IC Insights IC Insights

IC Insights, Inc. is a leading semiconductor market research company headquartered in Scottsdale, Arizona, USA. Founded in 1997, IC Insights offers complete analysis of the integrated circuit (IC), optoelectronic, sensor/actuator, and discrete semiconductor markets with coverage including current … More » DRAM Leads in Revenue, NAND With Top Percentage Growth in 2020December 3rd, 2020 by IC Insights

21 of 33 IC product categories to see positive growth in 2020 demonstrating remarkable resilience of IC market during pandemic-induced global economic downturn. IC Insights is in the process of updating its comprehensive forecasts and analyses of the IC industry for its 24th edition of The McClean Report, which will be released in January 2021. Among the revisions is a complete update of the sales and unit shipment growth forecast growth rates through 2025 for the 33 main product categories classified by the World Semiconductor Trade Statistics organization (WSTS). Shown in this bulletin are the top five largest product categories for sales and revenue growth for 2020. Coming as no surprise, each of the top-five IC product categories in terms of sales all have ties to computing or communication applications. With estimated sales of $65.2 billion, DRAM tops the list with the greatest sales revenue in 2020, followed in second place by NAND flash (Figure 1). Computer and cellphone processors also make the list along with Computer—Special Purpose Logic. Read the rest of DRAM Leads in Revenue, NAND With Top Percentage Growth in 2020 Strong GDP Rebound Forecast After 2020’s Steep DeclineNovember 11th, 2020 by IC Insights

A 4.8% surge in GDP next year will return global GDP to same level seen in 2019. IC Insights recently released its October Update to the 2020 McClean Report that included an updated overview of its latest GDP forecasts for 2020 and 2021. It is clear now, but the primary factor dragging on IC market growth this year is the severe downturn in the global economy due to ramifications associated with the Covid-19 outbreak. Figure 1 shows the severe impact the outbreak has had on the GDP growth rates of major countries/regions. Each country/region is forecast to see a steep decline in its GDP growth rate this year. The forecasted GDP growth rates range from -10.0% in the U.K. to China’s positive 2.4%. Among all major countries/regions, only China is expected to register positive GDP growth this year, although its growth rate is down significantly from 6.1% in 2019. China was able to contain Covid-19 in the second quarter of this year and the country’s economy has been on the mend since. Worldwide GDP is now forecast to decline 4.5% in 2020 compared to the 2.4% gain in 2019.

Figure 1 Read the rest of Strong GDP Rebound Forecast After 2020’s Steep Decline DRAM Price Erosion Expected Through the End of 2020October 27th, 2020 by IC Insights

Price jump that typically coincides with the introduction of new smartphone models in 3Q and 4Q is not expected due to disrupted buying patterns and cautious discretionary spending. IC Insights’ October Update to The McClean Report showed the monthly average selling price (ASP) of DRAM started on a steep downward trend in the second half of 2018 that eventually bottomed out at $3.04 in December 2019. DRAM prices rebounded in the first half of 2020 as memory demand grew for personal and enterprise computing systems after the Covid-19 virus forced a rapid and dramatic shift to online-based education, shopping, and business activity. DRAM demand also came from new data center server computers that were needed to handle the surge of online activity. Figure 1 shows that the DRAM ASP climbed to $3.70 in June 2020, before tapering off to $3.51 in July and August this year.  Figure 1 Read the rest of DRAM Price Erosion Expected Through the End of 2020 China Forecast to Represent 22% of the Foundry Market in 2020October 13th, 2020 by IC Insights

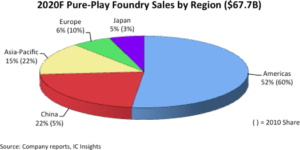

However, market uncertainty looms as TSMC’s shipments to HiSilicon ceased in mid-September. IC Insights recently released its September Update to the 2020 McClean Report that presented the second of a two-part analysis on the global IC foundry industry and included a look at the pure-play foundry market by region. China was responsible for essentially all of the total pure-play foundry market increase in 2018. In 2019, the U.S./China trade war slowed China’s economic growth but its foundry marketshare still increased by two percentage points to 21%. Moreover, despite the Covid-19 shutdown of China’s economy earlier this year, China’s share of the pure-play foundry market is forecast to be 22% in 2020, 17 percentage points greater than it registered in 2010 (Figure 1).

Figure 1 Read the rest of China Forecast to Represent 22% of the Foundry Market in 2020 Two Acquisitions Make 2020 Second-Highest Year for Semi M&AsSeptember 30th, 2020 by IC Insights

After a slow start, Analog Devices’ agreement to buy Maxim and Nvidia’s deal to acquire ARM raise the total value of M&A deals this year to more than $63.0 billion. Two huge purchase agreements in July and September have guaranteed that 2020 will become at least the second-largest year in history for semiconductor merger and acquisition announcements, according to data released in the September Update to IC Insights’ 2020 McClean Report, (Figure 1). In the first nine months of 2020, the combined value of semiconductor M&A agreements climbed to $63.1 billion, thanks to Nvidia’s $40 billion deal in September to acquire processor-design technology supplier ARM in the U.K. from SoftBank and Analog Devices’ $21 billion announcement in July to buy analog/mixed-signal IC maker Maxim Integrated Products in Silicon Valley. These two megadeals account for about 97% of the M&A dollar value in 2020.

Read the rest of Two Acquisitions Make 2020 Second-Highest Year for Semi M&As Pure-Play Foundry Market On Pace For Strongest Growth Since 2014September 22nd, 2020 by IC Insights

Application processors and other device sales for 5G smartphones act as a robust driver. IC Insights recently released it August Update to the 2020 McClean Report that included the first of a two-part analysis on the global IC foundry market. IC Insights defines a pure-play foundry as a company that does not offer a significant amount of IC products of its own design, but instead focuses on producing ICs for other companies. Examples of pure-play foundries include TSMC, GlobalFoundries, UMC, and SMIC. Integrated device manufacturer (IDM) foundries are defined as those companies that offer foundry services in addition to manufacturing their own ICs. Examples of IDM foundries are Samsung and Intel. Driven by growing demand for application processors and other telecomm device sales into 5G smartphones, the pure play foundry market is on pace to expand by a strong 19% this year, after declining 1% in 2019 (Figure 1). IC Insights forecasts 200 million 5G smartphone handsets will be shipped in 2020 (although some forecasts expect 250 million units), up from only about 20 million units in 2019.

Read the rest of Pure-Play Foundry Market On Pace For Strongest Growth Since 2014 Nvidia’s $40 Billion ARM Purchase Will Test Current M&A “Ceiling”September 18th, 2020 by IC Insights

Potentially the largest acquisition in semiconductor history faces plenty of obstacles. After nearly two months of negotiations and press reports that a blockbuster deal was in the works, Nvidia this week announced a $40 billion agreement to buy ARM—the leading supplier of processor intellectual property (IP)—from financially struggling SoftBank in Japan. If approved, the deal would be the largest semiconductor acquisition in history, provided the additional $5 billion cash/stock payment is included for the business achieving financial targets. The acquisition, which is expected to take 18 months to complete (around March 2022), would top Avago’s 2015 deal to buy Broadcom for $37 billion, and SoftBank’s $32 billion purchase of ARM in 2016 (Figure 1). ARM’s technology licenses and services generated $1.8 billion of revenue in 2019 and a little over $1.0 billion in the first half of 2020, but SoftBank decided to sell the business to help it climb out of huge losses from investments in technology startups. As part of the transaction, SoftBank is expected to take a stake in Nvidia (under 10% of its total stock) Read the rest of Nvidia’s $40 Billion ARM Purchase Will Test Current M&A “Ceiling” Total Microprocessor Sales to Edge Slightly Higher in 2020September 10th, 2020 by IC Insights

Sales expected to strengthen in 2021 with embedded processors and computer CPUs leading the growth. Total microprocessor sales are forecast to grow 1.4% in 2020 to nearly $79.3 billion, following a 2.4% decline in 2019, which was the first revenue drop in the worldwide MPU market in 10 years, according to data released in IC Insights’ Mid-Year Update to the 2020 McClean Report. The mid-year forecast shows total MPU sales strengthening with an 8.8% increase in 2021 to reach a new record high annual level of about $86.3 billion, under the assumption that vaccines become available for the Covid-19 virus and the health crisis diminishes in most regional markets next year. Figure 1 divides the 2020 microprocessor market by end-equipment categories, based on the Mid-Year Update forecast.

Read the rest of Total Microprocessor Sales to Edge Slightly Higher in 2020 MCUs Expected to Make Modest Comeback After 2020 DropAugust 28th, 2020 by IC Insights

Economic impact of the Covid-19 virus crisis will cause microcontroller sales to fall the most among major IC product categories in 2020, says Mid-Year Update. Far-flung microcontrollers used in vehicles, industrial and commercial equipment, home appliances, consumer electronics, and many other embedded systems applications are suffering the most among major IC product categories in the Covid-19 virus health crisis that wrecked the global economy six months ago, according to the Mid-Year Update of IC Insights’ 2020 McClean Report on integrated circuits. The mid-year forecast shows worldwide MCU sales falling 8% in 2020 to $14.9 billion after dropping 7% in 2019, when the weak global economy lowered the microcontroller market from record-high revenues of $17.6 billion in 2018 (Figure 1).  Figure 1 Read the rest of MCUs Expected to Make Modest Comeback After 2020 Drop China-Based HiSilicon’s Time in the Top-10 May be Short LivedAugust 11th, 2020 by IC Insights

Top-10 semiconductor suppliers logged strong 17% jump in 1H20/1H19 sales. IC Insights will release its August Update to the 2020 McClean Report later this month. This Update includes a discussion of the IC foundry market trends and a look at the top-25 1H20 semiconductor suppliers. The top-10 1H20 semiconductor suppliers are covered in this research bulletin. The top-10 worldwide semiconductor (IC and O-S-D—optoelectronic, sensor, and discrete) sales ranking for 1H20 is shown in Figure 1. It includes six suppliers headquartered in the U.S., two in South Korea, and one each in Taiwan and China. The ranking includes four fabless companies (Broadcom, Qualcomm, Nvidia, and HiSilicon) and one pure-play foundry (TSMC). Read the rest of China-Based HiSilicon’s Time in the Top-10 May be Short Lived |

|

|

|||||

|

|

|||||

|

|||||