EDACafe Editorial Roberto Frazzoli

Roberto Frazzoli is a contributing editor to EDACafe. His interests as a technology journalist focus on the semiconductor ecosystem in all its aspects. Roberto started covering electronics in 1987. His weekly contribution to EDACafe started in early 2019. Synopsys to acquire Ansys: what will be the impact on the EDA industry?January 18th, 2024 by Roberto Frazzoli

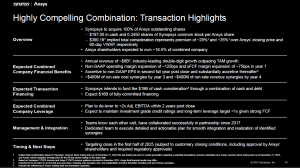

Is the $35 billion deal going to change the EDA oligopoly? Is the need for better electronics-physics integration a game changer? Is EDA as a standalone industry gradually disappearing? Will Cadence look for merger opportunities? The rumors have been confirmed: after a seven-year partnership, on January 16th Synopsys and Ansys announced that they have entered into a definitive agreement under which Synopsys will acquire Ansys for an enterprise value of approximately $35 billion. The transaction is anticipated to close in the first half of 2025. Summing up Synopsys’ 2023 revenue (approximately $6 billion) and Ansys’ 2023 revenue guidance (approximately $2 billion), the combined entity is expected to achieve a $8 billion annual income. According to the two companies, this merger is motivated by a compelling rationale: first of all, the new customer demands stemming from the complexity of today’s intelligent systems (including the chiplet trend), which require the integration of semiconductor design and simulation and analysis, in a “silicon to systems” approach that fuses electronics and physics; besides that, new growth opportunities in areas such as automotive, aerospace and industrial, where Ansys has an established presence; and the complementarity of the two companies’ respective solutions. A key role in the integration of the two organizations will be played by Rick Mahoney, currently Chief Revenue Officer in the Go-to-Market Group at Synopsys and previously Senior Vice President of Worldwide Sales, Customer Excellence, and Marketing at Ansys.

A few financial details As a result of the merger, Synopsys expects its total addressable market (TAM) to increase by 1.5x to approximately $28 billion and to continue growing at roughly an 11% CAGR, driven by megatrends accelerating the need for the fusion of electronics and physics across industries. The combination is also expected to expand Synopsys’ operating margin; to generate substantial and sustained free cash flow; to achieve approximately $400 million of cost synergies by year three post-closing and approximately $400 million of revenue synergies by year four post-closing. After the acquisition news, Synopsys shares were up 3.8% and Ansys shares were down 4.8%, according to Reuters. The Reuters report also points out that the deal could trigger regulatory scrutiny, especially worrying in China where approval times have become difficult to predict. Synopsys/Ansys solution integration: present and future The partnership with Ansys has been an integral part of Synopsys Fusion since 2017. As the two companies pointed out in their presentation to the investor community, the close collaboration has involved both the technological side and the “go to market” activity; as a result, today the vast majority of Synopsys Fusion Compiler users incorporate Ansys technology, and the joint solution is qualified at leading foundries. As for the future, some hints about how the two companies are planning to further integrate their respective solutions can be inferred from some of the “synergies” they expect to achieve – again, based on the investor relation presentation. By year three post-closing: integration of engineering platforms and technology reuse for AI and Cloud. By year four: integration of multi-physics system analysis for advanced chip design; expansion of direct account coverage for Ansys portfolio in semiconductor/high-tech sector; joint semiconductor solutions (e.g. analog/RF). Over the long term: new joint innovative system solutions, e.g. digital twin, functional safety. Will the Synopsys-Ansys merger change the EDA oligopoly landscape? Besides being a remarkable acquisition in absolute terms ($35 billion), the Synopsys-Ansys deal is definitely a major event for the EDA industry, and it’s worth trying to figure out what its impact will be – if it gets approved by the regulatory authorities. Consolidation and concentration are nothing new in the EDA industry, but Ansys is not a pure-play EDA vendor. So here are a few questions that, when answered, could probably provide some insights on the future of the EDA industry. Is tool integration more important today than it was in the past? We learned from EDA veterans and analysts that the EDA oligopoly is first and foremost an oligopoly of tools, rather than vendors. Within any one EDA product category there is a dominant vendor which becomes a supplier of choice, thanks to the proven reliability of its golden signoff tools that major foundries consider almost like a defacto standard. Large and advanced EDA users developing complex products usually do not rely on just a single vendor for the entire tool suite; they pick best-of-class tools in each different category, and then integrate them into their own unique tool flow. Will the Synopsys-Ansys merger allow the combined entity to become the supplier of choice in any product categories currently dominated by competitors? Assuming that this is what the two companies are hoping, success will largely depend on the value of tool integration in the new era characterized – for example – by the chiplet trend, posing new challenges on the mechanical and thermal front. Until now, the most sophisticated customers have been the category of users less likely to marry one single EDA vendor for their entire tool flow; will the chiplet trend convince them to prioritize the “convenience” of ready-to-use integrated solutions over the freedom of mixing and matching tools from different vendors? A second question concerns the benefits of working under one single umbrella: will Synopsys and Ansys as a unified organization be able to achieve something – in terms of product innovation – that they haven’t been able to achieve during their seven-year partnership? Is EDA as a standalone industry gradually disappearing? After the Synopsys-Ansys merger, two out of three of the “big three” EDA companies will be – in one way or another – large engineering software companies, offering a diverse range of tools besides EDA. Siemens EDA is part of Siemens Digital Industries Software, also providing PLM and manufacturing software; and Ansys – as a multiphysics simulation specialist – is obviously offering solutions in many other industries other than semiconductors. Some of them include automotive, aerospace, energy, transportation, healthcare, industrial equipment, nuclear. Not surprisingly, many of the mainstream media outlets reporting about the acquisition described Ansys as the maker of software used in creating Novak Djokovic tennis racket. Synopsys itself, one could argue, is not a pure-play EDA vendor either, in that it has a software security division. Increasingly, the border line around the EDA industry seems to be blurring. Will Cadence look for merger opportunities? According to Reuters, Ansys started exploring a sale late last year after getting inbound acquisition interest from Cadence. If this is true, preventing Cadence from buying Ansys might have been an additional reason for Synopsys to go ahead with the deal soon, even amid a top management change (from Aart de Geus to Sassine Ghazi, with the latter taking office just a couple of weeks before the acquisition announcement). Out of the “big three” EDA companies, Cadence is now the only pure-play EDA vendor left, and it is obviously much smaller than the other two – if we consider the parent company in the case of Siemens EDA, or the company resulting from the Synopsys-Ansys merger. Based on approximate figures (Wikipedia data), Cadence has 10,200 employees, Siemens Digital Industries Software has 24,000, and the combined Synopsys-Ansys company should be in the range of 26,400. To level the playing field in terms of company size and/or range of solutions offered, Cadence might now be looking for a major merger opportunity. Obviously, this could be pursued either by acquiring or by being acquired by other software vendors, either in the EDA industry or in the engineering software area. Names such as Autodesk or Dassault Systèmes come to mind – but, of course, this is pure speculation. |

|

|

|||||

|

|

|||||

|

|||||