The far-flung MCU market is expected to contract by 6% because of an overall slowdown in electronic systems, falloff in car purchases, and the U.S.-China trade war, says Mid-Year Update.

After reaching record-high sales in the last two years, the microcontroller (MCU) market slid lower in the first half of 2019 because of overall weakness in electronic systems, a slowdown in automobile sales, and no letup in the trade war between the U.S. and China. In the first six months of this year, worldwide sales of microcontrollers declined about 13% compared to the first half of 2018 while MCU unit shipments fell 14%, according to IC Insights’ Mid-Year Update to the 2019 McClean Report on integrated circuits.

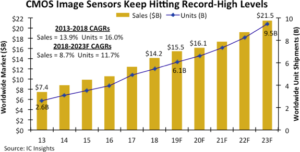

With the MCU market showing signs of stabilizing at the midpoint of 2019, microcontroller sales are expected to pull out of the double-digit percentage slump in the next six months and end this year with a 5.8% decline to $16.5 billion compared to the all-time high of $17.6 billion in 2018 (Figure 1). Worldwide MCU unit shipments are expected to drop 4% in 2019 to 26.9 billion from 28.1 billion in 2018, says the 200-page Mid-Year Update.

Figure 1

In 2020, the microcontroller market is expected to stage a modest rebound after the 2019 decline, growing 3.2% next year to about $17.1 billion, while MCU shipments are projected to increase over 7% and set a new record-high level of 28.9 billion units (surpassing the current annual peak of 28.1 billion reached in 2018). IC Insights’ Mid-Year Update forecast shows microcontroller sales rising by a compound annual growth rate (CAGR) of 3.9% in the 2018-2023 forecast, reaching $21.3 billion in 2023. MCU unit shipments are projected to grow by a CAGR of 6.3% in the five-year forecast period to 38.2 billion in 2023.

(more…)