The Breker Trekker Tom Anderson, VP of Marketing

Tom Anderson is vice president of Marketing for Breker Verification Systems. He previously served as Product Management Group Director for Advanced Verification Solutions at Cadence, Technical Marketing Director in the Verification Group at Synopsys and Vice President of Applications Engineering at … More » Silicon Valley Still a Center of Semiconductor InnovationJanuary 20th, 2016 by Tom Anderson, VP of Marketing

As someone who has lived in the heart of Silicon Valley for more than 30 years, I’m used to the regular cries that we’re losing our innovative edge. Every few years something happens to cast some doubt on our future: a stock market crash, a major company moving elsewhere, or a lot of press about some new Silicon Forest/Glen/Mountain/Prairie/Island/Whatever trying to beat us at our own game. Sure, we face plenty of challenges. A recent article on SemiWiki painted a rather cautionary view of today’s Silicon Valley. But there’s good news too. Silicon “Valley” has grown to include San Francisco and much of the Bay area, with corresponding growth in technology employment and impact. Today, I’d like to springboard from a recent post on semiconductor mergers and acquisitions to consider one particular aspect of the current role of Silicon Valley.

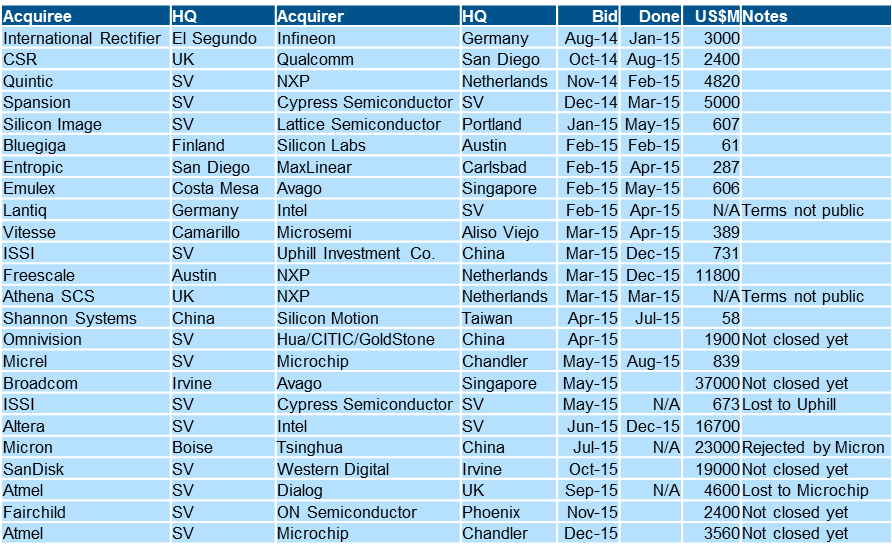

The incredible rate of change among chip manufacturers has been noted by many journalists and commentators, including a couple of posts here on The Breker Trekker blog. It seems that every week or two we hear of another merger and acquisition (M&A) move. As part of thinking about Silicon Valley’s ongoing innovation and competitiveness, it occurred to me to examine some of the more interesting deals to see which involved local companies as acquirers or acquirees. My thinking was that if a lot of Silicon Valley companies are being acquired for their technology, then we are maintaining an edge in innovation. When local companies are doing the acquiring, this could be viewed as positive for semiconductor leadership here, or perhaps a bit negative since we’re looking elsewhere to find innovation. The following chart shows 24 M&A deals announced or completed in 2015, sorted by the date of the initial bid:

I read these results as fairly good news. Nearly a third of the companies listed in the table are headquartered in Silicon Valley, and they are especially well represented in the “acquiree” column, with 10 of 22 distinct companies. This suggests that we are still producing innovative technology that the rest of the world wants to leverage. The remainder of the acquired companies come from a mix of locations around the world. Cypress and Intel played a significant role on the acquiring side, suggesting that at least some of the industry leadership will remain here. But, as with the Top 20 semiconductor list that we analyzed previously, the industry’s largest companies are geographically dispersed. I’m certainly not suggesting that Silicon Valley is the only place for innovation or even the center for innovation, but I am arguing that we are still important and relevant. This is the sort of blog post that will benefit immensely from your feedback and thoughts. I’ve taken a very specific slice of data and drawn some conclusions; you may very well catch an error in my data, come to different conclusions, or have a completely different set of data to consider. So thanks for reading, and I invite you to comment below. Tom A. The truth is out there … sometimes it’s in a blog. Tags: acquisition, Breker, chip, Cypress, EDA, functional verification, IC Insights, Intel, Internet of Things, IoT, M&A, merger, semiconductor, Silicon Valley, SoC, SoC verification, Top 20 2 Responses to “Silicon Valley Still a Center of Semiconductor Innovation”Warning: Undefined variable $user_ID in /www/www10/htdocs/blogs/wp-content/themes/ibs_default/comments.php on line 83 You must be logged in to post a comment. |

|

|

|||||

|

|

|||||

|

|||||

It would seem to me all this acquisition activity is going to have a big impact of the electronic design ecosystem. I think it helps the big 3 EDA companies who excel in closing large enterprise deals. Tier 2 and Tier 3 startups will be more challenged to provide differentiated solutions to the top 20 semiconductor companies. While Moore’s law is slowing, the need for innovation has not, and I still a need for startups that attack new and hard design problems.

Graham,

Thanks for the comment. Semiconductor consolidation will surely change EDA, but I can see multiple possible ways. I think that you’ve given me a topic for my next blog post – thanks again!

Tom A.