EDACafe Editorial Roberto Frazzoli

Roberto Frazzoli is a contributing editor to EDACafe. His interests as a technology journalist focus on the semiconductor ecosystem in all its aspects. Roberto started covering electronics in 1987. His weekly contribution to EDACafe started in early 2019. EDA and MEMS updates; Europe’s data sovereignty; future unicorns; acquisitionsJune 12th, 2020 by Roberto Frazzoli

Foundry roadmaps made news headlines over the past few days, with TMSC reportedly working on an intermediate 4 nanometers node before moving to 3 nanometers. Besides other semiconductor-related updates, interesting news this week also concern the IT industry in general. EDA/IP updates: Synopsys, Real Intent, Moortec Synopsys’ DesignWare True Random Number Generator IP has received validation by the NIST Cryptographic Algorithm Validation Program, making it easier for customer end products to obtain Federal Information Processing Standards (FIPS) 140-3 certification. Verix DFT, a full-chip, multimode DFT static sign-off tool recently unveiled by Real Intent, promises to reduce static sign-off time by several weeks. The new tool is deployed throughout the design process: during RTL design, as part of addressing asynchronous set/reset, clock and connectivity issues early; after scan synthesis, to check for scan chain rule compliance; and following place & route to assess and correct issues with scan-chain reordering or netlist modification. Time savings are gained from lower setup time, runtime speedup, and the reduced engineering debug and violation fixing due to consolidated reporting.

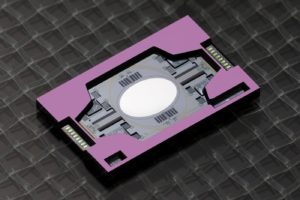

Moortec’s Distributed Thermal Sensor (DTS) solution for in-chip real-time thermal analysis is now supporting an additional process technology, the TSMC N5 process. According to the company, smaller geometries and multi-core architectures call for tighter thermal control, and Moortec’s highly granular DTS offers a 7x area reduction in comparison to some standard in-chip thermal sensor solutions. MEMS updates: AEye, STMicroelectronics A MEMS-based LiDAR manufactured by AEye (Dublin, California) has achieved automotive qualification for both shock and vibe. The product, called 4Sight M, is a member of a new family of 1550nm LiDAR vision systems developed in collaboration with Fraunhofer Institute for Photonic Microsystems (Dresden, Germany). AEye’s non-arrayed micro-MEMS solution uses a mirror that is less than 1mm in size. Other LiDAR systems use 3mm to 25mm mirrors, which implies larger inertia, more torque from shock and vibration events, and slower movement. According to AEye, 4Sight systems provide the automotive industry the combination of reliability, performance and price they have been seeking. MEMS sensors and actuators are the initial focus of the collaboration between STMicroelectronics and Silicon Catalyst (Santa Clara, CA), an incubator focused exclusively on accelerating solutions in silicon. ST has recently joined Silicon Catalyst as both a Strategic and In-Kind Partner. Gaia-X, a German data infrastructure initiative Media outlets have widely covered the announcement of Gaia-X, often depicted in the news as a cloud computing platform meant to be a pan-European counterpart to Microsoft Azure, Amazon AWS or Google Cloud. A closer look at the available documents, though, provides a different picture. Gaia-X can basically be described as a framework for federating the existing European IT assets, through the creation of a catalogue and identity verification mechanisms (see this architecture document). As for the European nature of the project, it should be noted that Gaia-X is currently a German industrial initiative, although co-sponsored by the French government and embodied in a soon-to-be created Belgian non-profit foundation. Just read the list of contributors to the architecture document, page 49 to 51. (Nothing wrong about that, obviously.) A key driver behind Gaia-X is “data sovereignty” in a situation that the initiative promoters describe as follows: “Europe’s digital infrastructure currently lies in the hands of a small number of major non-European corporations: Europe has no notable operating system developers, no relevant search engines, no global social network and no competitive cloud infrastructure. Essential data and analysis infrastructures are also provided by companies from outside Europe. European alternatives do not offer any comparable market capitalisation, scalability or breadth of applications; they are active in specialist niches at best. There is a risk of European data being stored outside of Europe or on servers in Europe that belong to non-European companies and will be subject to a so-called lock-in.” San Francisco, the city of future unicorns Market research firm CB Insights has recently published its new list of 50 future unicorns, companies that – according to the firm’s analysts – will eventually be valued at $1B or more. Highlights include that 30% of companies on this year’s list work on enterprise or big data tools, and 20% in the fintech space. Considering that the list covers the entire world, another interesting point can be added to highlights by checking headquarter locations: 30% of these companies are based in San Francisco. Here is the subset of SF-based future unicorns: Algolia, Bright Machines, Dialpad, Doctor on Demand, Flutterwave, Gong, Harness, Ironclad, Loom, Mercury, Omada Health, Qualia, Rippling, Sentry, Webflow. Home rental prices in the Bay Area are not going to decrease anytime soon. Acquisitions Synopsys has acquired Qualtera (Montpellier, France), a provider of big data analytics for semiconductor test and manufacturing. Qualtera’s analytics technology will be combined with Synopsys YieldExplorer yield management solution and TestMAX test automation solution. The resulting combination is expected to enhance the use of silicon measurements to guide improvements throughout a device’s development and manufacturing lifecycle, enabling post-silicon optimization. DSP Group (San Jose, CA), a provider of wireless chipset solutions, has acquired Switzerland-based SoundChip, a supplier of active noise cancellation (ANC) technology, engineering services, design tools, and production-line test systems for headsets. The acquisition combines SoundChip’s ANC technology with DSP Group’s SmartVoice low-power voice processing platform. The combined solution targets wireless and true wireless stereo (TWS) headsets. DSP Group’s technologies have recently been adopted by Google, Panasonic and Technics in their latest TWS headset models. National Instruments has recently entered into a definitive agreement to acquire OptimalPlus, an Israeli provider of data analytics software for the semiconductor, automotive and electronics industries. OptimalPlus develops analytic solutions based on its big data platform technology which combines machine-learning with a global data infrastructure. These solutions are used to provide real-time product analytics and to extract insights from data across the entire supply chain, with the goal of enhancing yield and efficiency. |

|

|

|||||

|

|

|||||

|

|||||