Posts Tagged ‘IC manufacturing’

Automotive IC Market on Pace for Third Consecutive Record Growth Year

Thursday, May 31st, 2018Integrated Circuit Technology Advances Continue to Amaze

Wednesday, February 21st, 2018Despite increasing costs of development, IC manufacturers are still making great strides.

The success and proliferation of integrated circuits has largely hinged on the ability of IC manufacturers to continue offering more performance and functionality for the money. Driving down the cost of ICs (on a per-function or per-performance basis) is inescapably tied to a growing arsenal of technologies and wafer-fab manufacturing disciplines as mainstream CMOS processes reach their theoretical, practical, and economic limits. Among the many levers being pulled by IC designers and manufacturers are: feature-size reductions, introduction of new materials and transistor structures, migration to larger-diameter silicon wafers, higher throughput in fab equipment, increased factory automation, three-dimensional integration of circuitry and chips, and advanced IC packaging and holistic system-driven design approaches.

For logic-oriented processes, companies are fabricating leading-edge devices such as high-performance microprocessors, low-power application processors, and other advanced logic devices using the 14nm and 10nm generations (Figure 1). There is more variety than ever among the processes companies offer, making it challenging to compare them in a fair and useful way. Moreover, “plus” or derivative versions of each process generation and half steps between major nodes have become regular occurrences.

(more…)

Top 10 Semiconductor R&D Spenders Increase Outlays 6% in 2017

Friday, February 16th, 2018Intel far surpasses others with R&D spending of $13.1 billion in 2017 and accounts for 36% of expenditures among Top R&D spenders.

The ten largest semiconductor R&D spenders increased their collective expenditures to $35.9 billion in 2017, an increase of 6% compared to $34.0 billion in 2016. Intel continued to far exceed all other semiconductor companies with R&D spending that reached $13.1 billion. In addition to representing 21.2% of its semiconductor sales last year, Intel’s R&D spending accounted for 36% of the top 10 R&D spending and about 22% of total worldwide semiconductor R&D expenditures of $58.9 billion in 2017, according to the 2018 edition of The McClean Report that was released in January 2018. Figure 1 shows IC Insights’ ranking of the top semiconductor R&D spenders, including both semiconductor manufacturers and fabless suppliers.

Figure 1

Intel’s R&D expenditures increased just 3% in 2017, below its 8% average annual growth rate since 2001, according to the new report. Still, Intel’s R&D spending exceeded the combined R&D spending of the next four companies—Qualcomm, Broadcom, Samsung, and Toshiba—listed in the ranking.

(more…)

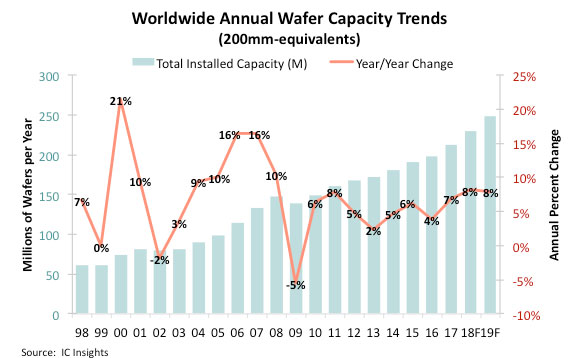

New IC Manufacturing Lines to Boost Total Industry Wafer Capacity 8%

Thursday, February 8th, 2018Wafer capacity growth of 8% forecast for 2018 and 2019 versus 4.8% average yearly growth from 2012-2017.

IC industry wafer capacity, specifically in the memory segment, was inadequate to meet demand throughout 2017. However, with Samsung, SK Hynix, Micron, Intel, Toshiba/WD, and XMC/Yangtze River Storage Technology planning to significantly ramp up 3D NAND flash capacity over the next few years, and Samsung and SK Hynix boosting DRAM capacity this year and next, what does this mean for total industry capacity growth? In its 2018-2022 Global Wafer Capacity report, IC Insights shows that new manufacturing lines are expected to boost industry capacity 8% in both 2018 and 2019 (Figure 1). From 2017-2022, annual growth in IC industry capacity is forecast to average 6.0% compared to 4.8% average growth from 2012-2017.

Figure 1

Large swings in the addition or contraction of wafer capacity by the industry, as a whole, appear to be moderating. Since 2010, annual changes in wafer capacity volume have been in the relatively narrow range of 2-8%, with the largest year-to-year difference being just three percentage points. This suggests that IC manufacturers are better today than in years past about trying to match supply with demand. It’s still an incredibly difficult task for companies to gauge how much capacity will be needed to meet demand from customers, especially given the time it takes a company to move from the decision to build a new fab to that fab being ready for mass production.

(more…)