EDACafe Editorial Roberto Frazzoli

Roberto Frazzoli is a contributing editor to EDACafe. His interests as a technology journalist focus on the semiconductor ecosystem in all its aspects. Roberto started covering electronics in 1987. His weekly contribution to EDACafe started in early 2019. Intel CEO retires; new U.S. restrictions on exports to China; HBM’s growing importanceDecember 5th, 2024 by Roberto Frazzoli

The unexpected retirement of Intel’s CEO Pat Gelsinger is clearly this week’s major event, and the December 2 announcement spurred a flurry of analysis, comments and backstories. According to Reuters, Gelsinger was forced out after a meeting when the company board told him that he could retire or be removed. Reportedly, the Intel board lost confidence in Gelsinger’s costly and ambitious plan to transform Intel, as the progress of change was not fast enough. In other words, the board holds Gelsinger responsible for Intel’s recent disappointing results: the reduction of its market capitalization (the Intel stock reportedly lost more than 60% under Gelsinger’s tenure), the significant growth of its capital expenditure, and the troubles still affecting its new Foundry business. A summary of the company’s financial performance, with charts, can be found here. The outcome of Gelsinger’s attempt to transform Intel begs questions about his IDM 2.0 strategy, a plan which could arguably be summarized as follows: in a few years, making Intel able to compete on par with both Nvidia and TSMC. Was this goal too ambitious and unrealistic? Or was the financial market not patient enough to wait for a feasible strategy to be fully implemented? And, assuming Gelsinger’s strategy was theoretically feasible, was its practical implementation hindered by Intel’s limited “ability to execute”, to use a Gartner term? If so, organizational inefficiencies may have played a role in delaying positive results. Former Cadence CEO Lip-Bu Tan quit the Intel board last August criticizing not just Gelsinger’s strategy, but reportedly complaining about Intel’s “bloated workforce”, its “risk-averse and bureaucratic culture”, saying he believed Intel was “overrun by bureaucratic layers of middle managers who impeded progress at Intel’s server and desktop chips divisions.” And Intel candidly admitted other inefficiencies in June 2023 when it adopted the “internal foundry model”: namely, an excessive use of “expedited” wafers that business units decide to move through Intel’s manufacturing process, which are costly and reduce factory efficiency, and Intel’s test times, which ran “double or triple those of competitors”. The next Intel CEO, whoever he or she will be, will have to decide not just whether to continue or discard Gelsinger’s IDM 2.0 strategy, but also how to deal with Intel’s inefficiencies – part of which arguably still exist, even though Gelsinger has gone. (By the way: searching for a new CEO, Intel has reportedly approached the above mentioned Lip-Bu Tan, among others). And, as for the future of Intel Foundry, he or she will face an additional complication: reportedly, the company has said that its recent deal for $7.86 billion in U.S. government subsidies restricts its ability to sell stakes in its foundry unit if it becomes an independent entity.

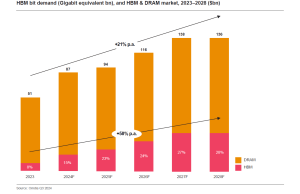

New U.S. restrictions on technology exports to China The U.S. Department of Commerce’s Bureau of Industry and Security (BIS) has announced a package of rules designed to further impair China’s capability to produce advanced-node semiconductors that can be used in the next generation of advanced weapon systems and in artificial intelligence and advanced computing, which have significant military applications. The rules include new controls on 24 types of semiconductor manufacturing equipment and three types of software tools for developing or producing semiconductors; new controls on high-bandwidth memory (HBM); new red flag guidance to address compliance and diversion concerns; 140 Entity List additions and 14 modifications spanning Chinese tool manufacturers, semiconductor fabs, and investment companies involved in advancing the Chinese government’s military modernization; and several critical regulatory changes to enhance the effectiveness of previous controls. Details of the new rules can be found here and here. ChinaTalk analysis website has an extremely interesting article about these new restrictions, with opinions from China analyst Jordan Schneider, Dylan Patel of SemiAnalysis and Greg Allen from think tank CSIS. Among the many topics touched by the article, “how China’s stockpiling spree may have already rendered these new rules partially obsolete, and what policymakers can do about that going forward; the law-enforcement approach vs. the counterintelligence approach [in other words, treating Chinese fabs as innocent until proven guilty, versus taking immediate action based of mere suspects, editor’s note] and whether export controls should be a foreign-policy tool or simply a law-enforcement activity; how the new chip controls are like removing puzzle pieces just one at a time — and why that’s exactly what China wants to slowly but surely self-indigenize.” HBM’s growing importance The new U.S. restrictions on technology exports to China recognize the importance of high-bandwidth memory (HBM), a key element in AI acceleration chips such as Nvidia GPUs. In its new 33-page “State of the Semiconductor Industry” report, professional services networks firm PwC notes that “HBM operates in a closed-loop ecosystem due to its rapidly evolving technological and performance demands, resulting in high barriers to entry. As HBM specifications evolve so quickly, its designs remain more closed, enabling vendors and customers to adapt swiftly to new developments. Consequently, product quality and through-silicon via (TSV) yield become important factors in ensuring performance and reliability.” Difficulties in entering the HBM market are exemplified by Samsung, who recently issued an apology note about that. According to PwC, the HBM market is set to expand rapidly up to and including 2028, with bit growth CAGR of 64% and revenue growth CAGR of 58%. By 2028, HBM will have become a $38 billion segment, accounting for approximately half of the server DRAM market and 27.6% of the $136 billion total DRAM market. Siemens’ Solido SPICE now certified for multiple Samsung Foundry processes Siemens’ Solido SPICE software – which supports the verification of advanced analog, mixed-signal, RF, memory, library IP and 3D-IC semiconductor designs – is now certified across Samsung Foundry’s FinFET and GAA fabrication processes. Certifications include the foundry’s 14LPU, 14LPP, 8LPP, 5LPE, SF4P/4LPP, SF4/4LPE, SF3(3GAP), SF3P and SF2 technologies. Solido SPICE is also qualified for Samsung Foundry’s FD-SOI 18FDS process technology. |

|

|

|||||

|

|

|||||

|

|||||