EDACafe Editorial Roberto Frazzoli

Roberto Frazzoli is a contributing editor to EDACafe. His interests as a technology journalist focus on the semiconductor ecosystem in all its aspects. Roberto started covering electronics in 1987. His weekly contribution to EDACafe started in early 2019. Semiconductor revenues in 2021; fab spending forecast; low power displays; DSA advancementsApril 1st, 2022 by Roberto Frazzoli

A few brief updates before moving to the rest of our weekly news round-up. Korean memory maker SK Hynix is reportedly considering the creation of a consortium to buy Arm. Speaking of memories, Apple is reportedly exploring alternative Flash suppliers for its iPhones, including China-based Yangtze Memory Technologies Co. Moving to the autonomous vehicle scenario, Waymo has started testing fully autonomous operations in San Francisco with Jaguar I-PACE electric cars. This new step comes after years of testing of fully autonomous service in the East Valley of Phoenix. 2021 semiconductor revenues According to market research firm Omdia, the worldwide semiconductor market surpassed annual revenue of half-a-trillion dollars for the first time ever in 2021, and nearly 60% of companies in the sector grew by more than 20% in revenues. On an annual basis, Intel ranked as the number one semiconductor company in 2021, with revenue at $76.6B, which represented 13% of all semiconductor revenue for the year. Intel’s 2021 revenue growth was nearly flat from 2020, in contrast with the following top nine semiconductor firms which all experienced year-over-year growth above 15%. Omdia points out that the MPU product category – Intel’s core business – grew at just 11% YoY last year, much lower than the total semiconductor growth level of 24%. Samsung finished 2021 just behind Intel, with semiconductor revenue of $75.2B, representing 12.8% of all revenue for the industry. Samsung growth owes to the strong increase in the DRAM and NAND markets (up 42% and 23% respectively in 2021), as the Korean firm is the number one vendor for both product categories.

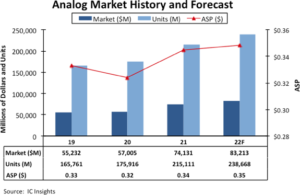

Analog IC growth forecast Market research firm IC Insights expects another year of double-digit market growth for analog integrated circuits in 2022, after sales in this semiconductor category surged by an unprecedented 30% in 2021. Total analog IC sales are forecast to rise 12% to $83.2 billion in 2022. This year, every major general-purpose analog and application-specific analog market category tracked by IC Insights is forecast to post a sales increase, ranging from 7% growth in the amplifiers and comparators segment to 17% growth for automotive application-specific analog ICs. Fab equipment growth forecast According to SEMI, global fab equipment spending for front-end facilities is expected to jump 18% year-over-year to an all-time high of US$107 billion in 2022, marking a third consecutive year of growth following a 42% surge in 2021. Taiwan is expected to lead fab equipment spending in 2022, increasing investments 56% YoY to US$35 billion, followed by Korea at US$26 billion, a 9% rise, and China at US$17.5 billion, a 30% drop from its peak last year. Europe/Mideast is forecast to log record high spending of US$9.6 billion this year, and – while comparatively smaller – this would represent a growth of 248% YoY. In the Americas, the report shows fab equipment spending peaking at US$9.8 billion by 2023. The foundry sector, with a share of about 50%, will account for the bulk of equipment spending in 2022 and 2023, followed by memory at 35%. Global fab equipment spending is forecast to have another healthy year in 2023 and is expected to remain above the $100 billion mark. Low power displays Japan Display Inc. (JDI) has developed a new technology for G6 TFT displays that promises a 40% power reduction compared to conventional products. Key to this advancement are new high-mobility oxide semiconductors – dubbed HMO – which have either 2X or 4X the field-effect mobility of conventional oxides. According to JDI, a further advantage of the new technology is that it can be used in G8 or larger production lines as – contrary to conventional high-mobility AMOLED backplanes – it does not require LTPS (low-temperature polycrystalline silicon) technology. Potential applications of HMO-based displays include VR and AR. Japan Display will begin immediate commercialization of this new solution. The company believes that HMO is a breakthrough technology that will drive its long term, sustainable growth. Advancements in directed self-assembly patterning A research team from University of Pennsylvania and University of Konstanz, Germany, has achieved advancements in directed self-assembly patterning, a promising alternative to lithography for advanced process nodes. The team has demonstrated that a new type of “multiblock” copolymers can produce exceptionally ordered patterns in thin films, achieving spacings smaller than three nanometers. More functions for the digital pen This video shows some examples of the new functions a digital pen can perform with the addition of gesture recognition and other sensing technologies. Among the new functions, a PC user can interact with a drawing or writing app by spinning or shaking the pen in the air. The sensor-enabled digital pen can also serve as a wireless presentation controller that can control the on-screen cursor with natural hand movements. The solution is based on a wireless sensor module jointly developed by digital pen maker Wacom together with STMicroelectronics and CEVA. ST contributed a custom version of its low-power 6-axis Inertial Measurement Unit sensor and Bluetooth Low Energy SoC, while CEVA contributed its MotionEngine Air motion-control software. Mergers and acquisitions Semikron and Danfoss Silicon Power (an independent business within the Danish Danfoss Group) will merge to create a joint business specialized in power electronics, focusing on power semiconductor modules. The newly formed Semikron-Danfoss will be owned by the current owner families of Semikron and the Danfoss Group, with Danfoss being the majority owner, and will retain the two main locations in Germany, Nuremberg and Flensburg. Intel will acquire Granulate Cloud Solutions, an Israel-based developer of real-time continuous optimization software aimed at maximizing compute workload performance and reduce infrastructure and cloud costs. Upcoming events The annual CEO Outlook hosted by the Electronic System Design Alliance will take place on April 28 in Santa Clara, CA. The unicorn herd Market intelligence firm CB Insights has compiled a logo collection of all the 1,066 currently existing unicorns – private companies around the world valued at one billion dollar or more – sorted into fifteen categories. |

|

|

|||||

|

|

|||||

|

|||||