Posts Tagged ‘Semiconductors’

Friday, October 11th, 2019

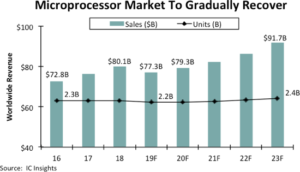

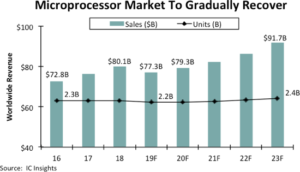

MPU market being pulled down by weakness in smartphones and servers, as well as the fallout from the U.S.‑China trade war. A modest rebound is expected in 2020, followed by new all-time high sales in 2021.

The microprocessor market’s string of nine straight record-high annual sales between 2010 and 2018 is expected to end this year with worldwide MPU revenue dropping 4% to about $77.3 billion because of weakness in smartphone shipments, excess inventories in data center computers, and the global fallout from the U.S.-China trade war, according to IC Insights’ recently updated forecast. Microprocessor sales are expected to stage a modest rebound in 2020, growing 2.7% to $79.3 billion (Figure 1) and then are forecast to reach a new record-high level of about $82.3 billion in 2021, based on IC Insights’ outlook for MPUs in the Mid-Year Update to the 2019 McClean Report.

Figure 1

(more…)

Tags: ICManufacturing, McClean Report, Semiconductors

No Comments »

Wednesday, September 25th, 2019

World’s largest foundry benefits from increasing demand and tight supplies of 7nm devices.

Taiwan Semiconductor Manufacturing Company’s heavy investments in advanced wafer-fab technology are set to pay off significantly for the world’s largest silicon foundry as it continues the production ramp of 7nm ICs in the second half of this year, according to an analysis in IC Insights’ September Update to the 2019 McClean Report.

Figure 1 provides an updated outlook for TSMC’s 2019 sales using quarterly revenue reported by the foundry in first half of this year and IC Insights’ projection for the second half. As shown, the company has estimated its current full-year sales to be about flat with 2018, but its 2H19/1H19 sales are forecast to jump by 32%—more than three times the 10% growth rate expected for the entire IC industry in the second half of 2019, based on IC Insights’ projection. There is little doubt that 7nm application processors for new smartphones from Apple and Huawei are driving the forecast for a strong second-half rebound in TSMC’s sales.

Figure 1

(more…)

Tags: Fab, foundry, Foundry Market, Semiconductors, tsmc

No Comments »

Thursday, September 19th, 2019

This year’s merger and acquisition announcements are driven by deals in networking and wireless connectivity ICs and by suppliers adding products for automotive systems and other strong-growth end-use markets into the next decade.

After slowing in the past couple years, semiconductor merger and acquisition activity strengthened in the first eight months of 2019 with the combined value of about 20 M&A agreement announcements reaching $28.0 billion for the purchase of chip companies, business units, product lines, intellectual property (IP), and wafer fabs between January and the end of August. An analysis in the September Update to IC Insights’ 2019 McClean Report shows the dollar value of semiconductor acquisition agreement announcements in the first eight months of 2019 surpassed the $25.9 billion total for all of 2018 and was close to topping the value in 2017 (Figure 1).

Figure 1 (more…)

Tags: ICManufacturing, McClean Report, NXP, qualcomm, Semiconductors

No Comments »

Friday, July 26th, 2019

Excluding memory, correlation coefficient expected to reach a very high level of 0.94 in the 2018-2023 timeframe.

In its soon to be released Mid-Year Update to The McClean Report 2019, IC Insights forecasts that the 2018-2023 global GDP and IC market correlation coefficient will reach 0.88 (0.94 when excluding memory), up from 0.87 in the 2010-2018 timeperiod. IC Insights depicts the increasingly close correlation between worldwide GDP growth and IC market growth through 2018, as well as its forecast through 2023, in Figure 1.

Figure 1

From 2010-2018, the correlation coefficient between worldwide GDP growth and IC market growth was 0.87 (0.92 excluding memory), a strong figure given that a perfect positive correlation is 1.0. In the three decades previous to this timeperiod, the correlation coefficient ranged from a relatively weak 0.63 in the early 2000s to a negative correlation (i.e., essentially no correlation) of -0.10 in the 1990s.

IC Insights believes that the increasing number of mergers and acquisitions, leading to fewer major IC manufacturers and suppliers, is one of major changes in the supply base that illustrate the maturing of the industry and helping foster a closer correlation between worldwide GDP growth and IC market growth.

(more…)

Tags: IC manufacturing, ICManufacturing, Semiconductors, worldwide

No Comments »

Wednesday, June 19th, 2019

China and Taiwan companies register double-digit shares in the fabless segment but very low shares of the IDM IC segment.

IC Insights will release its 200+ page Mid-Year Update to the 2019 McClean Report next month. A portion of the Mid-Year Update will examine the trends for worldwide IC company marketshare by headquarters location.

Figure 1 shows the 2018 IDM and fabless company shares of IC sales as well as the total worldwide share of the IC market by company headquarters location.

Figure 1

(more…)

Tags: China, Europe, IC manufacturing, ICManufacturing, Japan, Semiconductors, SK Hynix, taiwan

No Comments »

Tuesday, May 21st, 2019

Notably, the IC market has never shown more than three sequential quarters of decline.

IC Insights will release its May Update to the 2019 McClean Report later this month. This Update includes a discussion of the 1Q19 IC industry market results, a detailed quarterly IC market forecast for the remainder of this year, and a look at the top-25 1Q19 semiconductor suppliers.

Over its 60-year history, the IC industry is well known for its cyclical behavior. Looking back to the mid-1970s, IC Insights cannot identify a period where the IC market declined for more than three quarters in a row. Assuming the 2Q19 IC market registers a slight decline of 1% as compared to 1Q19, the 4Q18-2Q19 timeperiod would mark the sixth three-quarter IC market drop on record (Figure 1).

Tags: DRAM, IC manufacturing, ICManufacturing, McClean Report, Semiconductors

No Comments »

Thursday, May 9th, 2019

TI’s 2018 analog sales rise to $10.8 billion; Infineon moves into third position, ST posts strongest annual increase as top-10 suppliers collectively account for 60% of total analog market.

The 10 largest suppliers of analog ICs accounted for 60% of worldwide analog sales last year, or $36.1 billion, compared to nearly 61% in 2017, or about $33.0 billion, according to IC Insights’ 2018 rankings of leading semiconductor companies. The April Update to IC Insights’ 2019 McClean Report ranks the top 50 semiconductor suppliers and lists leading companies in several major product categories, including DRAM, flash memory, microprocessors, microcontrollers, and analog ICs. Figure 1 shows IC Insights’ ranking of the largest 10 analog suppliers in 2018.

Figure 1

Tags: DRAM, ICManufacturing, maxim, Microchip, NXP, ON Semi, Rensas, samsung, Semiconductors, ST, T, Texas Instruments, TI

No Comments »

Tuesday, April 30th, 2019

Weak early year results increase downside risk to IC Insights’ -9% 2019 IC market forecast.

IC Insights will report on and examine the 1Q19 worldwide IC market results in its May Update to the 500-page, 2019 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry next month.

From 1Q84 through 1Q19 there have been 141 quarters, and only seven of them registered an IC market decline of ≥10%. Figure 1 ranks the largest double-digit sequential quarterly IC market declines that have occurred since 1984. As shown, the 1Q19/4Q18 IC market decline of 17.6% was the fourth largest since 1984 and the third largest first quarter decline over that same timeperiod.

Figure 1

As shown, each year in which a double-digit quarterly IC market decline occurred, the full-year IC market dropped by at least 9%. It is interesting to note that three of the seven largest quarterly IC market downturns since 1984 took place during the first three quarters of 2001, which put the 3Q01 IC market 44% below that of 4Q00. As a result, 2001’s disastrous full-year IC market decline of 33% still stands as the worst annual performance in the history of the IC industry.The first quarter is usually the weakest quarter of the year for the IC market, averaging a sequential decline of 2.1% over the past 36 years, but the severity of the 1Q19/4Q18 IC market drop has started this year off at a very low level. As a result, given the typical seasonality of the IC market, an abnormally strong second half of the year will be required in order to avoid a full-year 2019 double-digit IC market decline.

Report Details: The 2019 McClean Report

Additional details on the 2019 quarterly IC market trends and forecasts will be provided in the May Update to The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2019). A subscription to The McClean Report includes free monthly updates from March through November (including a 200+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual-user license to the 2019 edition of The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.

To review additional information about IC Insights’ new and existing market research reports and services please visit our website: www.icinsights.com.

(more…)

Tags: IC manufacturing, McClean Report, Semiconductors

No Comments »

Wednesday, April 10th, 2019

Top-10 companies held 39% of the worldwide O-S-D market in 2018, the same level as in 2017.

IC Insights’ new 2019 O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes was released at the end of March. Among the O-S-D industry data included in the new 350-page report is an analysis of the top-30 O-S-D suppliers (the top-10 ranking is discussed in this Research Bulletin).

Companies selling optoelectronics currently dominate the ranking of the top-10 O-S-D suppliers. Figure 1 shows that nine of the top-10 companies sell optoelectronics, while six offer sensor/actuator semiconductors, and five provide discrete products. Only four of the top-10 companies sell products in all three O-S-D market segments. The 10 largest suppliers in the ranking accounted for 39% of combined worldwide O-S-D revenues in 2018, which is the same percentage as in 2017 (in contrast, the top-10 IC suppliers held a 70% share of the total IC market in 2018).

(more…)

Tags: Broadcom, Foundry Market, IC manufacturing, ICManufacturing, Infineon, Nichia, O-S-D, OmniVision, ON Semi, Osram, samsung, Semiconductors, sharp, Sony, ST

No Comments »

Friday, February 22nd, 2019

Despite increasing development costs, IC manufacturers continue to make great strides.

The advancement of the IC industry hinges on the ability of IC manufacturers to continue offering more performance and functionality for the money. As mainstream CMOS processes reach their theoretical, practical, and economic limits, lowering the cost of ICs (on a per-function or per-performance basis) is more critical and challenging than ever. The 500-page, 2019 edition of IC Insights’ McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2019) shows that there is more variety than ever among the logic-oriented process technologies that companies offer. Figure 1 lists several of the leading advanced logic technologies that companies are presently using. Derivative versions of each process generation between major nodes have become regular occurrences.

Figure 1 (more…)

Tags: Foundry Market, global foundry, globalfoundaries, intel, McClean Report, samsung, Semiconductors, smic, tsmc, umc

No Comments »

|