However, China’s indigenous IC production is still likely to fall far short of government targets.

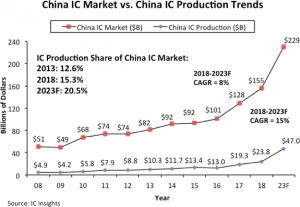

China has been the largest consuming country for ICs since 2005, but large increases in IC production within China have not immediately followed, according to data presented in the new 500-page 2019 edition of IC Insights’ McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry (released in January 2019). As shown in Figure 1, IC production in China represented 15.3% of its $155 billion IC market in 2018, up from 12.6% five years earlier in 2013. Moreover, IC Insights forecasts that this share will increase by 5.2 percentage points from 2018 to 20.5% in 2023.

Figure 1

Currently, China-based IC production is forecast to exhibit a very strong 2018-2023 CAGR of 15%. However, considering that China-based IC production was only $23.8 billion in 2018, this growth is starting from a relatively small base. In 2018, SK Hynix, Samsung, Intel, and TSMC were the major foreign IC manufacturers that had significant IC production in China. In fact, SK Hynix’s 300mm China fab had the most installed capacity of any of its fabs in 2018 at 200,000 wafers per month (full capacity).