IC Insights IC Insights

IC Insights, Inc. is a leading semiconductor market research company headquartered in Scottsdale, Arizona, USA. Founded in 1997, IC Insights offers complete analysis of the integrated circuit (IC), optoelectronic, sensor/actuator, and discrete semiconductor markets with coverage including current … More » U.S. Companies Continue to Represent Largest Share of Fabless IC SalesMarch 26th, 2019 by IC Insights

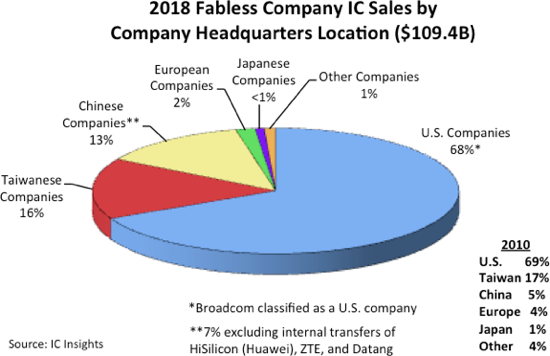

Chinese companies log fastest growth since 2010 and now hold a 13% share of fabless IC sales. IC Insights published its updated 2019-2023 semiconductor market forecasts and top-40 IDM and top-50 fabless IC company sales rankings in its recently released March Update, the first monthly Update to the 500-page, 2019 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. Figure 1 depicts the 2018 fabless company share of IC sales by company headquarters location. With 68%, the U.S. companies continued to hold the dominant share of fabless IC sales last year, just one percentage point less than in 2010.  2018 Fabless Company IC sales by company HQ location Read the rest of U.S. Companies Continue to Represent Largest Share of Fabless IC Sales Intel Expected to Recapture #1 Semi Supplier Ranking in 2019March 7th, 2019 by IC Insights

Steep memory market plunge likely to push Samsung’s 2019 semiconductor sales down by 20%. IC Insights is currently updating its 2019-2023 semiconductor market forecasts that will be presented later this month in the March Update, the first monthly Update to the 500-page, 2019 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2019). For 2019, a steep 24% drop in the memory market is forecast to pull the total semiconductor market down by 7%. With 83% of Samsung’s semiconductor sales being memory devices last year, the memory market downturn is expected to drag the company’s total semiconductor sales down by 20% this year. Although Intel’s semiconductor sales are forecast to be relatively flat in 2019, the company is poised to regain the number 1 semiconductor supplier ranking this year (Figure 1), a position it held from 1993 through 2016.  Figure 1 Read the rest of Intel Expected to Recapture #1 Semi Supplier Ranking in 2019 97 IC Wafer Fabs Closed or Repurposed During Past 10 YearsMarch 1st, 2019 by IC Insights

90% of closures were ≤200mm wafer fabs; greatest number of closures in Japan. The IC industry has been on a mission to pare down older capacity (i.e., ≤200mm wafers) in order to produce devices more cost-effectively on larger wafers. In its recently released Global Wafer Capacity 2019-2023 report, IC Insights shows that due to the surge of merger and acquisition activity in the middle of this decade and with more companies producing IC devices on sub-20nm process technology, suppliers are eliminating inefficient wafer fabs. Over the past ten years (2009-2018), semiconductor manufacturers around the world have closed or repurposed 97 wafer fabs, according to findings in the new report. Figure 1 shows that since 2009, 42 150mm wafer fabs and 24 200mm wafer fabs have been shuttered. 300mm wafer fabs have accounted for only 10% of total fab closures since 2009. Qimonda was the first company to close a 300mm wafer fab after it went out of business in early 2009.

Figure 1 Advances in Logic IC Process Technology Move ForwardFebruary 22nd, 2019 by IC Insights

Despite increasing development costs, IC manufacturers continue to make great strides. The advancement of the IC industry hinges on the ability of IC manufacturers to continue offering more performance and functionality for the money. As mainstream CMOS processes reach their theoretical, practical, and economic limits, lowering the cost of ICs (on a per-function or per-performance basis) is more critical and challenging than ever. The 500-page, 2019 edition of IC Insights’ McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2019) shows that there is more variety than ever among the logic-oriented process technologies that companies offer. Figure 1 lists several of the leading advanced logic technologies that companies are presently using. Derivative versions of each process generation between major nodes have become regular occurrences.  Figure 1 Read the rest of Advances in Logic IC Process Technology Move Forward Taiwan Maintains Largest Share of Global IC Wafer Fab CapacityFebruary 14th, 2019 by IC Insights

China shows biggest increase, nearly matching North America with 12 IC Insights recently released its new Global Wafer Capacity 2019-2023 report that provides in-depth detail, analyses, and forecasts for IC industry capacity by wafer size, process geometry, region, and product type through 2023. Figure 1 shows the world’s installed monthly wafer production capacity by geographic region (or country) as of December 2018. Each number represents the total installed monthly capacity of fabs located in that region regardless of the headquarters location of the company that own the fab(s). For example, the wafer capacity that South Korea-based Samsung has installed in the U.S. is counted in the North America capacity total, not in the South Korea capacity total. The ROW “region” consists primarily of Singapore, Israel, and Malaysia, but also includes countries/regions such as Russia, Belarus, and Australia.  Figure 1 Read the rest of Taiwan Maintains Largest Share of Global IC Wafer Fab Capacity China IC Production Forecast to Show a Strong 15% 2018-2023 CAGRFebruary 8th, 2019 by IC Insights

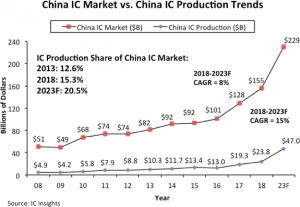

However, China’s indigenous IC production is still likely to fall far short of government targets. China has been the largest consuming country for ICs since 2005, but large increases in IC production within China have not immediately followed, according to data presented in the new 500-page 2019 edition of IC Insights’ McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2019). As shown in Figure 1, IC production in China represented 15.3% of its $155 billion IC market in 2018, up from 12.6% five years earlier in 2013. Moreover, IC Insights forecasts that this share will increase by 5.2 percentage points from 2018 to 20.5% in 2023.  Figure 1 Currently, China-based IC production is forecast to exhibit a very strong 2018-2023 CAGR of 15%. However, considering that China-based IC production was only $23.8 billion in 2018, this growth is starting from a relatively small base. In 2018, SK Hynix, Samsung, Intel, and TSMC were the major foreign IC manufacturers that had significant IC production in China. In fact, SK Hynix’s 300mm China fab had the most installed capacity of any of its fabs in 2018 at 200,000 wafers per month (full capacity). Read the rest of China IC Production Forecast to Show a Strong 15% 2018-2023 CAGR Semiconductor R&D Spending Will Step Up After SlowingFebruary 1st, 2019 by IC Insights

3D die-stacking technologies, manufacturing barriers, and growing complexities in end-use systems among the technical challenges that are expected to lift R&D growth rates through 2023. The semiconductor business is defined by rapid technological changes and the need to maintain high levels of investment in research and development for new materials, innovative manufacturing processes for increasingly complex chip designs, and advanced IC packaging technologies. However, since the 1980s, the long-term trend has been toward a slowdown in the annual growth rate of research and development expenditures according to data presented in the new, 2019 edition of IC Insights’ McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2019). Consolidation in the semiconductor industry has been a big factor contributing to lower growth rates for R&D expenditures so far this decade. In the most recent five-year span from 2013-2018, semiconductor R&D spending grew by CAGR of 3.6% per year, essentially unchanged from the 3.3% experienced from 2008-2013 (Figure 1).  Figure 1 IC Insights expects new challenges such as three-dimensional (3D) die-stacking technologies, growing complexities in end-use applications, and other significant manufacturing barriers to raise semiconductor R&D spending to a slightly higher growth rate of 5.5% per year in the 2018-2023 forecast period. Read the rest of Semiconductor R&D Spending Will Step Up After Slowing Semiconductor Unit Shipments Exceeded 1 Trillion Devices in 2018January 24th, 2019 by IC Insights

Semiconductor units forecast to increase 7% in 2019 with IC units rising 8%, O-S-D units growing 7%. Annual semiconductor unit shipments, including integrated circuits and optoelectronics, sensors, and discrete (O-S-D) devices grew 10% in 2018 and surpassed the one trillion unit mark for the first time, based on data presented in the new, 2019 edition of IC Insights’ McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. As shown in Figure 1, semiconductor unit shipments climbed to 1,068.2 billion units in 2018 and are expected to climb to 1,142.6 billion in 2019, which equates to 7% growth for the year. Starting in 1978 with 32.6 billion units and going through 2019, the compound annual growth rate for semiconductor units is forecast to be 9.1%, a very impressive growth figure over 40 years, given the cyclical and often volatile nature of the semiconductor industry. Read the rest of Semiconductor Unit Shipments Exceeded 1 Trillion Devices in 2018 Global GDP Growth Increasingly Important Driver of IC Market GrowthJanuary 22nd, 2019 by IC Insights

The 2019-2023 correlation coefficient forecast to reach 0.93, up from 0.86 from 2010-2018. IC Insights is in the process of completing its forecast and analysis of the IC industry and will present its new findings in The McClean Report 2019, which will be published later this month. Among the semiconductor industry data included in the new 500-page report is an analysis of the correlation between IC market growth and global GDP growth. Figure 1 depicts the increasingly close correlation between worldwide GDP growth and IC market growth through 2018, as well as IC Insights’ forecast through 2023.  Figure 1 Over the 2010-2018 timeframe, the correlation coefficient between worldwide GDP growth and IC market growth was 0.86 (0.91 excluding memory in 2017 and 2018), a strong figure given that a perfect positive correlation is 1.0. In the three decades previous to this timeperiod, the correlation coefficient ranged from a relatively weak 0.63 in the early 2000s to a negative correlation (i.e., essentially no correlation) of -0.10 in the 1990s. IC Insights believes that the increasing number of mergers and acquisitions, leading to fewer major IC manufacturers and suppliers, is one of major changes in the supply base that illustrates the maturing of the industry and has helped foster a closer correlation between worldwide GDP growth and IC market growth. Another reason for a better correlation between worldwide GDP growth and IC market growth is the continued movement to a more consumer driven IC market. IC Insights believes that 20 years ago, about 60% of the IC market was driven by business applications and 40% by consumer applications with those percentages being reversed today. As a result, with a more consumer-oriented environment driving electronic system sales, and in turn IC market growth, the health of the worldwide economy is increasingly important in gauging IC market trends. Report Details: The 2019 McClean Report

Additional information on IC Insights’ IC market forecasts through 2023 is included in the 2019 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry, which will be released in January 2019. A subscription to The McClean Report includes free monthly updates from March through November (including a 200+ page Mid-Year Update), and free access to subscriber-only webinars throughout the year. An individual user license to the 2019 edition of The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.As part of your 2019 subscription, you are entitled to free attendance at a McClean Report half-day seminar (one seat for each copy purchased; company-wide licensees receive five free seats). The remaining schedule for this year’s McClean Report seminar tour is shown below. Thursday, January 24, 2019 — Sunnyvale, California

(Space is limited, please call for availability)Tuesday, January 29, 2019 — Boston, Massachusetts (Space is limited, please call for availability) Value of Semiconductor Mergers and Acquisitions Falls ConsiderablyJanuary 17th, 2019 by IC Insights

2018 semiconductor M&A valued at $23.2 billion, down from the record $107.3 billion in 2015. IC Insights is in the process of completing its forecast and analysis of the IC industry and will present its new findings in The McClean Report 2019, which will be published later this month. Among the semiconductor industry data included in the new 400+ page report is an analysis of semiconductor merger and acquisition agreements. The historic flood of merger and acquisition agreements that swept through the semiconductor industry in 2015 and 2016 slowed significantly in 2017 and then eased back further in 2018, but the total value of M&A deals reached in the last year was still nearly more than twice the annual average during the first half of this decade. Acquisition agreements reached in 2018 for semiconductor companies, business units, product lines, and related assets had a combined value of $23.2 billion compared to $28.1 billion in 2017, based on data compiled by IC Insights. The values of M&A deals struck in these years were significantly less than the record-high $107.3 billion set in 2015 (Figure 1)  Figure 1 The original 2016 M&A total of $100.4 billion was lowered by $41.1 billion to $59.3 billion because several major acquisition agreements were not completed, including the largest proposed deal ever in semiconductor history—Qualcomm’s planned purchase of NXP Semiconductor for $39 billion, which was raised to $44 billion before being canceled in July 2018. Prior to the explosion of semiconductor acquisitions that erupted four years ago, M&A agreements in the chip industry had a total annual average value of $12.6 billion in the 2010-2014 timeperiod. |

|

|

|||||

|

|

|||||

|

|||||