EDACafe Editorial Roberto Frazzoli

Roberto Frazzoli is a contributing editor to EDACafe. His interests as a technology journalist focus on the semiconductor ecosystem in all its aspects. Roberto started covering electronics in 1987. His weekly contribution to EDACafe started in early 2019. Arm record numbers; RF GaN-on-Si; security partnerships; new AI chips; Broadcom acquires VMwareMay 26th, 2022 by Roberto Frazzoli

Catching up on some of the news from the last twenty days or so, let’s start with Intel: the company’s shareholders have reportedly rejected compensation packages for top executives, including a payout of as much as $178.6 million to CEO Pat Gelsinger. Advances to Real Intent’s Meridian DFT Real Intent has announced advances to its “Meridian DFT” multimode DFT static sign-off tool with root cause analysis. Meridian DFT now presents the results as tables, with detailed coverage reporting for violating registers, design instances with the most uncovered faults, and selected test points per test mode. It also annotates coverage debug attributes per test mode for controllability, observability, and stuck-at-0/1 faults. Additionally, the new version includes tables with hyperlinks for cross-probing of nets and instances to the schematic or source code viewer. Real Intent has also made additions to Meridian DFT’s rules, including specialized rules for sequential capture through loops and deep sequences of flip-flops without scan collars, controllability and observability through memories, and advanced connectivity checks. Deep learning acceleration – trends and news from the Linley Spring Processor ConferenceMay 19th, 2022 by Roberto Frazzoli

The Linley Spring Processor Conference 2022 – which took place last April 20th and 21st – saw the participation of numerous sponsor companies, many of them offering deep learning acceleration solutions. This week EDACafe takes a quick look at the conference content, mostly focusing on some technology trends and some new announcements. Full proceedings of the event can be accessed from www.linleygroup.com, the website of the technology analysis firm now owned by Canadian reverse engineering company TechInsights. Ever-growing NLP models In his keynote speech, TechInsights’ principal analyst Linley Gwennap pointed out that language-processing models keep growing at an impressive pace: Alibaba’s M6 has 10 trillion parameters. Model size is limited by training time (compute cycles): for example, training the GPT-3 model using one thousand A100 GPUs takes more than one month. Rapid growth has been achieved by moving to large and very expensive clusters. Recent progress focuses on adding parameters using fewer GPU cycles: for example, Alibaba reports training M6 required only 15% the time of smaller GPT-3. Training can be accelerated through ‘model sharding’, which divides a model across many chips. This requires complex software, possibly with manual assistance. Scaling massive models across servers and racks, sharding requires high-bandwidth connections. Cutting cloud costs with ExotaniumMay 13th, 2022 by Roberto Frazzoli

Saving up to 90% by leveraging the cloud ‘spot market’ and avoiding overprovisioning: that’s the promise of Exotanium, a startup enabling users to benefit from Live Virtual Machine Migration – even with stateful workloads – in a transparent way and without interruption Chip design teams are increasingly resorting to cloud computing, mostly as a way to reduce time-to-market. Running the EDA tools in the cloud, however, can prove extremely expensive, and skyrocketing cloud bills may prevent users from extending the benefits of cloud computing to a larger number of designs. A startup called Exotanium is now offering new solutions to optimize cloud costs, promising savings up to 90%. Cost reduction is obtained by taking advantage, as much as possible, of the cheapest cloud resources (the ones offered through the so-called “spot market”) and by avoiding overprovisioning (that is, paying for cloud resources that are larger in capacity than needed). These achievements were made possible by technologies originally developed at Cornell University (Ithaca, New York). Hakim Weatherspoon, CEO of Exotanium, described the company’s solutions in the video interview he recently gave to EDACafe’s Sanjay Gangal; in this article we will add a few details, as well as the answers provided by Rohan Prakash – Exotanium’s Senior Business Development Manager – to some additional questions.

Geopolitical issues; controversy over deep learning in EDA; high-NA EUV advancements; new RGB displayMay 5th, 2022 by Roberto Frazzoli

Politicians around the world are getting increasingly involved in initiatives aimed at boosting or protecting their countries’ competitiveness in the semiconductor market. This is why ‘geopolitical’ issues make up a significant part of this week’s news round-up. Other updates concern the controversial Google paper on deep learning-based chip block placing, high-NA EUV advancements, and more. Geopolitical issues: Arm IPO, Indian investments, Alphawave-OpenFive deal UK prime minister Boris Johnson has reportedly joined a final push to convince Arm – which is currently preparing its IPO – to list on the London stock exchange, as the UK government is concerned over the damage if Britain’s best-known tech company chooses New York for its initial public offering. SoftBank chief executive Masayoshi Son, however, has reportedly described New York’s Nasdaq exchange as “the most suitable” as it is “at the center of global high-tech”. Cadence’s CFD suite; cloud-based DFM analysis; Applied Material innovations; Arm IoT solutions; ECU virtualization; paper-thin loudspeakersApril 28th, 2022 by Roberto Frazzoli

As we saw last week in our special report on EDA startups, deep learning acceleration startups are more numerous and are getting much more funding. It’s therefore interesting to read the following comment by processor analyst Linley Gwennap: “Well-funded startups, including several unicorns, have been unable to demonstrate any advantage over Nvidia’s Ampere products, much less the upcoming Hopper generation. (…) Cerebras, Groq, and SambaNova, along with leading Chinese startups Enflame and Iluvatar, are in production but have published few or no benchmarks, probably owing to some combination of deficient hardware and unoptimized software. Of the best-funded AI-chip startups, only Graphcore has provided official MLPerf results, falling well short of Ampere in per-chip performance and power efficiency.” Let’s now move to this week’s news round-up, catching up on some of the updates from the last twenty days or so. Cadence launches a computational fluid dynamics software suite Cadence has recently introduced its Fidelity CFD Software, a suite of computational fluid dynamics solutions for multiple markets, including automotive, turbomachinery, marine, aerospace and others. The suite builds upon the expertise and technology that Cadence has gained from the Numeca and Pointwise acquisitions. Special report: EDA startups in the “silicon renaissance” eraApril 21st, 2022 by Roberto Frazzoli

Despite the booming semiconductor industry, the number of new EDA startups is smaller than one would expect. Is the EDA industry’s status quo hindering innovation? Is venture capital overlooking EDA? We asked these and other questions to industry veterans (Lucio Lanza, Wally Rhines, Alberto Sangiovanni-Vincentelli) and startuppers (Chouki Aktouf, Keshav Amla) “EDA, where electronics begins”: this was the title of a video produced in 2002 by the EDA Consortium (now Electronic System Design Alliance). The motto literally holds true today, in the so-called “semiconductor renaissance” era – an expression alluding not only to record high chip revenues and fab investments, but also to the dozens of startups developing new processing architectures for deep learning acceleration. In contrast, the number of new EDA startups seems to be smaller than one would expect. Undoubtedly, the current boom of the semiconductor industry is also benefitting the big EDA vendors and the EDA industry as a whole; just see the latest ESDA figures. Still, the relatively small number of EDA startups may raise some concerns, as these nascent companies are usually considered a key indicator of the liveliness and innovation capabilities of hi-tech industries. To shed some light on this matter, EDACafe talked to industry veterans and startuppers, getting interesting answers. Read the rest of Special report: EDA startups in the “silicon renaissance” era EDA goes SaaS; UCIe expansion; eFPGAs’ growth; ReRAM advancements; Risc-V; Zoned Storage; MLPerfApril 8th, 2022 by Roberto Frazzoli

As the news from Ukraine gets more and more disturbing, the list of Western tech firm that have suspended business operations in Russia gets longer: among them, Intel. Before moving to this week’s tech news round-up, a quick mention of a market forecast concerning datacenters: according to market research firm TrendForce, the penetration rate of Arm architecture in datacenter servers will reach 22% by 2025. Synopsys launches an EDA cloud SaaS solution Synopsys has announced a new cloud-optimized EDA deployment model based on a single-source, pay-as-you-go approach. Called Synopsys Cloud, the service provides access to the company’s cloud-optimized design and verification products, with pre-optimized infrastructure on Microsoft Azure. The initiative aims at overcoming the limitations of conventional cloud-based EDA design, such as the difficulties in forecasting compute needs – leading to underestimation – or predefined design and verification capacity of the “bring your own cloud” (BYOC) approach. Synopsys is also working with major foundries to streamline access to required manufacturing collateral for use with its cloud-optimized products. Semiconductor revenues in 2021; fab spending forecast; low power displays; DSA advancementsApril 1st, 2022 by Roberto Frazzoli

A few brief updates before moving to the rest of our weekly news round-up. Korean memory maker SK Hynix is reportedly considering the creation of a consortium to buy Arm. Speaking of memories, Apple is reportedly exploring alternative Flash suppliers for its iPhones, including China-based Yangtze Memory Technologies Co. Moving to the autonomous vehicle scenario, Waymo has started testing fully autonomous operations in San Francisco with Jaguar I-PACE electric cars. This new step comes after years of testing of fully autonomous service in the East Valley of Phoenix. 2021 semiconductor revenues According to market research firm Omdia, the worldwide semiconductor market surpassed annual revenue of half-a-trillion dollars for the first time ever in 2021, and nearly 60% of companies in the sector grew by more than 20% in revenues. On an annual basis, Intel ranked as the number one semiconductor company in 2021, with revenue at $76.6B, which represented 13% of all semiconductor revenue for the year. Intel’s 2021 revenue growth was nearly flat from 2020, in contrast with the following top nine semiconductor firms which all experienced year-over-year growth above 15%. Omdia points out that the MPU product category – Intel’s core business – grew at just 11% YoY last year, much lower than the total semiconductor growth level of 24%. Samsung finished 2021 just behind Intel, with semiconductor revenue of $75.2B, representing 12.8% of all revenue for the industry. Samsung growth owes to the strong increase in the DRAM and NAND markets (up 42% and 23% respectively in 2021), as the Korean firm is the number one vendor for both product categories. Nvidia’s innovations; secure design; cloud-based EDA; Risc-V tools; early-stage investmentsMarch 25th, 2022 by Roberto Frazzoli

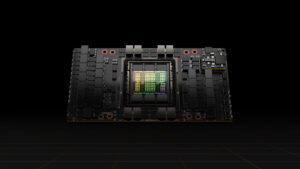

Both Nvidia and Arm are in the news this week, obviously for unrelated reasons after the proposed acquisition deal collapsed. Nvidia keeps introducing impressive innovations at an impressive pace, raising the bar for contenders. Meanwhile, Arm keeps preparing for its IPO – expected to value the company at $60 billion – with SoftBank reportedly planning to pick Goldman Sachs as the lead underwriter. Nvidia GTC updates At its recent GTC event, Nvidia introduced a host of new products and innovations mostly targeted at AI-powered data centers; here we will only provide an extremely brief overview. As for GPUs, the company launched its new Hopper architecture, claiming an order of magnitude performance leap over its predecessor Ampere architecture. Nvidia also announced the first Hopper-based GPU, the H100, an 80 billion transistors chip built using a TSMC 4N process, offering nearly 5 terabytes per second of external connectivity and 3 terabytes per second of memory bandwidth. Among the innovations introduced by the H100 is a new Transformer Engine (devoted to the Transformer model for natural language processing); the second generation of the Secure Multi-Instance GPU technology; the fourth generation of NVLink; new DPX instructions to accelerate dynamic programming. A 71-page white paper on the H100 architecture can be downloaded from this web page. As for data center CPUs, Nvidia announced its first Arm Neoverse-based processor, called ‘Grace CPU Superchip’, comprising two CPU chips coherently connected over NVLink-C2C, a new high-speed, low-latency, chip-to-chip interconnect. The device integrates 144 Arm cores, reaching an estimated performance of 740 on the SPECrate 2017_int_base benchmark. Another announcement from the GTC event concerns NVLink-C2C, a chip-to-chip and die-to-die interconnect, open to custom silicon integration. NVLink-C2C enables coherent interconnect bandwidth of 900 gigabytes per second or higher. In addition to it, Nvidia will also support the Universal Chiplet Interconnect Express (UCIe) standard announced earlier this month. Recent updates also include Nvidia reportedly interested in exploring chip manufacturing with Intel Foundry Services. Intel to invest in Europe; Arm to reportedly cut workforce; SiFive gets more funding; research updatesMarch 17th, 2022 by Roberto Frazzoli

Despite SEMI’s reassuring statement, concerns of a potential neon gas shortage due to the Ukrainian war keep surfacing. According to sources contacted by Reuters, effects on chip manufacturing could be felt if the conflicts drags on, and could mostly hit smaller chipmakers. On a wider IT scale, recent updates include concerns about data security expressed by some European governments in countries – Germany and Italy – that rely on Russia-headquartered Kaspersky’s cyber protection technologies. Moving to EDA companies, Aldec has suspended all sales and distribution transactions in Russia and is offering temporary housing to its Ukrainian personnel at a company’s facility in Poland; and Ansys, that had already suspended all sales transactions and consulting activities in Russia and Belarus, has now announced it will also make a financial contribution to ‘Doctors Without Borders’ in support of Ukrainian refugees. Let’s now move to tech news, this week including some academic research updates. Intel investments in Europe The European Union’s initiative to bolster local chip manufacturing (“EU Chip Act”) is starting to bear fruits: Intel has just announced the first phase of its plans to invest 80 billion euros in the European Union over the next decade along the entire semiconductor value chain. The plan includes a 17 billion euros investment for two semiconductor fabs in Magdeburg, Germany, a site that Intel has dubbed ‘Silicon Junction’. More Intel investments are planned in Ireland, Italy, Poland, Spain and France. In this latter country Intel is planning to establish its new European R&D hub, its European headquarters for high performance computing and artificial intelligence design capabilities, and its main European foundry design center. |

|

|

|||||

|

|

|||||

|

|||||