Posts Tagged ‘tsmc’

Tuesday, March 1st, 2022

2020-2022 expected to be the first 3-year period of double-digit capex growth since 1993-1995.

Figure 1 shows that after surging 36% in 2021, semiconductor industry capital spending is forecast to jump 24% in 2022 to a new all-time high of $190.4 billion, up 86% from just three years earlier in 2019. Moreover, if capital spending increases by ≥10% in 2022, it would mark the first three-year period of double-digit spending increases in the semiconductor industry since the 1993-1995 timeperiod.

Figure 1

(more…)

Tags: DRAM, Forecast, IC manufacturing, ICManufacturing, McClean Report, NAND, NVIDIA, NXP, ON Semi, Optoelectronics, qualcomm, samsung, Semiconductors, SK Hynix, Sony, ST, TI, toshiba, tsmc, umc

No Comments »

Friday, September 10th, 2021

Memory suppliers, Sony, and TSMC benefitting from strong demand and supply shortages.

IC Insights’ recently released its compilation of third-quarter sales growth expectations for the top-25 semiconductor suppliers. For the third quarter of this year (ending in September), sales growth outlooks for the top-25 suppliers range from 16th-ranked Sony’s 34% increase at the high end, to Intel’s 3% decline on the low end.

Third-quarter growth expectations for the top-15 suppliers are shown in Figure 1. In advance of an expected surge in demand for 5G smartphones during the upcoming holiday season, Qualcomm and Apple anticipate significant increases in their 3Q21 semiconductor sales. Also, the big three memory IC suppliers—Samsung, SK Hynix, and Micron—are each expected to post a 10% increase and Kioxia is anticipated to show an 11% jump in 3Q21 sales as demand remains strong for memory in data center servers, enterprise computing, and for 5G smartphones and related infrastructure.

(more…)

Tags: AMD, Apple, Broadcom, ICManufacturing, Infineon, intel, Kioxia, MediaTek, micron, NVISDIA, NXP, qualcomm, Semiconductors, SK Hynix, SKY Hynix, smasung, ST, TI, tsmc

No Comments »

Tuesday, May 25th, 2021

Excluding Intel, the group would have shown a 29% jump in 1Q21/1Q20 sales.

IC Insights released its May Update to the 2021 McClean Report last week. This Update included a discussion of the 1Q21 IC industry market results, an updated quarterly forecast for the remainder of this year, and a look at the top-25 1Q21 semiconductor suppliers. The top-15 1Q21 semiconductor suppliers are covered in this research bulletin.

The top-15 worldwide semiconductor (IC and O S D—optoelectronic, sensor, and discrete) sales ranking for 1Q21 is shown in Figure 1. It includes eight suppliers headquartered in the U.S., two each in South Korea, Taiwan and Europe, and one in Japan. The ranking includes six fabless companies (Qualcomm, Broadcom, Nvidia, MediaTek, AMD, and Apple) and one pure-play foundry (TSMC).

Figure 1

(more…)

Tags: AMD, Apple, Broadcom, foundry, Infineon, intel, Kioxia, McClean Report, MediaTek, NVIDIA, NXP, qualcomm, TI, tsmc

No Comments »

Thursday, June 4th, 2020

Six companies expect an increase in 2Q sales while 15 companies anticipate flat or declining sales.

As part of its May Update to the 2020 McClean Report, IC Insights compiled a list of semiconductor companies that have provided 2Q20 sales guidance. The list included companies from across all geographic regions and all product categories.

Because of uncertainty regarding the impact of Covid-19 on business in the second half of this year, many semiconductor companies have not provided full year 2020 guidance. However, several provided an outlook for 2Q20 (Figure 1). Of those that issued quarterly guidance, most expanded the range of their projections to be wider than normal due to uncertainty surrounding the impact of the coronavirus pandemic. The numbers shown in Figure 1 represent the mid-point of the guidance.

Collectively, the 21 companies on the list anticipate a sequential sales decline of 5% in the second quarter of 2020. Despite tentative economic conditions, six companies expect to see their sales rise in 2Q, and 15 anticipate a sales decline.

(more…)

Tags: AMD, Analog Devices, Infineon, intel, Media tek, Microchip, NVIDIA, NXP, ON Semi, Qorvo, qualcomm, Renesas, Rohm, skyworks, smic, ST, TI, tsmc, umc, WD/SanDisk, Xilinx

No Comments »

Monday, November 18th, 2019

Sony tops among only three top-15 semiconductor suppliers to show growth this year.

IC Insights’ November Update to the 2019 McClean Report, released later this month, includes a discussion of the forecasted top-25 semiconductor suppliers in 2019 (the top-15 2019 semiconductor suppliers are covered in this research bulletin). The Update also includes a detailed five-year forecast of the IC market by product type (including dollar volume, unit shipments, and average selling price) and a forecast of the major semiconductor industry capital spenders for 2019 and 2020.

The expected top-15 worldwide semiconductor (IC and O-S-D—optoelectronic, sensor, and discrete) sales ranking for 2019 is shown in Figure 1. It includes six suppliers headquartered in the U.S., three in Europe, two each in South Korea, Japan, and Taiwan.

Figure 1 Figure 1

(more…)

Tags: Broadcom, Infineon, intel, MediaTek, micron, NVIDIA, NXP, qualcomm, samsung, SK Hynix, Sony, ST, TI, toshiba, tsmc

No Comments »

Tuesday, November 5th, 2019

Samsung and TSMC each expected to set new all-time highs in quarterly spending in 4Q19.

IC Insights’ November Update to The McClean Report 2019 will include a capital spending forecast for the major semiconductor companies for 2019 and 2020. In January of next year, IC Insights will release The McClean Report 2020 and present its seminars that review the five-year forecasts for the IC industry.

The share of semiconductor industry capital spending held by the top five companies’ (i.e., Samsung, Intel, TSMC, SK Hynix, and Micron) is forecast to reach an all-time high of 68% this year, surpassing the previous record high of 67% recorded in 2013 and 2018 (Figure 1). With the top five spenders holding only 25% of the total industry outlays in 1994, the trend of the big companies increasing their share of capital spending continues unabated.

Figure 1 Figure 1

(more…)

Tags: Capex, Forecast, Foundry Market, McClean Report, samsung, Semiconductors, tsmc

No Comments »

Wednesday, September 25th, 2019

World’s largest foundry benefits from increasing demand and tight supplies of 7nm devices.

Taiwan Semiconductor Manufacturing Company’s heavy investments in advanced wafer-fab technology are set to pay off significantly for the world’s largest silicon foundry as it continues the production ramp of 7nm ICs in the second half of this year, according to an analysis in IC Insights’ September Update to the 2019 McClean Report.

Figure 1 provides an updated outlook for TSMC’s 2019 sales using quarterly revenue reported by the foundry in first half of this year and IC Insights’ projection for the second half. As shown, the company has estimated its current full-year sales to be about flat with 2018, but its 2H19/1H19 sales are forecast to jump by 32%—more than three times the 10% growth rate expected for the entire IC industry in the second half of 2019, based on IC Insights’ projection. There is little doubt that 7nm application processors for new smartphones from Apple and Huawei are driving the forecast for a strong second-half rebound in TSMC’s sales.

Figure 1

(more…)

Tags: Fab, foundry, Foundry Market, Semiconductors, tsmc

No Comments »

Thursday, May 16th, 2019

After surpassing Samsung in 4Q18, Intel further extends its lead in 1Q19.

IC Insights will release its May Update to the 2019 McClean Report later this month. This Update includes a discussion of the 1Q19 IC industry market results, an updated quarterly forecast for the remainder of this year, and a look at the top-25 1Q19 semiconductor suppliers. The top-15 1Q19 semiconductor suppliers are covered in this research bulletin.

The top-15 worldwide semiconductor (IC and O S D—optoelectronic, sensor, and discrete) sales ranking for 1Q19 is shown in Figure 1. It includes six suppliers headquartered in the U.S., three in Europe, two each in South Korea and Japan, and one each in Taiwan and China.

Tags: Broadcom, FabLess, Foundry Market, HiSilicon, ICManufacturing, Infineon, intel, McClean Report, micron, NVIDIA, NXP, qualcomm, samsung, SK Hynix, Sony, ST, TI, toshiba, tsmc

No Comments »

Tuesday, March 26th, 2019

Chinese companies log fastest growth since 2010 and now hold a 13% share of fabless IC sales.

IC Insights published its updated 2019-2023 semiconductor market forecasts and top-40 IDM and top-50 fabless IC company sales rankings in its recently released March Update, the first monthly Update to the 500-page, 2019 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry.

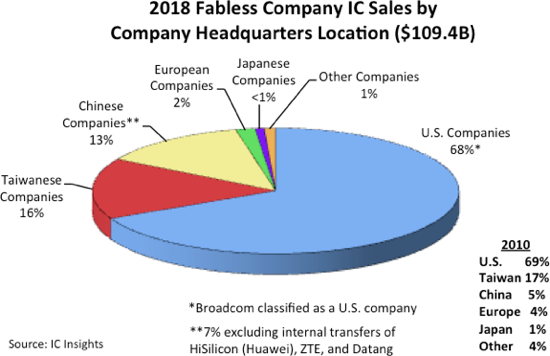

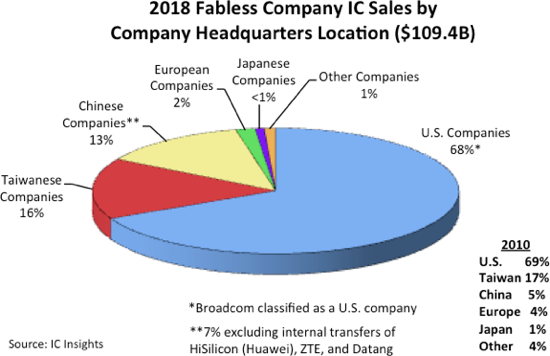

Figure 1 depicts the 2018 fabless company share of IC sales by company headquarters location. With 68%, the U.S. companies continued to hold the dominant share of fabless IC sales last year, just one percentage point less than in 2010.

2018 Fabless Company IC sales by company HQ location (more…)

Tags: tsmc

No Comments »

Thursday, March 7th, 2019

Steep memory market plunge likely to push Samsung’s 2019 semiconductor sales down by 20%.

IC Insights is currently updating its 2019-2023 semiconductor market forecasts that will be presented later this month in the March Update, the first monthly Update to the 500-page, 2019 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2019).

For 2019, a steep 24% drop in the memory market is forecast to pull the total semiconductor market down by 7%. With 83% of Samsung’s semiconductor sales being memory devices last year, the memory market downturn is expected to drag the company’s total semiconductor sales down by 20% this year. Although Intel’s semiconductor sales are forecast to be relatively flat in 2019, the company is poised to regain the number 1 semiconductor supplier ranking this year (Figure 1), a position it held from 1993 through 2016.

Figure 1

Tags: ICManufacturing, intel, McClean Report, micron, NXP, powerchip, qualcomm, samsung, TI, toshiba, tsmc

No Comments »

|

Figure 1

Figure 1 Figure 1

Figure 1