EDACafe Editorial Roberto Frazzoli

Roberto Frazzoli is a contributing editor to EDACafe. His interests as a technology journalist focus on the semiconductor ecosystem in all its aspects. Roberto started covering electronics in 1987. His weekly contribution to EDACafe started in early 2019. Driverless vehicles; Samsung’s GAA; Vodafone-Intel collaboration; geopolitical tensions; chip shortageFebruary 2nd, 2022 by Roberto Frazzoli

Advancements in autonomous vehicles are in the news this week, along with several other topical issues such as new transistor architectures, 5G, AI acceleration, geopolitical tensions, and the automotive chip shortage. Driverless vehicles updates: Cruise, TuSimple On February 1st Cruise opened up its driverless cars in San Francisco to the public. Users can book a driverless ride – free, for now – from a sign-up page on the company’s website. Cruise is planning to ramp up the service as more cars are made available. In a blog post, Kyle Vogt, interim CEO, CTO, and co-founder, wrote that reaching this milestone will prompt SoftBank Vision Fund to invest an additional $1.35 billion in Cruise. Advancements also concern TuSimple, which has reportedly announced that its autonomous trucks have driven 550 miles (885 km) on public roads in Arizona without being manned by human drivers. The company reported that a total of seven fully autonomous runs have been completed on an 80-mile stretch between Phoenix and Tucson, adding that no humans intervened in the traffic flow or operated the truck remotely. Fully autonomous freight services will also be offered in other large US shipping areas, including Texas, by the end of year 2023. TuSimple claims to be the world’s first company to operate fully driverless heavy-duty trucks.

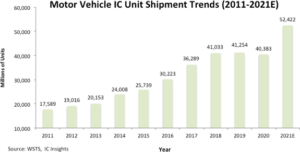

Samsung foundry to mass produce GAA transistors in 2022 On occasion of its recent Q4 2021 earnings release, Samsung Electronics disclosed its outlook for 2022. In terms of foundry process technologies, the company expects to “expand technology leadership via mass production 1st gen GAA [Gate All Around] process and exceed market growth by focusing on expanding supply to global customers”. The audio recording of the earnings call is available here. Vodafone and Intel reportedly team up for OpenRAN chips According to a Reuters exclusive report, UK-based telecom operator Vodafone has teamed up with Intel and other silicon vendors to design its own chip architecture for the OpenRAN network technology. Vodafone’s initiative will be based at its digital innovation and R&D center in Malaga, Spain – which will be staffed with 50 people dedicated to OpenRAN together with 650 software engineers, architects and technicians. The company plans to design silicon for Arm and Risc-V instruction sets as well as Intel x86. About twenty other vendors have reportedly joined the project, including Qualcomm, Broadcom, Arm and Lime Microsystems. According to the report, the Vodafone’s initiative is aimed to gain more independence from major telecoms equipment suppliers – such as Ericsson, Huawei and Nokia – as OpenRAN allows operators to mix and match suppliers in their radio networks. Ceremorphic targets reliable AI processing One more AI training chip startup has recently emerged from stealth mode: called Ceremorphic, it claims several distinctive aspects compared to competition. Among them, a focus on reliability against soft errors, immediate access to TSMC’s 5-nanometer process, and a veteran founder and CEO: Venkat Mattela, previously the founding CEO of Redpine Signals. With offices in San Jose and India, Ceremorphic already employs 150 people. The company is developing a chip called QS 1 which will include a custom machine learning processor running at 2GHz; a custom FPU running at 2GHz; a Risc-V-based processor for proxy processing using its patented ThreadArch multi-thread macro-architecture; custom video engines for metaverse processing (1GHz) along with M55 v1 Arm core; a custom designed X16 PCIe 6. 0 / CXL 3.0 connectivity interface. The chip will support Open AI framework. Ceremorphic claims for QS 1 a soft error rate of (100,000)-1, plus top security and low power. US-China tensions: Micron Technology, SMIC U.S. memory maker Micron Technology is reportedly planning to shut down its DRAM design team in Shanghai by the end of this year. According to the press report, the move comes after many members of Micron’s DRAM engineering team were poached by Chinese competitors, and will serve as a precautionary measure to prevent technology leaks. Advanced Micro Devices would also be reportedly planning to downsize its Shanghai research center, prompting some employees to leave the company. According to the report, many U.S. companies haven’t signed noncompete agreements with Chinese employees, making it easy for Chinese competitors to poach talent. Some China-based employers are reportedly offering fresh graduates with master’s degrees an annual salary of more than $63,000. U.S. Republican senators are reportedly urging the Biden administration to tighten the export controls on U.S. technology destined for SMIC foundry, which they say has close ties to the Chinese military. According to the press report, although SMIC is on the U.S. Department of Commerce’s trade blacklist, currently the toughest standard of review is only applied to highly specialized chipmaking equipment, while export of other U.S. items is granted on a “case by case” basis. Automotive chip shortage caused by surge in demand? According to market research firm IC Insights, the real reason behind the automotive IC shortage lies in the surge in demand for automotive ICs in 2021 and not from the semiconductor suppliers’ inability to ramp up production. Data gathered by the firm show that device suppliers shipped 30% more IC units to the automotive industry in 2021 as compared to 2020, which was much greater than the 22% increase in total worldwide IC unit shipments last year. Moreover, 27% more IC units were shipped to the auto sector in 2021 as compared to the pre-pandemic year of 2019. Therefore, IC Insights’ rejects the commonly accepted reason for the automotive chip shortage, usually explained as a consequence of the Covid-19 pandemic (the combined effect of the temporary automotive plants shutdown and chip manufacturing capacity being shifted to cellphones and PCs.). Acquisitions NEC Corporation has signed a definitive agreement to acquire privately held Blue Danube Systems, a U.S.-based provider of CBRS/4G/5G RAN products and AI/ML-based software solutions for mobile operators. The operation is aimed at strengthening NEC’s position in 4G and 5G radio units based on O-RAN specifications. Technologies contributed by Blue Danube will include its Coherent Massive MIMO solution for 5G beamforming, and a cloud-based software suite utilizing machine learning techniques to increase cellular networks capacity. |

|

|

|||||

|

|

|||||

|

|||||