Archive for the ‘Fabless Semiconductors’ Category

Thursday, February 27th, 2020

Though rising 7%, total semiconductor units forecast to fall short of all-time record.

Annual semiconductor unit shipments, including integrated circuits and optoelectronics, sensors, and discrete (O-S-D) devices are forecast to rise 7% in 2020 and surpass one trillion units for the second time in history, based on data presented in the new, 2020 edition of IC Insights’ McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry, released in January 2020.

The 7% increase to 1,036.3 billion total semiconductor shipments expected in 2020 follows an 8% decline in 2019 and 7% growth in 2018, the year that semiconductor shipments reached 1,046.0 billion units—a record high that is expected to remain in place through at least this year (Figure 1). Starting with 32.6 billion units in 1978 and ending in 2020, the compound annual growth rate (CAGR) for semiconductor units is forecast to be 8.6%, an impressive annual growth rate over 42 years, given the cyclical and often volatile nature of the semiconductor industry.

Figure 1 (more…)

No Comments »

Tuesday, February 11th, 2020

Leaders in memory IC and foundry production maintain strongest capacity presence.

IC Insights recently released its new Global Wafer Capacity 2020-2024 report that provides in-depth detail, analyses, and forecasts for IC industry capacity by wafer size, process geometry, region, and product type through 2024.

Included in the report is a ranking of the 25 largest wafer capacity leaders in terms of monthly installed capacity in 200mm-equivalents as of December 2019. The world’s top-five wafer capacity leaders each had capacity of more than 1,000,000 wafer starts per month (Figure 1). Combined capacity of the top five companies represented 53% of total global wafer capacity at the end of 2019. In contrast, the top five capacity leaders in 2009 held 36% of worldwide capacity. Capacity at other semiconductor leaders, including Intel (817K wafers/month), UMC (753K wafers/month), GlobalFoundries, Texas Instruments, and STMicro, fell off rapidly from the top five.

(more…)

No Comments »

Wednesday, January 22nd, 2020

Number of IC categories with expected sales growth in 2020 represents a big reversal from only six growth segments in 2019.

IC Insights recently released the 2020 edition of The McClean Report. The new analysis and forecast of the IC industry includes IC Insights’ 2020 ranking of sales growth rates for each of the 33 IC product categories defined by the World Semiconductor Trade Statistics (WSTS) organization. The top-10 fastest growing IC segments for 2020 are shown in Figure 1.

After posting the two worst growth rates among all IC product categories in 2019, NAND flash and DRAM are forecast to be among the top three fastest-growing IC segments in 2020. It is worth noting that DRAM and NAND flash were the two largest IC markets in terms of sales volume in 2019 and are forecast to repeat as the two largest IC sales categories again in 2020.

(more…)

No Comments »

Friday, October 11th, 2019

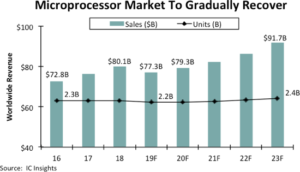

MPU market being pulled down by weakness in smartphones and servers, as well as the fallout from the U.S.‑China trade war. A modest rebound is expected in 2020, followed by new all-time high sales in 2021.

The microprocessor market’s string of nine straight record-high annual sales between 2010 and 2018 is expected to end this year with worldwide MPU revenue dropping 4% to about $77.3 billion because of weakness in smartphone shipments, excess inventories in data center computers, and the global fallout from the U.S.-China trade war, according to IC Insights’ recently updated forecast. Microprocessor sales are expected to stage a modest rebound in 2020, growing 2.7% to $79.3 billion (Figure 1) and then are forecast to reach a new record-high level of about $82.3 billion in 2021, based on IC Insights’ outlook for MPUs in the Mid-Year Update to the 2019 McClean Report.

Figure 1

(more…)

Tags: ICManufacturing, McClean Report, Semiconductors

No Comments »

Thursday, July 11th, 2019

Economic and trade uncertainties, softer demand to keep pressure on DRAM ASPs in 2019.

IC Insights will release its 200+ page Mid-Year Update to The McClean Report 2019 later this month. The Mid-Year Update revises IC Insights’ worldwide economic and IC industry forecasts through 2023 that were published in The McClean Report 2019, released in January. Included in the update is a review of capital spending and DRAM market trends for the balance of this year and through the forecast period.

One of the significant questions facing the IC industry in the second half of 2019 is if and when the DRAM market will rebound. Any rebound in the market will be driven in part by available manufacturing capacity. After huge capex outlays for DRAM in 2017 and 2018, the question becomes how much new capacity will come online and how far DRAM prices (price per bit) will fall as a result of this buildup.

The three main DRAM suppliers—Samsung, SK Hynix, and Micron—generally agree that DRAM bit volume will grow roughly 20% per year over the next few years. Figure 1 shows Micron’s perspective on the capex required to increase DRAM bit volume shipments 20% per year (data from Micron’s 2018 Analyst and Investor Event) versus IC Insights’ DRAM capex history and forecast data.

(more…)

No Comments »

Wednesday, June 19th, 2019

China and Taiwan companies register double-digit shares in the fabless segment but very low shares of the IDM IC segment.

IC Insights will release its 200+ page Mid-Year Update to the 2019 McClean Report next month. A portion of the Mid-Year Update will examine the trends for worldwide IC company marketshare by headquarters location.

Figure 1 shows the 2018 IDM and fabless company shares of IC sales as well as the total worldwide share of the IC market by company headquarters location.

Figure 1

(more…)

Tags: China, Europe, IC manufacturing, ICManufacturing, Japan, Semiconductors, SK Hynix, taiwan

No Comments »

Tuesday, May 21st, 2019

Notably, the IC market has never shown more than three sequential quarters of decline.

IC Insights will release its May Update to the 2019 McClean Report later this month. This Update includes a discussion of the 1Q19 IC industry market results, a detailed quarterly IC market forecast for the remainder of this year, and a look at the top-25 1Q19 semiconductor suppliers.

Over its 60-year history, the IC industry is well known for its cyclical behavior. Looking back to the mid-1970s, IC Insights cannot identify a period where the IC market declined for more than three quarters in a row. Assuming the 2Q19 IC market registers a slight decline of 1% as compared to 1Q19, the 4Q18-2Q19 timeperiod would mark the sixth three-quarter IC market drop on record (Figure 1).

Tags: DRAM, IC manufacturing, ICManufacturing, McClean Report, Semiconductors

No Comments »

Thursday, May 16th, 2019

After surpassing Samsung in 4Q18, Intel further extends its lead in 1Q19.

IC Insights will release its May Update to the 2019 McClean Report later this month. This Update includes a discussion of the 1Q19 IC industry market results, an updated quarterly forecast for the remainder of this year, and a look at the top-25 1Q19 semiconductor suppliers. The top-15 1Q19 semiconductor suppliers are covered in this research bulletin.

The top-15 worldwide semiconductor (IC and O S D—optoelectronic, sensor, and discrete) sales ranking for 1Q19 is shown in Figure 1. It includes six suppliers headquartered in the U.S., three in Europe, two each in South Korea and Japan, and one each in Taiwan and China.

Tags: Broadcom, FabLess, Foundry Market, HiSilicon, ICManufacturing, Infineon, intel, McClean Report, micron, NVIDIA, NXP, qualcomm, samsung, SK Hynix, Sony, ST, TI, toshiba, tsmc

No Comments »

Wednesday, April 24th, 2019

Positive and negative, memory sales continue to strongly impact total IC market.

IC Insights recently updated its 2019-2023 semiconductor market forecasts in its March Update to the 500-page, 2019 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry.

In the March Update, IC Insights shows how the total memory market heavily influenced total IC market growth for the positive during the past two years but will likely have a very negative impact on total IC market growth in 2019.

The DRAM and NAND flash markets continue to closely follow the original IC industry cycle model whereby the market cycles are primarily driven by fluctuations in capital spending and capacity. Including IC Insights’ forecast for 2019, it appears that little has changed regarding the extremely volatile nature of DRAM market cycles (Figure 1).

Tags: DRAM, Frash Memory, Report

No Comments »

Wednesday, April 10th, 2019

Top-10 companies held 39% of the worldwide O-S-D market in 2018, the same level as in 2017.

IC Insights’ new 2019 O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes was released at the end of March. Among the O-S-D industry data included in the new 350-page report is an analysis of the top-30 O-S-D suppliers (the top-10 ranking is discussed in this Research Bulletin).

Companies selling optoelectronics currently dominate the ranking of the top-10 O-S-D suppliers. Figure 1 shows that nine of the top-10 companies sell optoelectronics, while six offer sensor/actuator semiconductors, and five provide discrete products. Only four of the top-10 companies sell products in all three O-S-D market segments. The 10 largest suppliers in the ranking accounted for 39% of combined worldwide O-S-D revenues in 2018, which is the same percentage as in 2017 (in contrast, the top-10 IC suppliers held a 70% share of the total IC market in 2018).

(more…)

Tags: Broadcom, Foundry Market, IC manufacturing, ICManufacturing, Infineon, Nichia, O-S-D, OmniVision, ON Semi, Osram, samsung, Semiconductors, sharp, Sony, ST

No Comments »

|