IC Insights IC Insights

IC Insights, Inc. is a leading semiconductor market research company headquartered in Scottsdale, Arizona, USA. Founded in 1997, IC Insights offers complete analysis of the integrated circuit (IC), optoelectronic, sensor/actuator, and discrete semiconductor markets with coverage including current … More » Fabless Suppliers Held a Record 33% of the 2020 IC MarketApril 28th, 2021 by IC Insights

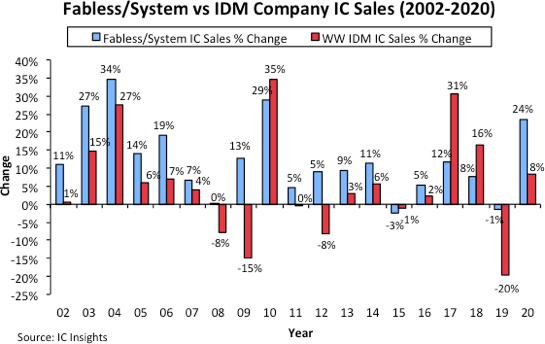

Fabless Suppliers Held a Record 33% of the 2020 IC Market Fabless IC suppliers registered a strong 24% surge in sales last year as compared to only an 8% increase by the IDMs. IC Insights’ April Update to the 2021 McClean Report describes how the sales growth rates of fabless IC companies versus IDM (integrated device manufacturers) IC suppliers have historically been very different (Figure 1). Typically, the sales growth rate registered by the fabless IC suppliers is better than that displayed by the IDMs. In fact, the first year on record that IDM IC sales growth outpaced fabless IC company sales growth was 2010 when IDM IC sales grew 35% and fabless IC company sales grew 29%.

Figure 1

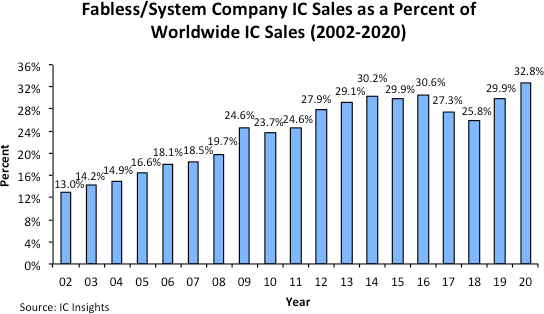

The difference between fabless IC supplier growth and IDM IC supplier growth was especially pronounced over the past two years. In 2019, driven by a collapse in the memory market, IDM IC sales plunged by 20%. In contrast, fabless IC supplier sales declined only 1%. In 2020, fabless IC company sales surged by 24% while IDM sales increased by only 8%. Even after including the booming 2017 and 2018 IDM sales increases of 31% and 16%, respectively, the 2010-2020 IDM CAGR was only 3%, one point less than the total IC market CAGR during this same timeperiod. In contrast, the average annual growth rate of IC sales from the fabless/system IC companies was 8%, double the total IC market CAGR during this same 10-year timeframe. Given the typical disparity in the annual growth rates in favor of the fabless/system IC suppliers versus the IDMs, it comes as little surprise that, except in 2010, 2015, 2017, and 2018 fabless/system IC companies increased their share of the total IC market (Figure 2). Figure 2

In 2002, fabless/system IC company sales accounted for only 13% of the total IC market. With the memory market soaring in 2017 and 2018, a market in which the fabless companies have very little share, the fabless share of the total IC market shrank in both of those years. However, with the memory market registering significant weakness in 2019, this situation reversed itself, with the fabless share of the total IC market jumping 4.1 percentage points that year to 29.9%. Led by Qualcomm’s $5.0 billion sales increase last year, fabless company IC sales surged 24% in 2020 and their share of worldwide IC sales set a new all-time record high of 32.8%! Over the long-term, IC Insights believes that fabless/system IC suppliers, and the IC foundries that serve them, will continue to be a strong force in the total IC industry landscape with their percentage share of the total IC market expected to reach the mid-30s over the next five years. Report Details: The 2021 McClean Report Categories: Fabless Semiconductors, Mergers & Acquisitions, Semiconductor Market Reasearch |

|

|

|||||

|

|

|||||

|

|||||