Posts Tagged ‘McClean Report’

Tuesday, March 1st, 2022

2020-2022 expected to be the first 3-year period of double-digit capex growth since 1993-1995.

Figure 1 shows that after surging 36% in 2021, semiconductor industry capital spending is forecast to jump 24% in 2022 to a new all-time high of $190.4 billion, up 86% from just three years earlier in 2019. Moreover, if capital spending increases by ≥10% in 2022, it would mark the first three-year period of double-digit spending increases in the semiconductor industry since the 1993-1995 timeperiod.

Figure 1

(more…)

Tags: DRAM, Forecast, IC manufacturing, ICManufacturing, McClean Report, NAND, NVIDIA, NXP, ON Semi, Optoelectronics, qualcomm, samsung, Semiconductors, SK Hynix, Sony, ST, TI, toshiba, tsmc, umc

No Comments »

Tuesday, May 25th, 2021

Excluding Intel, the group would have shown a 29% jump in 1Q21/1Q20 sales.

IC Insights released its May Update to the 2021 McClean Report last week. This Update included a discussion of the 1Q21 IC industry market results, an updated quarterly forecast for the remainder of this year, and a look at the top-25 1Q21 semiconductor suppliers. The top-15 1Q21 semiconductor suppliers are covered in this research bulletin.

The top-15 worldwide semiconductor (IC and O S D—optoelectronic, sensor, and discrete) sales ranking for 1Q21 is shown in Figure 1. It includes eight suppliers headquartered in the U.S., two each in South Korea, Taiwan and Europe, and one in Japan. The ranking includes six fabless companies (Qualcomm, Broadcom, Nvidia, MediaTek, AMD, and Apple) and one pure-play foundry (TSMC).

Figure 1

(more…)

Tags: AMD, Apple, Broadcom, foundry, Infineon, intel, Kioxia, McClean Report, MediaTek, NVIDIA, NXP, qualcomm, TI, tsmc

No Comments »

Tuesday, May 4th, 2021

Intel’s lackluster performance and surging DRAM market forecast to put Samsung in the lead.

IC Insights is currently assembling its 1Q21 top-25 semiconductor supplier ranking, which includes company sales forecasts for 2Q21 that will be presented later this month in the May Update, the third monthly Update to the 500-page, 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry.

As shown in Figure 1, Intel was locked in as the world’s top semiconductor manufacturer from 1993 through 2016. However, after nearly a quarter of a century, the semiconductor industry saw a new #1 supplier beginning in 2017 when the memory market surged and Samsung displaced Intel. This unseating marked a milestone achievement not only for Samsung, but also for all other competing semiconductor producers who had tried for years to supplant Intel as the world’s largest supplier.

(more…)

Tags: DRAM, IC manufacturing, ICManufacturing, intel, McClean Report, samsung, Semiconductors

No Comments »

Tuesday, May 5th, 2020

After 10 years of record-high sales, combined revenues for optoelectronics, sensors/actuators, and discrete semiconductors are expected to drop 6% in virus-plagued 2020, says the new O-S-D Report.

When 2020 began, global conditions pointed to single-digit percentage market growth this year for optoelectronics, sensors and actuators, and discrete semiconductors (known collectively as O-S-D devices), but the outlook suddenly deteriorated in the first quarter due to the worldwide outbreak of the Covid-19 coronavirus. The virus crisis deepened by the end of March, resulting in IC Insights cutting its 2020 semiconductor forecast and changing the growth outlook for the next five years. The revised forecast is contained in IC Insights’ new 2020 O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes, which shows total O-S-D sales falling 6% this year, ending a decade-long string of record-high annual sales (Figure 1).

(more…)

Tags: actuators, automotive, Broadcom, China, CMOS, discretes, DRAM, Europe, Foundry Market, IC manufacturing, ICManufacturing, McClean Report, Optoelectronics, Semiconductors, sensors

No Comments »

Thursday, April 16th, 2020

Semiconductor producers hoping to keep capital spending plans intact despite virus outbreak.

Using its “baseline” assumptions shown in the soon-to-be-released April Update to the 2020 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (MR20), IC Insights is not lowering its current -3% 2020 semiconductor industry capital spending forecast (Figure 1) due to the Covid-19 outbreak.

Although essentially all of the risk to the current -3% semiconductor industry capital spending forecast for this year is to the downside, it is assumed that most spending will proceed as planned since the vast majority of the outlays are directed at long term goals of process technology advancements and/or additions to wafer start capacity. However, if the Covid-19 outbreak is not contained in the first half of this year, significant cuts to current capital spending budgets will likely occur.

(more…)

Tags: China, Europe, Forecast, Foundry Market, ICManufacturing, McClean Report, Semiconductors, worldwide

No Comments »

Tuesday, November 12th, 2019

Despite a slowdown, combined revenues for optoelectronics, sensors/actuators, and discrete semiconductors are expected to barely set a 10th consecutive record high in 2019, followed by gradual strengthening in 2020 and 2021, says new updated forecast.

With the global economy slowing and the fallout from the U.S.-China trade war causing systems makers to draw down factory inventories, combined sales of optoelectronics, sensors and actuators, and discrete semiconductors (O-S-D) are on pace to grow just 1% in 2019 to $83.5 billion after rising 9% in 2018 and 11% in 2017, according to IC Insights’ update of the O-S-D marketplace. IC Insights believes O-S-D products will account for about 19% of total worldwide semiconductor sales in 2019 with integrated circuits representing 81% of the entire chip market this year.

(more…)

Tags: actuators, CMOS, discretes, gyroscopes, IC manufacturing, McClean Report, Optoelectronics, Semiconductors, sensors, transistors

No Comments »

Tuesday, November 5th, 2019

Samsung and TSMC each expected to set new all-time highs in quarterly spending in 4Q19.

IC Insights’ November Update to The McClean Report 2019 will include a capital spending forecast for the major semiconductor companies for 2019 and 2020. In January of next year, IC Insights will release The McClean Report 2020 and present its seminars that review the five-year forecasts for the IC industry.

The share of semiconductor industry capital spending held by the top five companies’ (i.e., Samsung, Intel, TSMC, SK Hynix, and Micron) is forecast to reach an all-time high of 68% this year, surpassing the previous record high of 67% recorded in 2013 and 2018 (Figure 1). With the top five spenders holding only 25% of the total industry outlays in 1994, the trend of the big companies increasing their share of capital spending continues unabated.

Figure 1 Figure 1

(more…)

Tags: Capex, Forecast, Foundry Market, McClean Report, samsung, Semiconductors, tsmc

No Comments »

Friday, October 11th, 2019

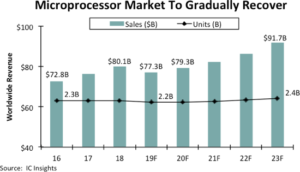

MPU market being pulled down by weakness in smartphones and servers, as well as the fallout from the U.S.‑China trade war. A modest rebound is expected in 2020, followed by new all-time high sales in 2021.

The microprocessor market’s string of nine straight record-high annual sales between 2010 and 2018 is expected to end this year with worldwide MPU revenue dropping 4% to about $77.3 billion because of weakness in smartphone shipments, excess inventories in data center computers, and the global fallout from the U.S.-China trade war, according to IC Insights’ recently updated forecast. Microprocessor sales are expected to stage a modest rebound in 2020, growing 2.7% to $79.3 billion (Figure 1) and then are forecast to reach a new record-high level of about $82.3 billion in 2021, based on IC Insights’ outlook for MPUs in the Mid-Year Update to the 2019 McClean Report.

Figure 1

(more…)

Tags: ICManufacturing, McClean Report, Semiconductors

No Comments »

Thursday, September 19th, 2019

This year’s merger and acquisition announcements are driven by deals in networking and wireless connectivity ICs and by suppliers adding products for automotive systems and other strong-growth end-use markets into the next decade.

After slowing in the past couple years, semiconductor merger and acquisition activity strengthened in the first eight months of 2019 with the combined value of about 20 M&A agreement announcements reaching $28.0 billion for the purchase of chip companies, business units, product lines, intellectual property (IP), and wafer fabs between January and the end of August. An analysis in the September Update to IC Insights’ 2019 McClean Report shows the dollar value of semiconductor acquisition agreement announcements in the first eight months of 2019 surpassed the $25.9 billion total for all of 2018 and was close to topping the value in 2017 (Figure 1).

Figure 1 (more…)

Tags: ICManufacturing, McClean Report, NXP, qualcomm, Semiconductors

No Comments »

Tuesday, May 21st, 2019

Notably, the IC market has never shown more than three sequential quarters of decline.

IC Insights will release its May Update to the 2019 McClean Report later this month. This Update includes a discussion of the 1Q19 IC industry market results, a detailed quarterly IC market forecast for the remainder of this year, and a look at the top-25 1Q19 semiconductor suppliers.

Over its 60-year history, the IC industry is well known for its cyclical behavior. Looking back to the mid-1970s, IC Insights cannot identify a period where the IC market declined for more than three quarters in a row. Assuming the 2Q19 IC market registers a slight decline of 1% as compared to 1Q19, the 4Q18-2Q19 timeperiod would mark the sixth three-quarter IC market drop on record (Figure 1).

Tags: DRAM, IC manufacturing, ICManufacturing, McClean Report, Semiconductors

No Comments »

|

Figure 1

Figure 1