Posts Tagged ‘Semiconductors’

Friday, February 16th, 2018

Intel far surpasses others with R&D spending of $13.1 billion in 2017 and accounts for 36% of expenditures among Top R&D spenders.

The ten largest semiconductor R&D spenders increased their collective expenditures to $35.9 billion in 2017, an increase of 6% compared to $34.0 billion in 2016. Intel continued to far exceed all other semiconductor companies with R&D spending that reached $13.1 billion. In addition to representing 21.2% of its semiconductor sales last year, Intel’s R&D spending accounted for 36% of the top 10 R&D spending and about 22% of total worldwide semiconductor R&D expenditures of $58.9 billion in 2017, according to the 2018 edition of The McClean Report that was released in January 2018. Figure 1 shows IC Insights’ ranking of the top semiconductor R&D spenders, including both semiconductor manufacturers and fabless suppliers.

Figure 1

Intel’s R&D expenditures increased just 3% in 2017, below its 8% average annual growth rate since 2001, according to the new report. Still, Intel’s R&D spending exceeded the combined R&D spending of the next four companies—Qualcomm, Broadcom, Samsung, and Toshiba—listed in the ranking.

(more…)

Tags: IC manufacturing, ICManufacturing, intel, qualcomm, r&d, Semiconductors, toshiba

No Comments »

Thursday, February 8th, 2018

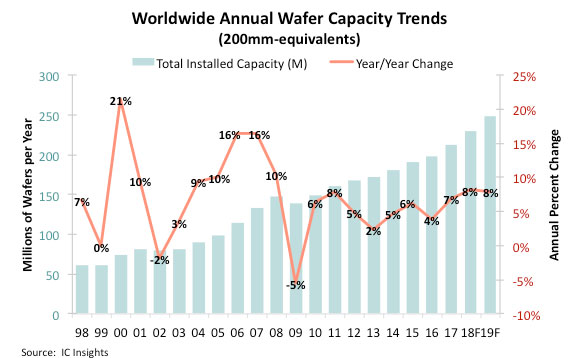

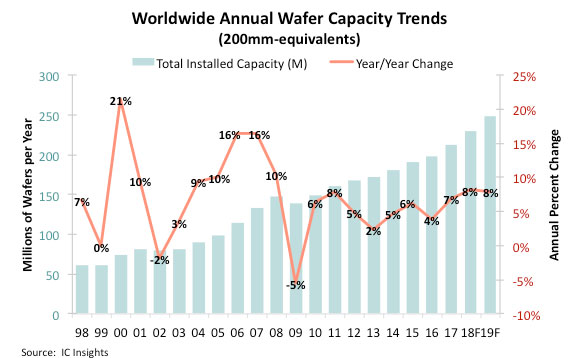

Wafer capacity growth of 8% forecast for 2018 and 2019 versus 4.8% average yearly growth from 2012-2017.

IC industry wafer capacity, specifically in the memory segment, was inadequate to meet demand throughout 2017. However, with Samsung, SK Hynix, Micron, Intel, Toshiba/WD, and XMC/Yangtze River Storage Technology planning to significantly ramp up 3D NAND flash capacity over the next few years, and Samsung and SK Hynix boosting DRAM capacity this year and next, what does this mean for total industry capacity growth? In its 2018-2022 Global Wafer Capacity report, IC Insights shows that new manufacturing lines are expected to boost industry capacity 8% in both 2018 and 2019 (Figure 1). From 2017-2022, annual growth in IC industry capacity is forecast to average 6.0% compared to 4.8% average growth from 2012-2017.

Figure 1

Large swings in the addition or contraction of wafer capacity by the industry, as a whole, appear to be moderating. Since 2010, annual changes in wafer capacity volume have been in the relatively narrow range of 2-8%, with the largest year-to-year difference being just three percentage points. This suggests that IC manufacturers are better today than in years past about trying to match supply with demand. It’s still an incredibly difficult task for companies to gauge how much capacity will be needed to meet demand from customers, especially given the time it takes a company to move from the decision to build a new fab to that fab being ready for mass production.

(more…)

Tags: IC manufacturing, ICManufacturing, Semiconductors, wafer

No Comments »

Thursday, February 1st, 2018

Though accounting for less than half of total MPU sales, data-handling cellphones, tablets, and MPUs for embedded processing applications to keep MPU market active through 2022.

Microprocessors, which first appeared in the early 1970s as 4-bit computing devices for calculators, are among the most complex integrated circuits on the market today. During the past four decades, powerful microprocessors have evolved into highly parallel multi-core 64-bit designs that contain all the functions of a computer’s central processing unit (CPU) as well as a growing number of system-level functions and accelerator blocks for graphics, video, and emerging artificial intelligence (AI) applications. MPUs are the “brains” of personal computers, servers, and large mainframes, but they can also be used for embedded processing in a wide range of systems, such as networking gear, computer peripherals, medical and industrial equipment, cars, televisions, set-top boxes, video-game consoles, wearable products and Internet of Things applications. The recently released 2018 edition of IC Insights’ McClean Report shows that the fastest growing types of microprocessors in the last five years have been mobile system-on-chip (SoC) designs for tablets and data-handling cellphones and MPUs used in embedded-processing applications (Figure 1).

Figure 1 Figure 1 (more…)

Tags: Acquisitions, AMD, chip, IC, Mergers, MobileSystem, MPU, Semiconductors

No Comments »

Tuesday, January 23rd, 2018

Numerous smaller deals were made but “megadeals” were scarce last year.

The historic flood of merger and acquisition agreements that swept through the semiconductor industry in 2015 and 2016 slowed significantly in 2017, but the total value of M&A deals reached in the year was still more than twice the annual average in the first half of this decade, according to IC Insights’ new 2018 McClean Report, which becomes available this month. Subscribers to The McClean Report can attend one of the upcoming half-day seminars (January 23 in Scottsdale, AZ; January 25 in Sunnyvale, CA; and January 30 in Boston, MA) that discuss the highlights of the report free of charge.In 2017, about two dozen acquisition agreements were reached for semiconductor companies, business units, product lines, and related assets with a combined value of $27.7 billion compared to the record-high $107.3 billion set in 2015 and the $99.8 billion total in 2016 (Figure 1). Prior to the explosion of semiconductor acquisitions that erupted several years ago, M&A agreements in the chip industry had a total annual average value of about $12.6 billion between 2010 and 2015.

Figure 1

Figure 1Two large acquisition agreements accounted for 87% of the M&A total in 2017, and without them, the year would have been subpar in terms of the typical annual value of announced transactions. The falloff in the value of semiconductor acquisition agreements in 2017 suggests that the feverish pace of M&A deals is finally cooling off. M&A mania erupted in 2015 when semiconductor acquisitions accelerated because a growing number of companies began buying other chip businesses to offset slow growth rates in major end-use applications (such as smartphones, PCs, and tablets) and to expand their reach into huge new market opportunities, like the Internet of Things (IoT), wearable systems, and highly “intelligent” embedded electronics, including the growing amount of automated driver-assist capabilities in new cars and fully autonomous vehicles in the not-so-distant future.

(more…)

Tags: Acquisitions, IC, Mergers, Semiconductors

No Comments »

|

Figure 1

Figure 1