Posts Tagged ‘wafer’

Thursday, July 15th, 2021

As a percent of worldwide total, China achieves largest increase in fab capacity at expense of all other regions, but still trails Taiwan, South Korea, and Japan in installed capacity.

IC Insights’ Global Wafer Capacity 2021-2025 report breaks out the world’s installed monthly wafer capacity by geographic region (or country). Figure 1 shows the installed capacity by region as of December of 2020.

To clarify what the data represents, each regional number is the total installed monthly capacity of fabs located in that region regardless of the headquarters location for the companies that own the fabs. For example, the wafer capacity that South Korea-based Samsung has installed in the U.S. is counted in the North America capacity total, not in the South Korea capacity total. The ROW “region” consists primarily of Singapore, Israel, and Malaysia, but also includes countries/regions such as Russia, Belarus, and Australia.

Figure 1

(more…)

Tags: China, Europe, Japan, Korea, North America, ROW, taiwan, wafer

No Comments »

Thursday, February 14th, 2019

China shows biggest increase, nearly matching North America with 12

IC Insights recently released its new Global Wafer Capacity 2019-2023 report that provides in-depth detail, analyses, and forecasts for IC industry capacity by wafer size, process geometry, region, and product type through 2023. Figure 1 shows the world’s installed monthly wafer production capacity by geographic region (or country) as of December 2018. Each number represents the total installed monthly capacity of fabs located in that region regardless of the headquarters location of the company that own the fab(s). For example, the wafer capacity that South Korea-based Samsung has installed in the U.S. is counted in the North America capacity total, not in the South Korea capacity total. The ROW “region” consists primarily of Singapore, Israel, and Malaysia, but also includes countries/regions such as Russia, Belarus, and Australia.

Figure 1 (more…)

Tags: McClean Report, Semiconductors, wafer, Wafer Capacity

No Comments »

Thursday, March 1st, 2018

150mm and 200mm wafer fabs accounted for two-thirds of total closures.

Since the global economic recession of 2008-2009, the IC industry has been on a mission to pare down older capacity (i.e., ≤200mm wafers) in order to produce devices more cost-effectively on larger wafers. The spree of merger and acquisition activity and the migration to producing IC devices using sub-20nm process technology has also led suppliers to eliminate inefficient wafer fabs. From 2009-2017, semiconductor manufacturers around the world have closed or repurposed 92 wafer fabs, according to data compiled, updated, and now available in IC Insights’ Global Wafer Capacity 2018-2022 report.

Figure 1 shows that since 2009, 41% of fab closures have been 150mm fabs and 26% have been 200mm wafer fabs. 300mm wafer fabs have accounted for only 10% of total fab closures since 2009. Qimonda was the first company to close a 300mm wafer fab after it went out of business in early 2009.

Figure 1

Figure 1 (more…)

Tags: Fab, wafer

No Comments »

Thursday, February 8th, 2018

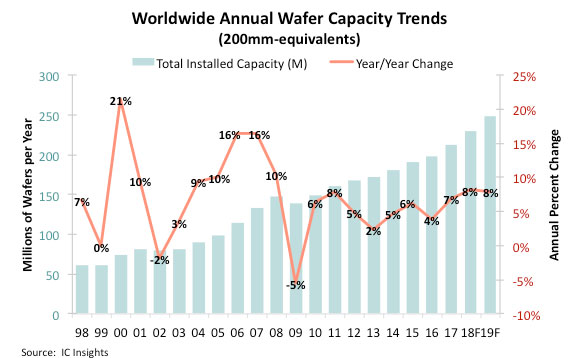

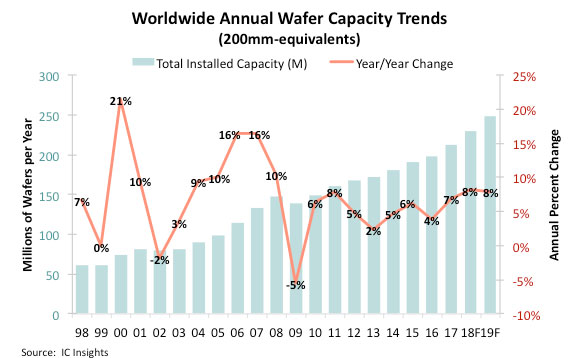

Wafer capacity growth of 8% forecast for 2018 and 2019 versus 4.8% average yearly growth from 2012-2017.

IC industry wafer capacity, specifically in the memory segment, was inadequate to meet demand throughout 2017. However, with Samsung, SK Hynix, Micron, Intel, Toshiba/WD, and XMC/Yangtze River Storage Technology planning to significantly ramp up 3D NAND flash capacity over the next few years, and Samsung and SK Hynix boosting DRAM capacity this year and next, what does this mean for total industry capacity growth? In its 2018-2022 Global Wafer Capacity report, IC Insights shows that new manufacturing lines are expected to boost industry capacity 8% in both 2018 and 2019 (Figure 1). From 2017-2022, annual growth in IC industry capacity is forecast to average 6.0% compared to 4.8% average growth from 2012-2017.

Figure 1

Large swings in the addition or contraction of wafer capacity by the industry, as a whole, appear to be moderating. Since 2010, annual changes in wafer capacity volume have been in the relatively narrow range of 2-8%, with the largest year-to-year difference being just three percentage points. This suggests that IC manufacturers are better today than in years past about trying to match supply with demand. It’s still an incredibly difficult task for companies to gauge how much capacity will be needed to meet demand from customers, especially given the time it takes a company to move from the decision to build a new fab to that fab being ready for mass production.

(more…)

Tags: IC manufacturing, ICManufacturing, Semiconductors, wafer

No Comments »

|