EDACafe Editorial Roberto Frazzoli

Roberto Frazzoli is a contributing editor to EDACafe. His interests as a technology journalist focus on the semiconductor ecosystem in all its aspects. Roberto started covering electronics in 1987. His weekly contribution to EDACafe started in early 2019. Semi capex to drop in 2023; Synopsys results; MCUs with RRAM; AI learning in the fieldDecember 2nd, 2022 by Roberto Frazzoli

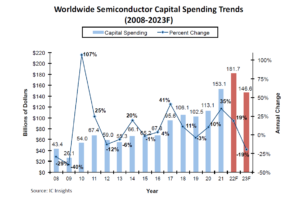

Will the U.S. ‘CHIPS and Science Act’ benefit fabless companies? As noted by a report just released by the Semiconductor Industry Association (SIA) and the Boston Consulting Group, the recently passed U.S. support plan will provide public funding for semiconductor manufacturing, but not for design. The report finds that a federal investment in semiconductor design and R&D of $20 to $30 billion through 2030 – including a $15 to $20 billion for an investment tax credit for semiconductor design – will help maintain long term U.S. chip design leadership. Semiconductor capex to drop in 2023 – forecast Despite the booming demand in early 2022, market research firm IC Insights forecasts a -19% drop in total worldwide semiconductor capital industry spending in 2023, “the steepest decline since the global financial meltdown in 2008-2009.” This forecast already considers the impact of the U.S ‘CHIPS and Science Act’: “IC Insights does not expect a boost to semiconductor capital spending from the $52 billion in grants that will be given to U.S. semiconductor suppliers as part of the U.S. CHIPS and Science Act that was passed earlier this year. Rather, IC Insights believes that most U.S. semiconductor producers that receive this money will use it to replace what they would have spent if not receiving the grant. In other words, the CHIPS and Science Act money is not expected to be ‘additive’ funding to planned semiconductor industry spending, but instead is likely to replace the money a semiconductor producer was going to budget if CHIPS and Science Act funding was unavailable,” the market research firm maintains.

Synopsys’ 2022 results Synopsys’ revenue for the fourth quarter of fiscal year 2022 was $1.284 billion, compared to $1.152 billion for the fourth quarter of fiscal year 2021. Revenue for fiscal year 2022 was $5.082 billion, an increase of 20.9 percent from $4.204 billion in fiscal year 2021. Aart de Geus, chairman and CEO of Synopsys, said the company achieved record results in fiscal year 2022, substantially exceeding its original targets. For fiscal year 2023 Synopsys is targeting 14-15% revenue growth. Automotive updates: Defacto, Infineon, CEA-Leti Defacto’s SoC Compiler 9.0. tool and documentation are now certified to ISO26262, and deemed to be fit for use up to ASIL D automotive design projects. Next generation of Infineon’s Aurix TC4x microcontrollers for automotive applications will integrate TSMC’s resistive RAM non-volatile memory. Replacing the usual Flash memory with RRAM will enable the MCUs to further shrink to 28-nanometers and beyond. According to Infineon, RRAM offers additional benefits such as high disturb immunity and bit-wise write without the need to erase. Endurance and data retention are comparable with Flash technology. French research institute CEA-Leti has improved MEMS-based Lidars for automotive applications. Innovations include a piezo-electric mechanism to move the micro-mirrors that only requires 20V, versus 150V for electrostatic mirrors. The solution also eliminates the need for bulky magnets, which are required for electromagnetic mirrors. Also, to support the high-power laser beam required for long-range Lidar applications, the usual gold reflector was replaced with layers of Bragg deposited on silicon with CMOS compatible processes. This makes the reflectors less absorbent and thus less prone to overheating by the laser. Rohm’s AI chip learns in the field A prototype SoC for IoT applications developed by Rohm includes an AI accelerator that can learn onsite (in the IoT field), without prior training or cloud connection. The chip utilizes artificial intelligence to predict failures in electronic devices equipped with motors and sensors, in real-time with ultra-low power consumption. The prototype device (BD15035) is based on an on-device learning algorithm (a three-layer neural network) downsized to just 20,000 gates and controlled by Rohm’s 8-bit CPU tinyMicon MatisseCORE that enables AI learning and inference with power consumption of just a few tens of mW. As explained in this presentation, “AI learns what normal is” onsite, therefore anomaly detection is possible even for unknown input data patterns without involving a cloud server or prior AI training. Foundry updates: Samsung, TSMC Nvidia, Qualcomm, IBM, and Baidu have reportedly signed contracts with Samsung Foundry to use its 3-nanometer technology, which is anticipated to be supplied as early as 2024. TSMC is reportedly planning to produce chips with 3-nanometer technology at its new factory in Arizona, even though the plans are not completely finalized yet. According to another report, when the new Arizona fab opens in 2024 TSMC may increase its production from the initially planned 20,000 wafers per month (4-nanometer). The increased would be spurred by U.S. customers including Apple, AMD and Nvidia. SiC updates: agreements STMicroelectronics and Soitec have announced the next stage of their cooperation on Silicon Carbide substrates, with the qualification of Soitec’s SiC substrate technology by ST planned over the next eighteen months. The goal of this cooperation is the adoption by ST of Soitec’s SmartSiC technology for its future 200mm substrate manufacturing, with volume production expected in the midterm. Shenzhen BASiC Semiconductor and Rohm have entered into a strategic partnership agreement on SiC power devices for automotive applications. The first step involves supplying onboard power modules that leverage the combined technologies to several major automakers. BASiC Semiconductor has shipped more than 20 million SiC power devices to over 600 customers around the globe. Amazon’s new chips While Alexa voice assistant is reportedly losing money, other parts of Amazon’s tech activities are developing at a fast pace. Amazon Web Services has recently announced three new Amazon Elastic Compute Cloud (Amazon EC2) instances powered by three new AWS-designed chips: Graviton 3E, Inferentia2, fifth generation Nitro. People Foxconn has hired Chiang Shang-yi, a former top executive at TSMC and SMIC, to lead its growing push in the chip business with the role of Semiconductor Strategy Officer. Randhir Thakur, President of Intel Foundry Services, is reportedly leaving the company at the end of first quarter 2023. Acquisitions After VLSI Research and The Linley Group, Canadian reverse engineering company TechInsights has acquired market analysis firm Strategy Analytics. More recently, it also acquired The McClean Report from IC Insights. Bill McClean has retired, and market research firm IC Insights will be permanently closing on December 30, 2022. Latest addition to the TechInsights platform is IC Knowledge LLC, specializing in cost modeling of semiconductors. |

|

|

|||||

|

|

|||||

|

|||||