanometer technology. The processor will be available in both PCIe M.2 and PCIe card form-factors. Integrated software platform aims to cut automotive engineering costs Elektrobit, a German supplier of embedded and connected software products for the automotive industry, has announced a software platform designed to streamline the development of automotive electronics architectures based on high-performance computing. Called EB xelor, the platform provides car makers and Tier 1 suppliers a software foundation, allowing them to focus less on automotive infrastructure and more on differentiating features and functions. EB xelor integrates a functional safety software stack based on Linux and Adaptive Autosar, a real-time and safety software stack based on Classic Autosar using ‘EB tresos’ – a hypervisor – plus software for HPC updates and platform health management capabilities. It also includes tools and services to automate builds and facilitate integration. The EB xelor platform is optimized for HPC environments using SoC devices from NXP and Renesas. Car makers can then add their own vehicle-specific software on top of these stacks. Elektrobit estimates that using this platform – instead of sourcing and integrating these elements on their own – car makers can obtain savings of up to 30% in overall engineering costs. Immediately upcoming events On December 1st, from 9:15 am to 2:00 pm Central European Time, Mentor will be holding the European edition of its User2User virtual conference, with a rich program of technical papers. Also on December 1st, from 5:30 to 7:00 pm Pacific time, Silicon Catalyst will host its virtual Semiconductor Industry Forum, a panel of experts from the industry and the financial investors community discussing trends and challenges. |

|

|

|||||

|

|

|||||

|

|||||