Posts Tagged ‘ICManufacturing’

Wednesday, March 14th, 2018

Increased expectations for the DRAM and NAND flash markets spur upward revision.

IC Insights’ latest market, unit, and average selling price forecasts for 33 major IC product segments for 2018 through 2022 is included in the March Update to the 2018 McClean Report (MR18). The Update also includes an analysis of the major semiconductor suppliers’ capital spending plans for this year.The biggest adjustments to the original MR18 IC market forecasts were to the memory market; specifically the DRAM and NAND flash segments. The DRAM and NAND flash memory market growth forecasts for 2018 have been adjusted upward to 37% for DRAM (13% shown in MR18) and 17% for NAND flash (10% shown in MR18).

The big increase in the DRAM market forecast for 2018 is primarily due to a much stronger ASP expected for this year than was originally forecast. IC Insights now forecasts that the DRAM ASP will register a 36% jump in 2018 as compared to 2017, when the DRAM ASP surged by an amazing 81%. Moreover, the NAND flash ASP is forecast to increase 10% this year, after jumping by 45% in 2017. In contrast to strong DRAM and NAND flash ASP increases, 2018 unit volume growth for these product segments is expected to be up only 1% and 6%, respectively.

(more…)

Tags: DRAM, ICManufacturing, McClean Report, NAND, Semiconductors

No Comments »

Wednesday, February 21st, 2018

Despite increasing costs of development, IC manufacturers are still making great strides.

The success and proliferation of integrated circuits has largely hinged on the ability of IC manufacturers to continue offering more performance and functionality for the money. Driving down the cost of ICs (on a per-function or per-performance basis) is inescapably tied to a growing arsenal of technologies and wafer-fab manufacturing disciplines as mainstream CMOS processes reach their theoretical, practical, and economic limits. Among the many levers being pulled by IC designers and manufacturers are: feature-size reductions, introduction of new materials and transistor structures, migration to larger-diameter silicon wafers, higher throughput in fab equipment, increased factory automation, three-dimensional integration of circuitry and chips, and advanced IC packaging and holistic system-driven design approaches.

For logic-oriented processes, companies are fabricating leading-edge devices such as high-performance microprocessors, low-power application processors, and other advanced logic devices using the 14nm and 10nm generations (Figure 1). There is more variety than ever among the processes companies offer, making it challenging to compare them in a fair and useful way. Moreover, “plus” or derivative versions of each process generation and half steps between major nodes have become regular occurrences.

(more…)

Tags: IC, IC manufacturing, ICManufacturing, roadmap, Semiconductors, technology

No Comments »

Friday, February 16th, 2018

Intel far surpasses others with R&D spending of $13.1 billion in 2017 and accounts for 36% of expenditures among Top R&D spenders.

The ten largest semiconductor R&D spenders increased their collective expenditures to $35.9 billion in 2017, an increase of 6% compared to $34.0 billion in 2016. Intel continued to far exceed all other semiconductor companies with R&D spending that reached $13.1 billion. In addition to representing 21.2% of its semiconductor sales last year, Intel’s R&D spending accounted for 36% of the top 10 R&D spending and about 22% of total worldwide semiconductor R&D expenditures of $58.9 billion in 2017, according to the 2018 edition of The McClean Report that was released in January 2018. Figure 1 shows IC Insights’ ranking of the top semiconductor R&D spenders, including both semiconductor manufacturers and fabless suppliers.

Figure 1

Intel’s R&D expenditures increased just 3% in 2017, below its 8% average annual growth rate since 2001, according to the new report. Still, Intel’s R&D spending exceeded the combined R&D spending of the next four companies—Qualcomm, Broadcom, Samsung, and Toshiba—listed in the ranking.

(more…)

Tags: IC manufacturing, ICManufacturing, intel, qualcomm, r&d, Semiconductors, toshiba

No Comments »

Thursday, February 8th, 2018

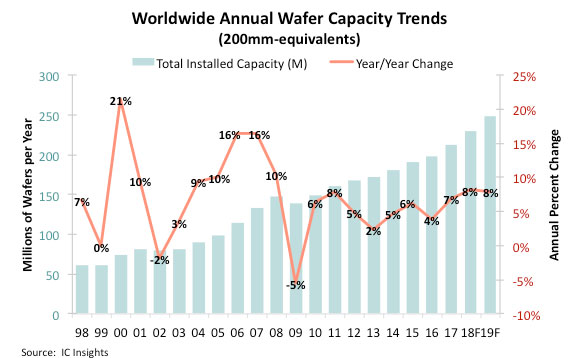

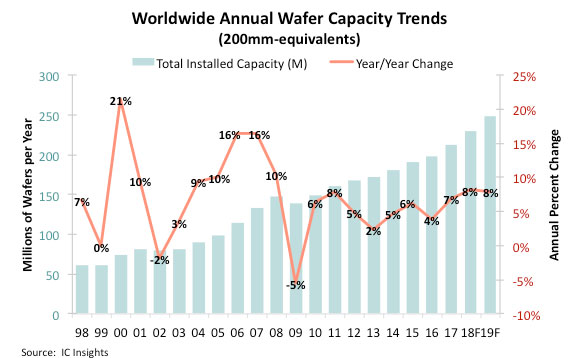

Wafer capacity growth of 8% forecast for 2018 and 2019 versus 4.8% average yearly growth from 2012-2017.

IC industry wafer capacity, specifically in the memory segment, was inadequate to meet demand throughout 2017. However, with Samsung, SK Hynix, Micron, Intel, Toshiba/WD, and XMC/Yangtze River Storage Technology planning to significantly ramp up 3D NAND flash capacity over the next few years, and Samsung and SK Hynix boosting DRAM capacity this year and next, what does this mean for total industry capacity growth? In its 2018-2022 Global Wafer Capacity report, IC Insights shows that new manufacturing lines are expected to boost industry capacity 8% in both 2018 and 2019 (Figure 1). From 2017-2022, annual growth in IC industry capacity is forecast to average 6.0% compared to 4.8% average growth from 2012-2017.

Figure 1

Large swings in the addition or contraction of wafer capacity by the industry, as a whole, appear to be moderating. Since 2010, annual changes in wafer capacity volume have been in the relatively narrow range of 2-8%, with the largest year-to-year difference being just three percentage points. This suggests that IC manufacturers are better today than in years past about trying to match supply with demand. It’s still an incredibly difficult task for companies to gauge how much capacity will be needed to meet demand from customers, especially given the time it takes a company to move from the decision to build a new fab to that fab being ready for mass production.

(more…)

Tags: IC manufacturing, ICManufacturing, Semiconductors, wafer

No Comments »

|