EDACafe Editorial Roberto Frazzoli

Roberto Frazzoli is a contributing editor to EDACafe. His interests as a technology journalist focus on the semiconductor ecosystem in all its aspects. Roberto started covering electronics in 1987. His weekly contribution to EDACafe started in early 2019. Amkor to get CHIPS Act funds; startup funding; Synopsys acquires Valtrix; liquid cooling growthAugust 1st, 2024 by Roberto Frazzoli

Scarce supply isn’t the only issue worrying hyperscalers when it comes to relying on Nvidia GPUs: the other factor is high price. The quest for a cheaper, homegrown alternative is driving Amazon’s chip development effort, according to a Reuters report. And Nvidia’s dominant position in the AI market prompted U.S. progressive groups and Democratic Senator Elizabeth Warren to press the Department of Justice to investigate the GPU leader over competition concerns. Meanwhile, Cerebras – an Nvidia competitor – has reportedly filed for an initial public offering in the United States, in a confidential manner. Ultra Librarian-Footprintku AI partnership Ultra Librarian has announced a partnership with Footprintku AI aimed at bringing Footprintku AI’s technologies in Design-for-Manufacturing (DFM) processes into the Ultra Librarian CAD library. Goal of this collaboration is to provide a new on-demand DFM-aware library for companies looking to enhance and validate their libraries for DFM. New fab updates: Amkor, SK hynix Packaging service provider Amkor has signed a non-binding preliminary memorandum of terms with the US Department of Commerce to receive proposed funding as part of the CHIPS and Science Act. Amkor announced in November 2023 its plans to build its first domestic OSAT (outsourced semiconductor assembly and test) facility in Peoria, Arizona. The company projects to invest approximately $2 billion and employ approximately 2,000 people at the new facility. Upon completion, this will be the largest outsourced advanced packaging and test facility in the United States. The terms include up to $400 million in proposed direct funding, and access to $200 million in proposed loans.

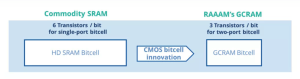

SK hynix has decided to invest about 9.4 trillion won in building the first fab and business facilities of the Yongin Semiconductor Cluster – a 4.15 million square meter site in Wonsam-myeon, Yongin, Gyeonggi Province (South Korea). The company plans to build four state-of-the-art fabs that will produce next-generation semiconductors, and a semiconductor cooperation complex with more than fifty small local companies. Construction of the first fab is expected to start in March next year and complete in May 2027. The new fab will produce next-generation DRAMs, including HBMs; in addition, SK hynix plans to build a “mini-fab” to help small businesses develop, demonstrate and evaluate technologies. Startup funding: Fractile, RAAAM UK-based AI startup Fractile has emerged from stealth mode announcing $15 million in seed funding. The company is developing a new acceleration chip for AI inference based on an “in-memory compute” approach, promising 100x faster performance, 10x cheaper cost and 20x lower power in terms of TOPS/W. RAAAM Memory Technologies, a start-up company that invented a new solution to implement on-chip memory, has been awarded with 5.25M€ from the European Innovation Council (EIC). The company claims that its GCRAM is the most cost-effective on-chip memory technology in the semiconductor industry, providing up-to 50% silicon area reduction and up-to 10X reduced power consumption over SRAM, and it is fully compatible with the standard CMOS fabrication flow, requiring no additional process steps or cost. Liquid cooling penetration expected to reach 10% by late 2024 According to market research firm TrendForce, the penetration rate of liquid cooling solutions in datacenters could reach 10% by late 2024. This forecast is based on the expected adoption of Nvidia’s Blackwell platform by major communications service providers. With an individual B200 chip drawing 1,000 watts and complete rack systems projected to reach 140kW, advanced liquid cooling solutions will be essential for effective heat management in datacenters. US allies won’t be required to align to some future US export restrictions According to a Reuters report, the U.S. government plans a new rule that will expand U.S. powers to stop exports of semiconductor manufacturing equipment from some foreign countries to Chinese chipmakers – but shipments from allies that export key chipmaking equipment (including Japan, the Netherlands and South Korea) – will be excluded, limiting the impact of the rule. The spirit of the new regulation would be using diplomacy when implementing restrictions, and avoiding antagonizing allies. It looks like the financial community took this news as a green light for European and Japanese equipment manufacturers to sell their products to China: reportedly, ASML shares jumped 6.5% and Tokyo Electron shares closed 7.4% higher after the leak. Acquisitions Valtrix, an EDA startup headquartered in Bangalore, India, delivering products and solutions for design verification of Risc-V and ARM based SoC/IP/CPU implementations, is now part of Synopsys. Luminar Technologies, a maker of lidar sensors for self-driving cars, has reportedly purchased the optoelectronic components and laser modules business of Britain’s Gooch & Housego (G&H) to expand its semiconductor operation. The firm launched its semiconductor arm Luminar Semi last year based on the prior acquisition of three companies: laser manufacturer Freedom Photonics, custom chip design house Black Forest Engineering and photodetector firm Optogration. Further reading A new study from German think tank “Interface” (formerly known as Stiftung Neue Verantwortung) argues that the EU Chips Act fails to provide a long-term strategy with clear policy objectives. The paper looks at the current failings of this initiative and emphasizes the need for EU member states to start filling in the blanks on what has been until now a list of strong aspirations. It also invites each EU country to take the following actions: understand the competitive position of their domestic semiconductor industries; articulate why and to what end they want to support this sector, and what their long-term policy objectives are; invest in their national administrative resources and brainpower. According to the study, if EU governments fail to step up and better coordinate their efforts, there is a very real risk that the European semiconductor industry will lose its prominence in the global semiconductor value chain. |

|

|

|||||

|

|

|||||

|

|||||