EDACafe Editorial Roberto Frazzoli

Roberto Frazzoli is a contributing editor to EDACafe. His interests as a technology journalist focus on the semiconductor ecosystem in all its aspects. Roberto started covering electronics in 1987. His weekly contribution to EDACafe started in early 2019. New Intel financial reporting structure highlights Intel Foundry’s loss of $7B in 2023April 4th, 2024 by Roberto Frazzoli

The news about Intel Foundry takes center stage this week. Prior to summarizing the Intel announcement, here’s a short comment. Before Pat Gelsinger took office as the company’s CEO, some investors suggested Intel to adopt the fabless model, just like AMD in 2008. Gelsinger, instead, doubled down on manufacturing, announcing not just his intention to keep the fabs, but even to offer a foundry service. Intel’s decision to separate the financial reporting for the two parts of its business – foundry service VS chip sales – is probably an unavoidable step in the implementation of Gelsinger’s strategy, and will put it to the test. On the one hand, the new reporting structure will force Intel Products (the chip sales business) to correct its inefficiencies, as it will lose the convenience of easy access to internal manufacturing resources and seemingly costless design respins. On the other hand, Intel Foundry will be forced to quickly become competitive against TSMC, also because – at least officially – Intel Products will now be free to choose any other foundry instead. As of today, an unavoidable side effect of this decoupling is the public disclosure of Intel Foundry’s substantial losses. Will Intel Foundry deliver on its promise of reaching breakeven around 2027? It would be interesting to know if Intel has a plan B, and – if so – if plan B involves going fabless as an extreme option. The new financial reporting structure makes it easy to spot the lossy business within Intel (if any), and this easy spotting capability may sound like setting the stage for divestiture. A key difference from 2008, however, is the current chip war economy, with taxpayers around the world currently subsidizing their respective domestic semiconductor industries. Depending on the dose, public subsidies can offset a company’s inefficiencies and make it competitive on the market. Let’s now move to the Intel announcement and other related news. Intel’s financial reporting structure to separate Foundry from Products On April 2, Intel outlined a new financial reporting structure that is aligned with the company’s previously announced foundry operating model. The new reporting structure establishes a foundry relationship between Intel Foundry, the company’s manufacturing organization, and Intel Products, comprised of the company’s product business units. Beginning with the first quarter 2024, Intel will present segment results aligned to the following operating segments: Client Computing Group (CCG); Data Center and AI (DCAI); Network and Edge (NEX); Intel Foundry; Altera; Mobileye; and Other. CCG, DCAI and NEX will collectively be referred to as Intel Products; Altera, Mobileye and Other will collectively be referred to as All Other. Under this new structure, Intel Foundry will recognize revenues generated from both external foundry customers and Intel Products, as well as technology development and product manufacturing costs historically allocated to Intel Products. Instead of recognizing manufacturing costs that were previously allocated to the product operating segments, Intel Products will be charged a market-based price by Intel Foundry. Following the adoption of this new reporting structure, Intel filed a new Form 8-K containing recalculated operating segment results for the years 2023, 2022 and 2021.

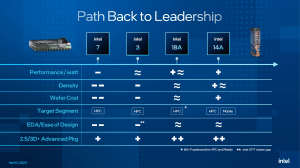

Intel Foundry announces $7 billion losses for 2023 The new Form 8-K recalculated results show that Intel Foundry in 2023 had an operating loss of $7 billion, compared to an operating loss of $5.2 billion in 2022. In addition to that, the Foundry revenue in 2023 was $18.9 billion, down $8.6 billion from 2022. Intel Foundry, however, has plans for moving from losses to profits. Operating margin improvement is expected through shifting volume mix to extreme ultraviolet (EUV) nodes as the company achieves process parity (compared to competitors) and leadership. Intel Foundry expects to drive further operating margin expansion by manufacturing a larger percentage of Intel’s products, growing its high-margin advanced packaging business, continuing to expand its external foundry business, and further focusing on capital utilization, cost efficiency and growing scale. Intel Foundry’s operating losses are expected to peak in 2024 as Intel completes its “five-nodes-in-four-years” journey, and the company is driving to achieve break-even operating margins midway between now and the end of 2030, when it targets 40% non-GAAP gross margins and 30% non-GAAP operating margins. Below is a slide – from Intel’s New Segment Reporting Webinar – that has been posted and commented by several analysist over the past few days, depicting Intel Foundry plans for regaining manufacturing leadership. (Compared to leading foundry competitors – presumably TSMC – the minus sign in the slide means behind, the plus sign means ahead, and the wave sign means roughly equal). The EUV role As one can see from the transcript of Intel’s New Segment Reporting Webinar, Pat Gelsinger maintains that one of the main reasons behind the foundry losses is Intel’s delay in the adoption of EUV lithography, “We were slow to adopt EUV,” he said. “As we went through our stumble of not embracing EUV and Intel 7, this allowed the industry to catch up. But the cost and complexities of EUV resulted in a flattening of the curve for the entire industry. We have now broken through that EUV wall and turned the corner toward High-NA. And importantly, we’re putting the economics back into Moore’s Law, where it’s going to be uncompetitive for earlier pre-EUV technologies and for chips and fabless vendors using those to not embrace the leadership technologies.” (…) “In the post-EUV era, we see that we’re very competitive now in price performance, back to leadership. And the pre-EUV era we’ve carried a lot of cost and uncompetitiveness.” (…) “If you measure the cost per 100 million transistors, essentially pre-EUV to post-EUV it’s about half, meaning it’s uncompetitive to be building chips on pre-EUV nodes going forward.” Market reactions and analysts’ comments According to Reuters, Intel shares fell nearly 7% on April 3, following the disclosure of the Foundry losses. The Reuters report maintains that Intel is set to lose more than $12 billion in market value if the losses hold. The new Intel financial reporting structures and Intel Foundry’s loss-to-profit plan elicited interesting comments from several industry analysts, who discussed different aspects of manufacturing costs and inefficiencies – besides just using or not using EUV. Those analysis cannot be summarized here, so we will only flag two of them as “further reading” suggestions: from SemiAnalysis and from More than Moore. |

|

|

|||||

|

|

|||||

|

|||||