EDACafe Editorial Roberto Frazzoli

Roberto Frazzoli is a contributing editor to EDACafe. His interests as a technology journalist focus on the semiconductor ecosystem in all its aspects. Roberto started covering electronics in 1987. His weekly contribution to EDACafe started in early 2019. Rapidus advancements; automotive AI updates; CHIPS Act supporting SOI and SiC fabs; Qualcomm-Arm legal battleDecember 19th, 2024 by Roberto Frazzoli

Let’s start with an EDA update that is closely related to the so called “chip war” between China and the U.S. According to an article from South China Morning Post, Chinese EDA company Empyrean has ceded control to its largest state-owned shareholder, China Electronics Corporation (CEC). Empyrean’s board of directors granted CEC full control of the company after the EDA firm was put on a U.S. trade blacklist (the “Entity List”). So Chinese state-owned CEC, once a strategic investor, will reportedly consolidate the financial statements of Empyrean into its own and manage the EDA firm as a direct subsidiary. Rapidus advancements: process, equipment, EDA collaborations Recently established Japanese foundry Rapidus has announced several steps towards becoming operational with its 2-nanometer GAA process. Working in partnership, IBM and Rapidus have achieved the capability of building nanosheet gate-all-around transistors with multiple threshold voltages (or multi-Vt), which enable ultra-low threshold voltages for high-performance computing, and higher threshold voltages for low-power computing. The two companies believe Rapidus will be able to produce these chips before the end of this decade. Details of the challenges and solutions can be found here. Additionally, Rapidus has received and installed an ASML’s EUV lithography equipment at its fab currently under construction in Chitose, Hokkaido, which will be used for the 2-nanometer gate-all-around (GAA) manufacturing. According to the company, this is the first time that an EUV lithography tool will be used for mass production in Japan.

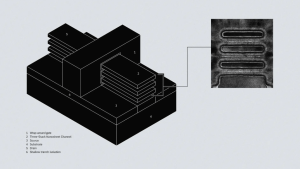

Rapidus has also signed an agreement with Synopsys to enable a solution that will shorten design cycle time, using a new approach to natively model process sensitivity and variation in the design steps. Rapidus’ Design for Manufacturing and Co-Optimization (DMCO) concept aims to simultaneously optimize design and manufacturing and enable agile design, addressing the bottleneck of the IP library re-characterization each time the process design kit or manufacturing process is updated. The new DMCO solution will use Synopsys AI-driven EDA products, including Synopsys PrimeShield. Additionally, Rapidus will use sensors and AI in the wafer process to streamline designs based on silicon big data from the manufacturing process, leveraging Synopsys’ AI-driven EDA flows. Lastly, Rapidus is also collaborating with Cadence to provide co-optimized AI-driven reference design flows and a broad IP portfolio to support its 2-nanometer gate-all-around process and its backside power delivery network technology. U.S. CHIPS Act updates The latest CHIPS Act announcements from the U.S. Department of Commerce include a funding award to GlobalWafers and the signature of a preliminary memorandum of terms with Bosch. GlobalWafers America (GWA) and MEMC, subsidiaries of GlobalWafers, will be awarded up to $406 million to support the construction of wafer manufacturing facilities in Texas and Missouri. The GWA facility in Texas will be the first advanced high-volume 300mm silicon wafer fab in the United States. The MEMC facility in Missouri will serve as a key domestic production site for 300mm silicon-on-insulator wafers. And, based on the memorandum, Bosch will be provided up to $225 million to support the company’s planned investment of $1.9 billion to transform and expand its manufacturing facility in Roseville, California, for production of silicon carbide power semiconductors. Automotive AI and ADAS collaborations: Synopsys/SiMa.ai, BOS/Tenstorrent Synopsys and SiMa.ai have announced a strategic collaboration to jointly deliver a new solution for automotive companies to accelerate the development of workload-specific silicon and software needed to power artificial intelligence-enabled features in next-generation automobiles. The solution will combine Synopsys’ EDA, automotive-grade IP, and hardware-assisted verification solutions with SiMa.ai’s machine learning accelerator IP and complete ML software stack application development environment – for maximum customization of IP, subsystems, chiplets, and SoCs. South Korean BOS Semiconductors and U.S.-headquartered Tenstorrent have unveiled what they claim is the first automotive AI accelerator chiplet SoC, Eagle-N. Jointly developed by the two companies, Eagle-N incorporates Tenstorrent’s Tensix NPU core, which is tailored for artificial intelligence applications in Advanced Driver Assistance Systems (ADAS) and In-vehicle infotainment (IVI) solutions. According to the two companies, carmakers and their Tier-1 suppliers can simply implement Eagle-N on top of their existing ADAS or IVI domain computing system to upgrade the AI performance. Acquisitions NXP has entered into a definitive agreement to acquire Aviva Links, a provider of in-vehicle connectivity solutions, in an all-cash transaction valued at $242.5 million. Aviva Links solutions are compliant to the standards developed by the Automotive SerDes Alliance (ASA), a non-profit industry alliance of automotive technology providers aiming to encourage the standardization of asymmetric SerDes technology – as an alternative to proprietary solutions. Further reading The legal battle between Qualcomm and Arm over Nuvia and licensing fees has entered a key phase with the trial currently going on in U.S. federal court in Delaware. Interesting backstories are revealed by press articles reporting about questions asked by the attorneys and the testimony provided by company officers. A Nuvia co-founder was reportedly pressed to acknowledge that the licensing contract covered “derivatives” and “modifications” of the Arm IP, even though he estimates that the amount of Arm’s technology in Nuvia’s final designs is one percent or less. In his testimony, Qualcomm’s CEO Cristiano Amon reportedly explained that the goal of the Nuvia acquisition was to reduce the dependence on Arm – but in 2021 Nuvia was focused on the server market, not laptops and mobile devices. So, to justify the Nuvia acquisition price ($1.4 billion), Amon told Qualcomm’s board that the company could save $1.4 billion per year on payments to Arm by switching away from Arm’s cores to those designed by Nuvia. This huge saving estimate – a much higher figure than the $50 million reduction in revenue feared by Arm – was based on the expectation that Qualcomm would enter a big new market for PC chips that would otherwise require massive royalty payments to Arm. |

|

|

|||||

|

|

|||||

|

|||||