EDACafe Editorial Roberto Frazzoli

Roberto Frazzoli is a contributing editor to EDACafe. His interests as a technology journalist focus on the semiconductor ecosystem in all its aspects. Roberto started covering electronics in 1987. His weekly contribution to EDACafe started in early 2019. Flexible NoCs; Tesla to cut SiC use; South Korea semi ambitions; GPT-4March 16th, 2023 by Roberto Frazzoli

The international race for semiconductor supremacy and the impact of electric vehicles on the SiC market are among the themes of this week’s news roundup. But first, some IP and EDA updates. IP and EDA updates: Signature IP, Defacto, Cadence New startup Signature IP aims to innovate the Networks-on-Chip IP scenario. As the company stated in a press release, the company’s purpose is to make it easy to design and configure the NoC backbone within a chip and benefit from the flexibility of exploring the design space before committing to an architecture. “There are few commercial NoC providers to choose from, and they are typically very restrictive in their architectures and commercial terms,” said CEO Purna Mohanty. “Our flexible iNoCulator NoC configuration tool enables customers to experiment with their SoC architecture and simulate it in real time so they can optimize it at the top level.” Offered as Software-as-a-Service, iNoCulator NoC Configurator can generate both coherent and non-coherent NoCs. It enables users to change the NoC topology, experiment with different configuration settings, and simulate the results to measure throughput and latency. Defacto has announced SoC Compiler 10.0, the new major release of its front-end design solution for large SoCs. Among new pre-synthesis design features, the ability to use both Accelera’s IP-XACT and RTL as input formats for internal and external IPs at different design steps; “ifdef” support to generate generic and configurable RTL code; a higher degree of automation in the management of design collaterals such as UPF and SDC jointly with RTL and IP-XACT; and Python native support.

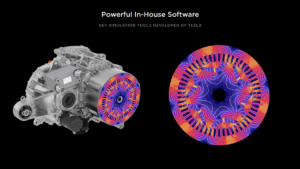

Renesas has deployed Cadence Verisium AI-driven verification platform to enable efficient root cause analysis of bugs for its R-Car designs targeting automotive applications. Result metrics provided by Renesas are a 2X improvement of simulation probing performance and up to 6X improvement of the entire debug productivity. Tesla to cut SiC use by 75% The recently held Tesla Investor Day took suppliers of wide-bandgap power components by surprise when Colin Campbell – VP of Powertrain Engineering – said the company will reduce silicon carbide by 75% in its next drive units, in an effort to cut costs. Reassuring SiC suppliers and their investors, analysts have offered optimistic explanations to that statement. According to Steve Russell from TechInsights, just moving to the latest generation of SiC power devices will enable Tesla to significantly reduce SiC use, as newer devices are much more efficient; this will not imply a downturn in the overall SiC market, given Tesla plans to dramatically increase car production. Multiple optimistic scenarios for SiC reduction have also been discussed by Yole Group’s analysts. Other interesting insights from Tesla Investor Day include the emphasis on vertical integration as a way to pursue holistic optimization: among other things, the company boasted about its “powerful in-house software” for the simulation of electric motors, and said that 100% of controllers on its next generation vehicles will be designed by Tesla itself. The 169-slide investor presentation addresses many more interesting aspects of Tesla vision and plans. Moving away from China India, Vietnam and Malaysia will likely benefit from US-China tensions, as alternative investment destination in Asia. Foxconn has reportedly won an order to make AirPods for Apple and plans to build a factory in India to produce the wireless earphones. The deal will see Foxconn become an AirPod supplier for the first time and underlines its efforts to further diversify production away from China. The decision to set up production in India was requested by Apple, according to the report. And several Dutch suppliers of ASML are reportedly considering building plants in Southeast Asia – primarily Vietnam or Malaysia – instead of China amid political tensions between Beijing and the West. South Korea’s semiconductor ambitions After the US, the European Union and Japan, another key country has announced initiatives to support its domestic semiconductor industry. The government of South Korea will reportedly seek 300 trillion won ($229 billion) in investments from the private sector to establish the world’s largest high-tech semiconductor cluster in Seoul metro area by 2042. According to the report, the massive investment will be handled solely by Samsung Electronics. Among the priorities of the plan is the construction of five logic chip manufacturing plants. The South Korean government will invest 25 trillion won to create “the Korean version” of Belgian research institute imec. Subsidies welcome The fab that Samsung is building in Taylor, Texas, will reportedly cost over $25 billion, up more than $8 billion from initial forecasts. The increase is primarily due to the impact of inflation on construction cost. Chipmakers are now starting to apply for CHIPS Act subsidies, but the bill was proposed in 2020, before a sharp increase of inflation in the U.S. TSMC‘s talks with the German state of Saxony about building its first European factory are reportedly at an advanced stage, and are now focused on government subsidies to support the investment. According to the report, subsidies are expected from Saxony State, Federal German government, and the European Union through the EU Chips Act. TSMC’s German factory, if it goes ahead, will likely focus on mature nodes used in the auto industry. Acquisitions San Jose-based Infinera, a manufacturer of optical semiconductors and networking products, is reportedly exploring options that include a sale of the company. According to the report, there is no certainty that Infinera will reach any deal. Nano Dimension, a supplier of additively manufactured electronics and 3D printers, has made a formal, non-binding offer to acquire Stratasys, a manufacturer of 3D printers. Further reading Market intelligence firm CB Insights has analyzed the impact of the closure of Silicon Valley Bank, which will change the accessibility of “venture debt” for startups. OpenAI has just published a 99-page technical report detailing the development of GPT-4, a large-scale, multimodal model which can accept image and text inputs and produce text outputs. GPT-4 exhibits human-level performance on various professional and academic benchmarks, including passing a simulated bar exam with a score around the top 10% of test takers. Below is an example of GPT-4 capability: explaining why the image – showing a VGA connector plugging into a smartphone – is funny. |

|

|

|||||

|

|

|||||

|

|||||