Will the U.S. ‘CHIPS and Science Act’ benefit fabless companies? As noted by a report just released by the Semiconductor Industry Association (SIA) and the Boston Consulting Group, the recently passed U.S. support plan will provide public funding for semiconductor manufacturing, but not for design. The report finds that a federal investment in semiconductor design and R&D of $20 to $30 billion through 2030 – including a $15 to $20 billion for an investment tax credit for semiconductor design – will help maintain long term U.S. chip design leadership.

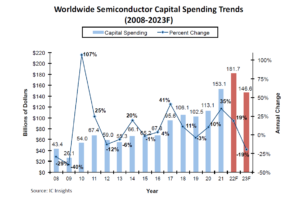

Semiconductor capex to drop in 2023 – forecast

Despite the booming demand in early 2022, market research firm IC Insights forecasts a -19% drop in total worldwide semiconductor capital industry spending in 2023, “the steepest decline since the global financial meltdown in 2008-2009.” This forecast already considers the impact of the U.S ‘CHIPS and Science Act’: “IC Insights does not expect a boost to semiconductor capital spending from the $52 billion in grants that will be given to U.S. semiconductor suppliers as part of the U.S. CHIPS and Science Act that was passed earlier this year. Rather, IC Insights believes that most U.S. semiconductor producers that receive this money will use it to replace what they would have spent if not receiving the grant. In other words, the CHIPS and Science Act money is not expected to be ‘additive’ funding to planned semiconductor industry spending, but instead is likely to replace the money a semiconductor producer was going to budget if CHIPS and Science Act funding was unavailable,” the market research firm maintains.