Introduction

Let’s face it! Very few people in the general populace could name any company in the EDA Industry. Fewer still know that the Big 3 in EDA today are Synopsys, Cadence and Mentor Graphics, in that order. Even when a small fraction of the population knows who some of the “design automation tool builders” are, the larger MCAD companies such as Autodesk or even Dassault Systemes are mentioned more often.

Oh sure, occasionally when people use modern cell phones, surf the Internet, or lust after the latest apps for their Apple® iPads, some stop to wonder just how these amazing electronic miracles get designed and built, but they pause only for a few seconds. Most people could not distinguish an IC from a PCB. That’s just the way it is.

Well, occasionally a Big 3 EDA Vendor reaches at least the inside pages of the daily newspaper in Silicon Valley or perhaps Portland, OR, like when Cadence made a failed “offer” to buy Mentor Graphics in 2008, or when investor Carl Icahn tried earlier this year to take over control of Mentor Graphics. But that’s unusual; EDA cognoscenti have learned to look within our own specialty EDA Industry for possibly interesting stories about the Big 3 EDA entities.

And what have we seen lately, about, say, Mentor Graphics? The oldest EDA Vendor among the Big 3, Mentor turned 30 in April 2011. Cadence is youngest at 24, and Synopsys is 25. Mentor perennially ranks third in annual revenue. So what could be worthy of a story about Mentor these days?

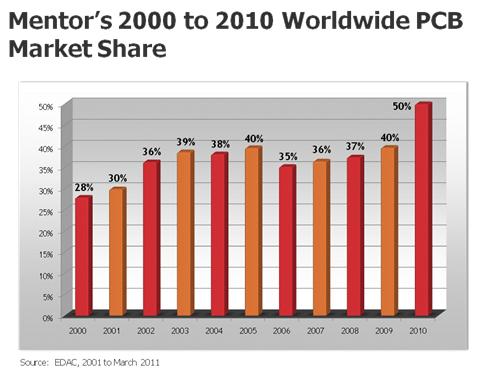

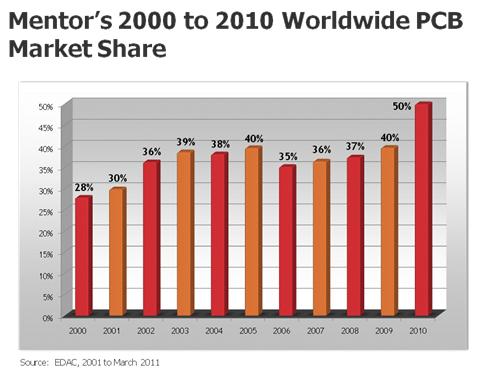

How about a “Back to the Future” story? Once the Market Share Leader in the Printed Circuit Board niche, Mentor let the future slip away, and now it has not only regained the lead, but also it dominates the PCB business at 50% Market Share. Now that’s an interesting story for an EDA-ophile, speaking as one to another of course. Read on!

This article was the July 25, 2011 edition of the EDA WEEKLY, entitled, “Back to the Future.”

Again a reminder. Please note that contributed articles, blog entries, and comments posted on EDACafe.com are the views and opinion of the author and do not necessarily represent the views and opinions of the management and staff of Internet Business Systems and its subsidiary web-sites.

Also: Posted anew every four weeks, the EDA WEEKLY delivers to its readers information concerning the latest happenings in the EDA industry, covering vendors, products, finances and new developments. Frequently, feature articles on selected public or private EDA companies are presented. Brought to you by EDACafe.com. If we miss a story or subject that you feel deserves to be included, or you just want to suggest a future topic, please contact us!

Prologue

For the past 15 years, this writer has had a soft spot in his heart for Mentor Graphics, probably because working there was his last long-term full-time corporate executive experience (1990-1996) before becoming a ‘lonesome consultant’ at Henke Associates. For the majority of that 6½ year MGC tenure, the writer ran the Company’s PCB Division as VP & General Manager. At that time, PCB Division headquarters were in San Jose, CA, the heart of Silicon Valley.

It was a very fulfilling assignment, as together with excellent current and newly-added people, we quadrupled our revenue within the first three years to grab the 1992 worldwide market leadership in printed circuit board (PCB) software (and did it again in 1993), all by establishing an unprecedented synergy with the independent MGC worldwide sales/support force; consolidating the previously-split Regional Sales and PCB teams from Zanker Road in San Jose into one beautiful, refurbished professional building on Ridder Park Drive; introducing some stunning new products and practices; creating hundreds of new customers; delivering outstanding profits; and forming many friendships inside and outside the Company that have endured ever since.

Fast forward to 2009

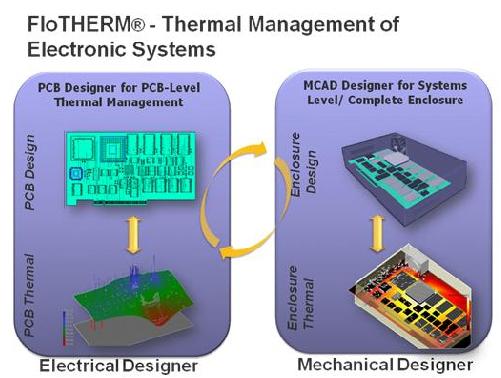

Accordingly, it was not entirely coincidental that one of the writer’s first issues posted in December 2009 on EDACafe.com as a new contributing editor of the EDA WEEKLY, was about Mentor Graphics and its acquisition of Flomerics plc (October 2008), and the

Dr. Buergel

subsequent introduction of a new GM of the Mechanical Analysis Division (MAD) Dr. Erich Buergel in November 2009:

In addition to describing the new computational fluid dynamics (CFD) software products being offered by MAD, some interesting statistics about MGC overall were discussed when the writer and Dr. Buergel met in November 2009. For example, that in 2009 MGC had reached a 44% share of the North American PCB market, and in Europe 51%.

Dr. Buergel also stated that as of mid-2009, MGC held a 36% share of the overall worldwide PCB market. The nearest PCB competitor, he said then, was Cadence, with a 21% worldwide market share circa mid-2009. Moreover, with MAD in place, he said MGC then-owned a whopping 78% of the worldwide PCB thermal analysis sub-market, with Zuken second at 20%.

Organizationally, UK-based Erich Buergel reported then and reports today to one Henry Potts, VP & GM of the MGC Systems Design Division (SDD):

Henry Potts

Joining MGC in 1999, Mr. Potts is headquartered in Longmont, CO. As indicated in that December 2009 EDA WEEKLY article, the present MGC System Design Division is today the far larger Longmont CO-based successor of the aforementioned MGC PCB Division that was headquartered in San Jose CA in the early nineties.

Seeds Sown in 2009 for a future Market Share Article

Thus the seeds were sown in November 2009 for a future EDA WEEKLY article, to summarize the story of the PCB to SDD evolution, and to be posted once MGC achieved a 50% share of the PCB Systems market. As it turned out, that milestone took another year to be achieved, some 5 more months to be announced, and then another quarter before a spot opened in the EDA WEEKLY editorial calendar. Besides, the news about MGC was dominated by the Carl Icahn saga for the first half of 2011.

Carl Icahn

The 50% Market Share MGC News Release of April 2011

Finally, on April 11, 2011, as part of a blizzard of MGC news releases that could arguably be interpreted as aimed at blunting the campaign of Carl Icahn, we saw at last the long-awaited news release about the MGC PCB Systems’ market share:

Mentor Graphics PCB Design Investment Strategy & Execution Results in 50% Worldwide Market Share

Wilsonville, Ore, April 11, 2011 - Mentor Graphics Corporation (NASDAQ: MENT) today announced that, according to the Electronic Design Automation (EDA) Consortium Market Statistics Service Report for 2010, the company has achieved a 50% worldwide market share in

PCB design solutions. For over 12 years, Mentor Graphics® has been consistently executing on a vision and investment strategy to bring the most advanced design capabilities to the industry. Today, Mentor is supplying industry-unique capabilities that extend beyond the design of the PCB and integrate the multiple engineering disciplines necessary for complete product development and delivery.

“Our continued R&D and strategic investments in advanced systems design technologies, far exceeding that of other suppliers, has resulted in a gradual increase in our revenues and market share,” stated Henry Potts, vice president and general manager of Mentor’s Systems Design Division. “The electronics industry requires these advanced technologies to support their PCB product development and manufacturing processes and Mentor is the only supplier seriously investing. This positive cycle continues, as the more revenues and market share we obtain, the more we can continue to invest in future

design solutions to the benefit of our customers.”

R&D and strategic investments in systems design have been a major focus for Mentor Graphics. The result has been industry-unique technologies that address users’ most advanced design and manufacturing needs including:

- Mechanical analysis supporting thermal analysis of electronic products including the IC package, the PCB, and the complete system

- The expansion of Mentor’s capabilities to support the complete design-through-manufacturing process including design for manufacturability, new product introduction (NPI) to manufacturing, and PCB manufacturing process execution optimization

- The

HyperLynx® PI (power integrity) for AC and DC analysis of complex power distribution networks on high-end products

- Major enhancements to the

Expedition® Enterprise platform in support of advanced technology product design by mid-sized to large and global enterprises

- Best-in-class desktop PCB technologies with

PADS® software, tailored to meet the design needs of individual users

“In 2010 we conducted and published a research project entitled Why Printed Circuit Board Design Matters to the Executive,” stated Michelle Boucher, research analyst for Aberdeen Group. “This study highlighted several PCB design best practices that enabled electronics companies to achieve best-in-class status by meeting their aggressive business goals. The design capabilities offered by Mentor Graphics support these best practices.”

Of particular note in the EDA Consortium report is Mentor’s market share in North America, Europe, and Asia/Pacific with 60%, 57% and 50% respectively. Japan was the only market where Mentor did not show the largest PCB design market share but did grow their market share by more than 75% from 2009 to 2010. The impressive growth in Japan is due to Mentor’s emphasis on this important market with increased dedicated sales and support targeted at major enterprise companies.

About the EDA Consortium

The EDA Consortium is the international association of companies that provide design tools and services that enable engineers to create the world’s electronic products used for communications, computer, space technology, medical, automotive, industrial equipment, and consumer electronics markets among others. For more information about the EDA Consortium and the Market Statistics Service Report, visit

www.edac.org.

About Mentor Graphics

Mentor Graphics Corporation (NASDAQ: MENT) is a world leader in electronic hardware and software design solutions, providing products, consulting services and award-winning support for the world’s most successful electronics and semiconductor companies. Established in 1981, the company reported revenues over the last 12 months of about $915 million. Corporate headquarters are located at 8005 S.W. Boeckman Road, Wilsonville, Oregon 97070-7777. World Wide Web site:

http://www.mentor.com/. (Mentor Graphics, Mentor, HyperLynx, Expedition, and PADS are registered trademarks of Mentor Graphics Corporation. All other company or product names are the registered trademarks or trademarks of their respective owners.)

For more information, please contact:

Larry Toda Suzanne Graham

Mentor Graphics Mentor Graphics

503.685.1664 503.685.7789

Genesis

Among the “Big 3” vendors that dominate the overall EDA landscape today, Mentor Graphics Corporation is, as mentioned, the oldest, having been founded in April 1981 after the exodus from Tektronix of Messrs. Tom Bruggere, Gerry Langeler and Dave Moffenbeier.

Bruggere Langeler Moffenbeier

All three founders were to remain with MGC for 13 or 14 years before departing.

Of course, everyone also knows that since then, Mentor Graphics Corporation perennially ranks third in revenues to Synopsys and Cadence, the other two members of today’s “Big 3.” Neither of those latter two companies existed in 1981, although today all of the Big 3 vendors contain sizeable elements of their predecessors through acquisitions and routine hiring & cross-hiring.

Synopsys as we know it today originated in 1986 and Cadence was formed in 1988. [1]

In the beginning, MGC did not participate in the emerging printed circuit board market, as in 1981 the MGC founders chose instead to focus on ASIC and custom IC design software for three years or so.

Indeed, during the first part of the 1980’s, electronics board designers in industry contented themselves with either in-house developed tools, or adapted for board design the early MCAD products of Applicon, ComputerVision, Calma, Gerber and others.

Still, the fledgling MGC had fellow travelers even in the early 80’s, such as Daisy Systems and Valid Logic, all initially focused on the front end of the EDA process (schematic capture, logic simulation, etc.). These three entities back then were referred to collectively as, “The DMV”.

While both the D and the V of the DMV were destined to eventually be subsumed, both D and V added board software to their repertoire, but did so a little later than did M.

For in 1984, ex-IBMer Ning Nan of CADI in San Jose, whose tiny company had just been acquired by MGC, urged three additional talented IBM engineers (John Cooper, Bob Vincent & John Isaac by name) to leave IBM and the dreary confines of the Northeast for sunny CA to join Ning’s San Jose MGC satellite operation. (Cooper, Vincent & Isaac had been instrumental in developing the IBM Federal Systems Division in-house PCB system, for which IBM had issued a rare couple of Outstanding Achievement Awards). With these additional resources, MGC San Jose switched to a PCB focus and its previous IC

work was moved to Oregon. [Note: Remember these three names: Cooper, Vincent, & Isaac); these folks were to play significant roles in the MGC PCB saga for years to come].

Messrs. Cooper and Vincent immediately rolled up their sleeves and started from scratch on the development of MGC Board Station, which would become Mentor Graphics’ first entry into the PCB market in 1987. [Note: Thanks to ongoing updates and rewrites, MGC Board Station is still in use today by many users worldwide as their primary board design solution].

As other EDA vendors entered the automated board design market in the late 80’s, intense competition was generated among Mentor and its new board rivals, all fighting for fresh shares of this new market segment. All these vendors grew as the market rapidly expanded, until the typical merger mania cycle started.

[Note: In another 80’s move that will pop up later, we note that John Cooper (and David Chyan) left Mentor Graphics during 1989 to form Cooper & Chyan Technologies (CCT) to create independently the next generation of printed circuit board routing technology.]

A New GM for the PCB Division

In late 1989, a new General Manager was recruited from outside MGC whose name may be familiar to the readers of the EDA WEEKLY.

That’s right, c’est moi! Yours truly was on the job in early January 1990 in time to attend the annual Mentor Graphics Worldwide Sales Kickoff in Oregon.

Dr. Henke (circa 1989)

Thus began the four consecutive years of PCB Division progress briefly described in paragraph two of the Prologue. During these years, the PCB Division succeeded in achieving the leading worldwide PCB market share in both 1992 and 1993.

Appendix I contains a list of some the Division’s specific 1990 – 1993 accomplishments, recalled to the writer’s mind via the assistance of one John Isaac (yes, the very same person who joined MGC PCB from IBM in 1984, and the person that the fresh-in-1990 PCB GM named as his official Director of Marketing at the earliest opportunity).

As Appendix I states, the MGC PCB Division subsequently changed to a different general manager in 1994.

The MGC PCB Story 1995 -1999

Not surprisingly, MGC competitors ignored MGC’s internal 1993 corporate changes and 1994 PCB Division changes, with the printed circuit board market share dogfight continuing with even more intensity. Cadence and Racal Redac (bought by Zuken in 1994) started to gain market share.

Then, in 1997, a pivotal moment arrived. CCT went public and soon after was purchased by Cadence. Recall that John Cooper and David Chyan had left MGC in 1989 to develop a new autorouter. Once introduced to the market by CCT a few years later, the latest CCT router proved to be excellent and the MGC PCB Division OEM’d it.

By 1995, other MGC PCB competitors also began to OEM and integrate the CCT router within their layout solutions, although Mentor remained CCT’s largest OEM benefactor (e.g. MGC paid CCT some $7 million in OEM royalties in 1997 alone).

When CCT began to entertain bids to be acquired, MGC reportedly participated in the bidding to buy CCT the company, but MGC ultimately was unwilling to match the bid level Cadence had reached.

Cadence’s subsequent purchase of CCT changed the ball game. It left Mentor at the mercy of a strong competitor for the key piece of PCB functionality (interactive and automatic routing). It also gave Cadence direct access to Mentor’s installed PCB base via customer support for the CCT router. Cadence soon surpassed Mentor in PCB market share, according to reports at the time.

It’s fair to say that the 1995 through 1998 period was not one of progress for Mentor’s PCB business.

A Game Changer

While Mentor Graphics led the world in PCB market share in 1992 and 1993, its years of relative inattention to that market from 1995 to 1998 proved costly.

By 1999, Mentor top management finally decided once again to reach outside for a new PCB Division GM.

In March of 1999, Mentor hired Henry Potts as VP and GM of the PCB Division. Henry came to Mentor with an extensive resume of IC and Systems development management experience at Hitachi, Motorola, VLSI Technology, Schlumberger and Texas Instruments.

Henry Potts joined Mentor Graphics in March of 1999 as Vice President and General Manager of the Systems Design Division. Potts brought more than 33 years of experience in the electronics industry to his role at Mentor Graphics, including experience in IC & Systems development to serving as President and CEO of a venture capital funded startup. He served as a Senior Vice President for Hitachi Semiconductor where he oversaw all marketing and product development activities for microprocessor and embedded products for the US markets. He had also held senior management positions at Motorola, VLSI Technology, Schlumberger and Texas Instruments.

Potts has a BS degree in Electrical Engineering from University of Southwestern Louisiana.

Potts knew from his experience that there was far more to designing an electronic system than simply laying out the PCB grid. He also realized, perhaps ahead of his peers, that developing an advanced electronic product was a collaborative team effort. Not only does a customer design team need high levels of productivity and the ability to handle the most advanced technologies in the PCB design process, but also (as Potts theorized early on) that the customers would need to implement concurrency and co-design among the entire systems development parts: PCB, IC/Package, FPGA, MCAD, procurement and manufacturing.

Note that these “C” terms: collaboration, co-design, concurrency ... were seldom found in the vocabularies of EDA executives at the Millennium.

Potts also patiently set about gradually persuading Mentor’s top management that offering PCB systems design software was a very good business to pursue and should not be treated as a “cash cow”, but rather that it should be and must be suitably supported with substantial R&D and strategic acquisitions. Bravo!

But first things first. As the new person in charge, Potts had inherited a PCB product line whose key component (the interactive and autorouting technology) was then owned by an arch rival. According to an article by Richard Goering of EE|Times dated November 2, 1999, Potts said at the time, “By not having the ability to offer one continuous flow, we were not able to satisfy all the requirements of our customers.”

The good news for Mentor was that the EDA vendor Veribest was having difficulty, was available, and possessed world class routing technology. By November 1999, Potts had driven Mentor’s acquisition of Veribest to a successful close. While terms were not disclosed at the time, the price was very attractive [2].

Moreover, there were other parts of the Veribest product line acquired by Mentor that later proved to be jewels in the rough:

- The development of I/O Designer for the co-design of PCB’s and FPGA’s. Here FPGA’s could be designed and pin-outs optimized in the context of the PCB.

- The development of Expedition Enterprise as Mentor’s next generation PCB systems design solution.

The acquisition of Veribest relieved Mentor of its dependence on Cadence for routing, and soon the acquired Expedition router was replacing that of Cadence (CCT) in the marketplace.

The Veribest acquisition also added skilled headcount to the MGC PCB Division, and of course its Colorado location proved irresistible as a Division HQ.

As Potts continued the division’s own R&D, he remained persistently watchful for strategic acquisitions to fill other gaps in Mentor’s total PCB solution.

Indeed, the ink was hardly dry on the Veribest deal, when Potts’ eyes fell on Innoveda, Inc., then a public company based in Marlboro, MA.

Innoveda had been created by the merger of Viewlogic Systems, Inc. and Summit Design, Inc., and then the subsequent merger of that Innoveda and PADS Software, Inc. These unions formed the foundation of a comprehensive electronic product line for system level design, design capture, board design and electromechanical design that could help engineers visualize, design and build advanced electronic systems for customers participating in the telecommunications, transportation, computers and consumer electronics markets – all the words that were interesting to

Henry Potts.

The April 2002 price paid by Mentor for Innoveda ($160 million in cash) [3] was somewhat more dear than the bargain-basement $19 million paid for Veribest, but consider what Mentor realized from the Innoveda deal:

PADS—A Desktop PCB Design System:

At this juncture, Mentor already possessed world-class mid- to high-end enterprise systems in Board Station and Enterprise Expedition, but in 2002 Mentor could offer no low cost system. Competition was attacking Mentor from the bottom with their low end systems. Mentor could definitely benefit by offering its own low-end alternative as well as expand its revenue potential by addressing small companies that could use a system like PADS, which offered good technology but without the need for the infrastructure system and large-team design capabilities.

HyperLynx--for Signal Integrity:

Now the world’s most popular simulation & analysis system for high speed net design. Mentor already had a signal integrity offering, but HyperLynx was much easier to learn and use, and it was already installed in many Mentor competitors’ accounts.

DxDesigner – An excellent Design Entry System:

Same reasons as HyperLynx. Excellent technology plus it was also already installed in many competitors’ accounts. DxDesigner would redefine front-end design engineering through a process of "design definition" that combines four key process technologies: component information systems; design entry and sharing; simulation and planning; and enterprise connectivity within a single, comprehensive solution. This enables better communication among geographically dispersed engineering and manufacturing teams, resulting in more efficient component selection, less post-layout re-work, fewer design defects, and shorter

prototype-debugging cycles.

Still, the Veribest and Innoveda acquisitions could be viewed mostly as catch-up actions, necessary to restore Mentor’s ability to compete in the market niche it once led.

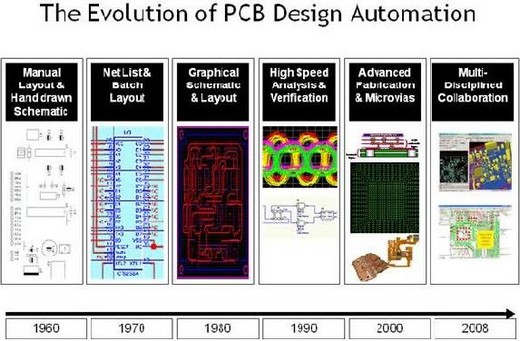

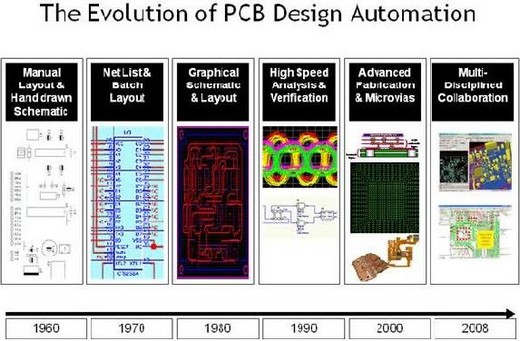

But Potts knew better. He already had articulated his vision of “collaboration, co-design, concurrency” in words, and then he had made two acquisitions that he knew would further his goals. At this juncture he started using visuals to punctuate his points, such as the last two panels on the right side of this illustration:

Concurrency and Collaboration

But Pott’s vision went further than adding productivity and additional functionality to the PCB core design process. When one can turn serial processes into parallel processes, it’s like turning lead into gold, since designers can make significant gains in design cycle reduction and time to market improvements.

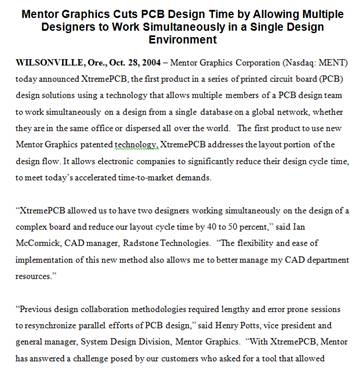

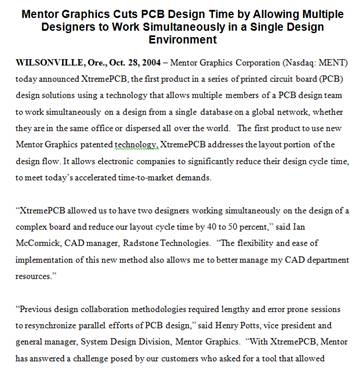

In 2004, the Systems Design Division (renamed from PCB Division) delivered one of the most significant breakthrough technologies to the industry addressing the design cycle reduction issue, in the form of “XtremePCB!”

XtremePCB allowed multiple layout designers (up to 15) to simultaneously edit the same database (without any database partitioning) and view each other’s edits in real time on a LAN or WAN network. Sort of like a video game for CAD designers. This enabled designers to reduce their layout design cycle times by up to 70%.

“By using XtremePCB, we reduced our layout time from 13 to 5 weeks. We more than doubled our design productivity.” – Alcatel Shanghai Bell

This technology was patented by Mentor and has not been duplicated.

But the concurrency did not stop at the layout process. In the same fashion, Mentor supplied true concurrent design (no partitioning, real time viewing of peers’ edits) into schematic and high speed constraint entry. This not only improved design cycle time but improved quality and reduced changes. Engineers could instantly see their peers’ edits and thus stay more in sync with the rest of the design, than if they each operated separate workstations and had to periodically re-synchronize the design database.

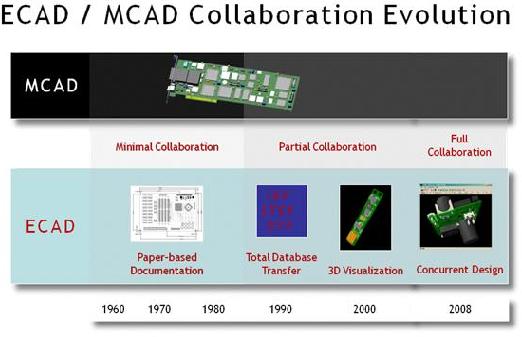

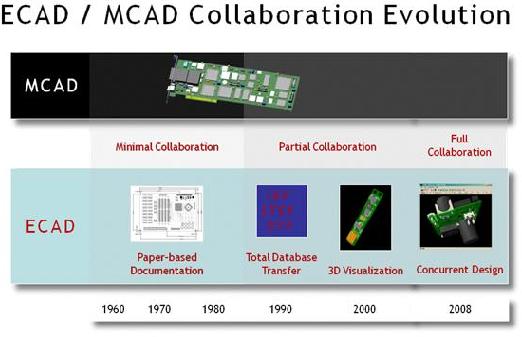

Combining ECAD with MCAD

As previously stated, designing a product these days is usually more than an ECAD challenge. Other disciplines such as MCAD are equally as important. But for years, these two domains had grown up as separate silos of design technology. Interfaces have existed that were able to transfer databases between the respective design domains, but these were en masse transfers and did not really enable real time collaboration.

In 2005, Potts initiated a task force, with the cooperation of key European users and of the ProSTEP standards organization, to define an interface standard that could communicate incremental change proposals between the ECAD and MCAD systems. This standard was developed, approved and then published by ProSTEP in the spring of 2008.

In 2008 Mentor Graphics and Parametric Technology Corporation (PTC) were the first vendors in their respective domains to implement the standard. It allowed a proposed change to originate in either domain and be communicated to the other electronically. A negotiation process can follow and once agreed upon, each database updated to reflect the agreed-to change. True incremental collaboration between ECAD and MCAD! If you would like to see a 15 minute demo of this capability by PTC and Mentor, go to

ECAD/MCAD.

Other Potts’ Acquisitions

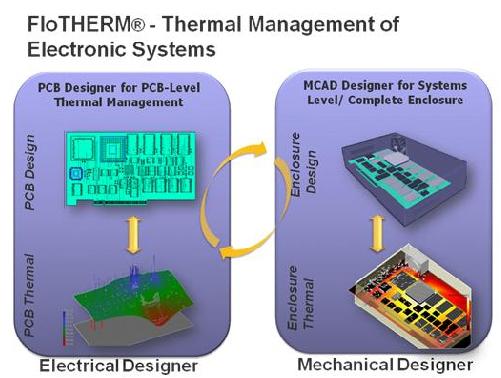

Potts didn’t stop there in his determination to improve the entire PCB development process. As mentioned earlier, in 2008 he persuaded MGC to acquire the 74% of Flomerics plc that MGC didn’t already own, for about $60 million. Finally MGC had access to Flomerics’ IC package, its PCB and systems level thermal analysis, and its general purpose Computational Fluid Dynamics (CFD) technology. Potts named this business unit the Mechanical Analysis Division, making a clear statement that electronics do not live in a vacuum. Again this brought the mechanical and electrical co-dependencies to light and

provided users with yet another bridge between the two domains. For more details, see the EDA WEEKLY of December 2009:

http://www10.edacafe.com/nbc/articles/view_weekly.php?articleid=764356

... and on to Manufacturing

The next major step was to extend support beyond the design of the PCB and into manufacturing. With the 2010 $50 million acquisition of Valor Computerized Systems (and Frontline, a 50% joint venture with Orbotech), Mentor became the first (and so far only) supplier to be able to support a Design-through-Manufacturing process.

Important pieces of these products include the ability during the PCB design process to do extensive design for manufacturability (DFM) checks. Such checks ensure that the PCB once designed can in fact be manufactured (both bare board fabrication and assembly).

Other Valor products actually optimize the manufacturing line setup and then monitor it during operation for efficiency and reduced down time.

Again, the goal is to cut time to target volume production as well as to optimize the profits of the manufacturer and reduce product costs for the OEM.

Epilogue

So, as Mentor added needed capabilities to its portfolio, Mentor’s market share started to take off again, surpassing all other competitors and finally reaching the 50% mark in 2010. See bar chart below (Source: EDA Consortium, March 2011):

To which the writer, overjoyed but hiding it, meekly and obligingly asked, “So, this all seems really great for Mentor, but what does a 50% market share and increasing revenues mean to Mentor’s customers?”

The Mentor spokesperson patiently answered, “Basically, it means that as Mentor increases revenues and market share, Mentor will be able to continue and even increase its high level of investment in PCB systems design. Mentor understands that getting a more competitive electronic product to market faster and at reduced cost, requires more than a great PCB place-and-route capability. Product development requires the efficient collaboration of many disciplines, extensive virtual prototyping, a full design through manufacturing supporting flow, and functionality to address the most advanced IC and PCB fabrication

technologies.”

The spokesperson went even further, “Mentor offers what may be the most advanced PCB Design through Manufacturing system today and as investment continues, Mentor should be able to provide its customers with whatever it takes to meet their most aggressive business goals and beat their competition.”

The “PCB Daddy from the 90’s” is very proud of his offspring!

##########

[1] Footnote:

Besides Mentor Graphics, the other two members of today’s EDA Big 3 are (1) Synopsys (founded by Aart de Geus among others in 1986; Dr. de Geus is Synopsys CEO in 2011):

Aart de Geus

And (2) Cadence (formed initially by the merger of ECAD and SDA Systems in 1988). The CEO of Cadence from 1988 to 1997 was Joe Costello. Others who held that position thereafter for relatively long periods included Ray Bingham (1999 – 2004) and Mike Fister (2004 – 2008).

Lip-Bu Tan has been CEO of Cadence since January 2009:

Lip-Bu Tan

Dr. Walden Rhines has been CEO of Mentor Graphics since late 1993:

Walden Rhines

[2] Footnote:

The following is from a MENTOR GRAPHICS company report at the time:

On October 31, 1999, the Company (MGC) purchased certain assets and all liabilities of Veribest for cash, a warrant, and assumed net liabilities with a total value of $19.1 million. The purchase accounting allocations resulted in a charge for in-process R&D of $5.2 million, capitalized goodwill of $7.5 million, and capitalized technology of $6.4 million.

[3] Footnote:

Wednesday April 24, 2002 12:19 am Eastern Time

Mentor Graphics Corporation Agrees to Acquire Innoveda, Inc.

WILSONVILLE, Ore. -(Dow Jones)- Mentor Graphics Corp. (MENT) signed a definitive agreement to acquire Innoveda Inc. (INOV) for $3.95 a share cash, or about $160 million.

##########

Special thanks for assistance with this article goes out to John (Ike) Isaac, Director of Market Development of the Mentor Graphics SDD Longmont CO, and friend extraordinaire of 21 years

John provided the illustration below that represents technologies contained in Mentor’s industry-unique Design-through-Manufacturing PCB systems design solution:

Mentor’s Design-through Manufacturing Technologies Wheel

#########

Appendix I

The PCB Division of 1990 through 1993

For several months in late 1989 the writer had been repeatedly contacted by recruiter Dan Mirich of Korn Ferry. Mr. Mirich had been retained by MGC’s Beaverton, OR-based Gerry Langeler and Marv Wolfson in the autumn of 1989 to identify a series of candidates for a new General Manager of the young MGC PCB Division.

Not yet nine years old, Mentor Graphics itself remained in the hands of the original founders Bruggere, Langeler, and Moffenbeier, all three of whom were determined and aggressive, with a strong vision for Mentor’s future.

In late 1989, however, the writer was briefly pre-occupied with the sale of his Bay Area-based MCAD/MCAE company to Morgan Stanley, and he resisted Dan Mirich’s entreaties until that sale was successfully completed. (The recruiting process adopted by MGC for this new PCB GM position was unusual, in the sense that the key people at the PCB Division were allowed to choose their new general manager from a series of interviews held with multiple candidates presented by Dan Mirich. This approach had the twin benefit of the GM candidates learning directly the issues he or she would face on day one).

Finally, the writer agreed to meet with the employee interview team of the MGC PCB Division on Zanker Road in mid-December 1989. An offer was extended between Christmas and New Year’s Day, and yours truly was on the job in early January 1990 in time to attend the annual Mentor Graphics Worldwide Sales Kickoff in Oregon.

Dr. Henke (1989)

Thus began the four consecutive years of PCB Division progress briefly described in paragraph two of the Prologue. During those years, the PCB Division succeeded in achieving the worldwide leading market share in both 1992 and 1993.

Some of the PCB Division’s 1990 – 1993 accomplishments:

- The first order of business for the new GM in January 1990 was tackled immediately. Using techniques he had learned in his previous 22 years of management experience, Henke stabilized and strengthened the Division management team within a few months, with minimum but not zero turnover; reconciled warring factions among division functions, instilled a new sense of collective urgency; began identifying outside personnel who might be recruited going forward; re-established positive relationships between San Jose and Company HQ in Oregon; and began energizing the worldwide MGC sales force to focus on PCB Division software

products.

- As a result, the PCB Division profitably grew revenues by 18% in 1990. We simultaneously completed the Company’s first applications software product suite running on MGC’s revolutionary 8.0 Concurrent Object Oriented Framework, and we met every subsequent 8.X release date on time throughout the 1990-1992 period. We were also the first MGC division to get its software ported from purely Apollo workstations to SUN, HP700’s, DIGITAL, IBM RS6000, and other workstations, thereby enhancing the size of the available MGC PCB market.

- We introduced and packaged new products into emerging markets, to create incremental PCB revenue. These products, such as MCM STATION and BOARDSTATION 500, subsequently won MILTON S. KIVER innovation awards.

- We converted all PCB software (over one million lines) from PASCAL to C++ code, smoothly and transparently on the fly to 4000 users. We also introduced automated software quality test suites and the SEI self-assessment process to improve productivity of S/W development processes. (Kudos to Bob Vincent, et al).

- We set up new, innovative marketing programs (PCB Snap-On Tools, PCB Million Dollar Sales Club, Silicon Valley Solutions Expositions, new Sales Kits, Videotapes, self-paced interactive CD demo suites, etc.).

- Sensing little corporate appetite for PCB-related acquisitions, we aggressively supplemented our PCB functionality via key OEM deals, with Quad Design for signal integrity, Cooper & Chyan for advanced gridless routing of PCB’s, Texas Instruments, SDRC, MITRON, ITI and others. We also partnered with Dassault Systemes to link CATIA to PCB Cable Station. Early thermal analysis was also offered.

- We established “MCM foundry” relationships with MMS, Sorep, AT&T, Hughes, Toshiba, etc. We formed a dedicated Conversion Services Team (to win business from customers using legacy code, or code from competition). In addition, we formed the highly-effective and aggressive PCB Division Benchmark Team. (Benchmarking was still a critical step in a prospect’s purchasing process in those days). Twice we entered, competed in and won the Printed Circuit Board Magazine multi-vendor benchmarks.

- We expanded the Technology Leadership Awards program that recognized customer PCB designers for innovative use of MGC PCB tools to overcome tough technical challenges. The PCB Division GM traveled to nearby or distant customer sites with the respective MGC sales teams, for formal presentations of these Awards, such as the presentation by GM Henke to Siemens Plessey Radar on the Isle of Wight, UK, shown below:

The Technology Leadership Awards Program still exists at MGC today.

- We identified, proposed, negotiated and landed MGC’s first-ever DARPA contract, for $6.3 million, to support a team of ten PCB expert engineers for 30 months of advanced s/w product development on MCM’s within the PCB Division.

- We increased our emphasis on the Silicon Valley community and participated in multiple charitable benefits for non-profits.

The PCB Division team actively supported the San Jose Symphony Orchestra, initiating the annual Silicon Valley CEO NIGHT at the Symphony on behalf of Mentor Graphics. Early 1990's guest conductors for CEO Nights at the Symphony included, among others, composers and artists Bert Bacharach (below left), Peter Nero, and Henri Mancini (below right).

- We moved both the PCB Division and the local sales team from two older, separated buildings on Zanker Road to a new MGC SILICON VALLEY HQ Building on Ridder Park Drive in May 1992. The GM became Site Executive and was the principal spokesperson for MGC in the Silicon Valley among press, customers, vendors, employees, analysts, and shareholders.

At the new building’s dedication ceremony in mid-1992, we were pleased to have in attendance the then-current Mayor of San Jose Susan Hammer, as well as MGC founder and then CEO Tom Bruggere.

- Finally, via the innovative programs described above, and the willingness of the GM and his direct reports to travel worldwide to any customer with the MGC sales force, we grew PCB Division Revenues during ’90-’92 by +12% CAGR, while the PCB market was declining "minus 6%" per year, and while MGC overall revenue was "minus 11%" per year!

- The Regional Manager of Sales Ms. Wendy Reeves Dunn and PCB GM Dr. Henke worked together over several years in driving revenues for the PCB Division.

#########

Appendix II

S I A

Steady and Modest Growth Mark May 2011 Sales for Semiconductor Industry

by

Email Contact

On July 5, 2011 the Semiconductor Industry Association (SIA), representing U.S. leadership in semiconductor manufacturing and design, announced that worldwide sales of semiconductors were $25 billion for the month of May 2011, a (mere) 1.8% increase from the prior month when sales were $24.6 billion, and a 1.3% growth from May 2010. All monthly sales numbers represent a three-month moving average.

"Taking into consideration macroeconomic factors impacting consumer confidence, the steady but modest growth that the industry demonstrated in May is encouraging,” said Brian Toohey, president, Semiconductor Industry Association. “Global demand for high-end electronics, the continuing proliferation of semiconductor technology into a wider range of products, growth in emerging economies and better than expected recovery from the Japan earthquake will be continued drivers of industry growth in 2011."

The industry continues to see increasing demand for tablets and e-readers, as well as increased demand for industrial processors that enable devices to harness renewable energy like solar panels and e-meters. Additionally, the industry has seen strong demand for electronic systems included across all ranges of vehicles.

Economic uncertainty both in the U.S. and abroad bears close watching, while further opportunities for semiconductor sales growth will be concentrated in emerging markets like China and India. Year-to-date results are in line with projections recently reported in the Spring Semiconductor Sales Forecast from WSTS that indicate global industry sales will increase 5.4% for 2011, 7.6% in 2012 and 5.4% in 2013, with a 3-year compound annual growth rate of 6.13% from 2010 to 2013.

To learn more about SIA visit,

www.sia-online.org.

############

Appendix III

On July 18, 2011 the EDA Consortium (EDAC) Market Statistics Service (MSS) announced that the Electronic Design Automation (EDA) industry revenue increased 16.0% for Q1 2011 to $1446.4 million, compared to $1247.0 million in Q1 2010. Sequential EDA revenue for Q1 2011 decreased 4.1% compared to Q4 2010.

Just counting the five vendors reported in the June 27, 2011 EDA WEEKLY Almanac, the EDA G5 revenue increased 19.7% for Q1 2011 to $946.3 million, compared to $790.8 million in Q1 2010. Sequential EDA G5 revenue for Q1 2011 decreased 2.9% compared to Q4 2010. As reported on June 27 in the EDA WEEKLY Almanac, the EDA G5 alone in Q1 2011 accounted for 65.4 % of the total EDA Industry revenue reported on July 18 by EDAC for Q1

2011.

“First quarter 2011 (total EDAC) results represent a significant increase in all product categories compared to Q1 2010, with CAE, PCB & MCM, IC Physical Design & Verification, and SIP all showing double digit increases,” said Wally Rhines, EDAC chair and chairman and CEO of Mentor Graphics. “Geographically, all regions realized increased revenue in Q1 2011 compared to Q1 2010, with the Americas, Japan, and Asia/Pacific regions posting double digit increases.”

Companies that were tracked (by EDAC) employed 26,457 professionals in Q1 2011, a decrease of 1.2% compared to the 26,767 people employed in Q4 2010, but up 1.4% compared to Q1 2010.

The complete MSS report, containing detailed revenue information broken out by both categories and geographic regions, is available via subscription from the EDA Consortium.

Revenue by Product Category

The largest category, Computer Aided Engineering (CAE), generated revenue of $530.6 million in Q1 2011. This represents a 15.7% increase over Q1 2010. The four-quarters moving average for CAE increased 12.9%.

IC Physical Design & Verification revenue increased to $318.5 million in Q1 2011, a 16.1% increase compared to Q1 2010. The four-quarters moving average increased 7.6%.

In the overall category of PCB Systems that firms the subject matter of the “Back to the Future” article in this July 25 EDA WEEKLY posting, EDAC reported on July 18 that overall Printed Circuit Board and Multi-Chip Module (PCB & MCM) revenue of $140.4 million for Q1 2011 represents an increase of 28.3% compared to Q1 2010. The four-quarters moving average for PCB & MCM increased 14.9%.

Semiconductor Intellectual Property (SIP) revenue reported by EDAC totaled $371.4 million in Q1 2011, a 15.7% increase compared to Q1 2010.

Just counting the five Electronics IP vendors reported in the June 27, 2011 EDA WEEKLY Almanac, G5 Electronics IP revenue totaled $286.7 million in Q1 2011, a 14.9% decrease compared to $336.1 million in Q1 2010. The distortion in Q1 2010 G5 Electronics IP revenue came from a giant revenue number posted for Q1 2010 of $161.9 million by Rambus. If both of Rambus’ Q1 2010 and Q1 2011 revenue numbers were to be left out of the G5 totals, the Q1 2011 figure for revenue for the remaining IP G4 is

28.1% higher than Q1 2010.

The EDAC four-quarters SIP moving average increased 27.9%.

Services revenue was $85.6 million in Q1 2011, an increase of 2.2% compared to Q1 2010. The four-quarters moving average decreased 2.1% .

Revenue by Region

The Americas, EDA’s largest region, purchased $602.4 million of EDA products and services in Q1 2011, an increase of 22.2% compared to Q1 2010. The four-quarters moving average for the Americas increased 12.8%.

Revenue in Europe, the Middle East, and Africa (EMEA) was up 7.8% in Q1 2011 compared to Q1 2010 on revenues of $241.8 million. The EMEA four-quarters moving average increased 7.9%.

First quarter 2011 revenue from Japan increased 17.7% to $295.3 million compared to Q1 2010. The four-quarters moving average for Japan increased 6.9%.

The Asia/Pacific (APAC) region revenue increased to $307.0 million in Q1 2011, a 10% increase compared to the same quarter in 2010. The four-quarters moving average increased 31.7%.

About the MSS Report

The EDA Consortium Market Statistics Service reports EDA industry revenue data quarterly and is available by annual subscription. Both public and private companies contribute data to the report. Each quarterly report is published approximately three months after quarter close. MSS report data is segmented as follows: revenue type (product licenses and maintenance, services, and SIP), application (CAE, PCB/MCM Layout, and IC Physical Design and Verification), and region (the Americas, Europe Middle East and Africa, Japan, and Asia Pacific), with many subcategories of detail provided. The report also tracks total employment of

the reporting companies.

About the EDA Consortium

The EDA Consortium is the international association of companies that provide design tools and services that enable engineers to create the world’s electronic products used for communications, computer, space technology, medical, automotive, industrial equipment, and consumer electronics markets among others. For more information about the EDA Consortium, visit

www.edac.org, or to subscribe to the Market Statistics Service, call 408-287-3322 or email

Email Contact.

The information supplied by the EDA Consortium is believed to be accurate and reliable, but the EDA Consortium assumes no responsibility for any errors that may appear in this document. All trademarks and registered trademarks are the property of their respective owners.

###########

About the Writer of the EDA WEEKLY:

Since 1996, Dr. Russ Henke has been and remains active as president of HENKE ASSOCIATES, a San Francisco Bay Area high-tech business & management consulting firm. The number of client companies served by Henke Associates during those years now numbers close to fifty. Engagement lengths have varied from a few weeks up to ten years and beyond.

During his previous corporate career, Henke operated sequentially on "both sides" of MCAE/MCAD and EDA, as a user and as a vendor. He's a veteran corporate executive from Cincinnati Milacron (Research Scientist), SDRC (President & COO), Schlumberger Applicon (Executive VP), Gould Electronics (President & General Manager), ATP (Chairman and CEO), and Mentor Graphics (VP & General Manager).

Henke is a Fellow of the Society of Manufacturing Engineers (SME) and served on the SME International Board of Directors. Henke was also a board member of SDRC, PDA, ATP, and the MacNeal Schwendler Corporation, and he currently serves on the board of Stottler Henke Associates, Inc.

Henke is also a member of the IEEE and a Life Fellow of ASME International. In April 2006, Dr. Henke received the 2006 Lifetime Achievement Award from the CAD Society, presented by CAD Society president Jeff Rowe at COFES2006 in Scottsdale, AZ. In February 2007, Henke became affiliated with Cyon Research's select group of experts on business and technology issues as a Senior Analyst. This Cyon Research connection aids and supplements Henke's ongoing, independent consulting practice (HENKE ASSOCIATES). Dr. Henke is also a contributing editor of the EDACafé EDA WEEKLY, and he has published EDA WEEKLY articles every four

weeks since November 2009; URL's available.

Since May 2003 HENKE ASSOCIATES has also published a total of ninety-six (96) independent COMMENTARY articles on MCAD, PLM, EDA and Electronics IP on IBSystems' MCADCafé and EDACafé.

Further information on HENKE ASSOCIATES, and URL's for past Commentaries, are available at

http://www.henkeassociates.net.

March 31, 2011 marked the 15th Anniversary of the founding of HENKE ASSOCIATES.

You can find the full EDACafe.com event calendar here.

To read more news, click here.

-- Russ Henke, EDACafe.com Contributing Editor.

Wilsonville, Ore, April 11, 2011 - Mentor Graphics Corporation (NASDAQ: MENT) today announced that, according to the Electronic Design Automation (EDA) Consortium Market Statistics Service Report for 2010, the company has achieved a 50% worldwide market share in

PCB design solutions. For over 12 years, Mentor Graphics® has been consistently executing on a vision and investment strategy to bring the most advanced design capabilities to the industry. Today, Mentor is supplying industry-unique capabilities that extend beyond the design of the PCB and integrate the multiple engineering disciplines necessary for complete product development and delivery.

“Our continued R&D and strategic investments in advanced systems design technologies, far exceeding that of other suppliers, has resulted in a gradual increase in our revenues and market share,” stated Henry Potts, vice president and general manager of Mentor’s Systems Design Division. “The electronics industry requires these advanced technologies to support their PCB product development and manufacturing processes and Mentor is the only supplier seriously investing. This positive cycle continues, as the more revenues and market share we obtain, the more we can continue to invest in future

design solutions to the benefit of our customers.”

R&D and strategic investments in systems design have been a major focus for Mentor Graphics. The result has been industry-unique technologies that address users’ most advanced design and manufacturing needs including:

- Mechanical analysis supporting thermal analysis of electronic products including the IC package, the PCB, and the complete system

- The expansion of Mentor’s capabilities to support the complete design-through-manufacturing process including design for manufacturability, new product introduction (NPI) to manufacturing, and PCB manufacturing process execution optimization

- The

HyperLynx® PI (power integrity) for AC and DC analysis of complex power distribution networks on high-end products

- Major enhancements to the

Expedition® Enterprise platform in support of advanced technology product design by mid-sized to large and global enterprises

- Best-in-class desktop PCB technologies with

PADS® software, tailored to meet the design needs of individual users

“In 2010 we conducted and published a research project entitled Why Printed Circuit Board Design Matters to the Executive,” stated Michelle Boucher, research analyst for Aberdeen Group. “This study highlighted several PCB design best practices that enabled electronics companies to achieve best-in-class status by meeting their aggressive business goals. The design capabilities offered by Mentor Graphics support these best practices.”

Of particular note in the EDA Consortium report is Mentor’s market share in North America, Europe, and Asia/Pacific with 60%, 57% and 50% respectively. Japan was the only market where Mentor did not show the largest PCB design market share but did grow their market share by more than 75% from 2009 to 2010. The impressive growth in Japan is due to Mentor’s emphasis on this important market with increased dedicated sales and support targeted at major enterprise companies.

About the EDA Consortium

The EDA Consortium is the international association of companies that provide design tools and services that enable engineers to create the world’s electronic products used for communications, computer, space technology, medical, automotive, industrial equipment, and consumer electronics markets among others. For more information about the EDA Consortium and the Market Statistics Service Report, visit

www.edac.org.

About Mentor Graphics

Mentor Graphics Corporation (NASDAQ: MENT) is a world leader in electronic hardware and software design solutions, providing products, consulting services and award-winning support for the world’s most successful electronics and semiconductor companies. Established in 1981, the company reported revenues over the last 12 months of about $915 million. Corporate headquarters are located at 8005 S.W. Boeckman Road, Wilsonville, Oregon 97070-7777. World Wide Web site:

http://www.mentor.com/. (Mentor Graphics, Mentor, HyperLynx, Expedition, and PADS are registered trademarks of Mentor Graphics Corporation. All other company or product names are the registered trademarks or trademarks of their respective owners.)

For more information, please contact:

Larry Toda Suzanne Graham

Mentor Graphics Mentor Graphics

503.685.1664 503.685.7789

Genesis

Among the “Big 3” vendors that dominate the overall EDA landscape today, Mentor Graphics Corporation is, as mentioned, the oldest, having been founded in April 1981 after the exodus from Tektronix of Messrs. Tom Bruggere, Gerry Langeler and Dave Moffenbeier.

Bruggere Langeler Moffenbeier

All three founders were to remain with MGC for 13 or 14 years before departing.

Of course, everyone also knows that since then, Mentor Graphics Corporation perennially ranks third in revenues to Synopsys and Cadence, the other two members of today’s “Big 3.” Neither of those latter two companies existed in 1981, although today all of the Big 3 vendors contain sizeable elements of their predecessors through acquisitions and routine hiring & cross-hiring.

Synopsys as we know it today originated in 1986 and Cadence was formed in 1988. [1]

In the beginning, MGC did not participate in the emerging printed circuit board market, as in 1981 the MGC founders chose instead to focus on ASIC and custom IC design software for three years or so.

Indeed, during the first part of the 1980’s, electronics board designers in industry contented themselves with either in-house developed tools, or adapted for board design the early MCAD products of Applicon, ComputerVision, Calma, Gerber and others.

Still, the fledgling MGC had fellow travelers even in the early 80’s, such as Daisy Systems and Valid Logic, all initially focused on the front end of the EDA process (schematic capture, logic simulation, etc.). These three entities back then were referred to collectively as, “The DMV”.

While both the D and the V of the DMV were destined to eventually be subsumed, both D and V added board software to their repertoire, but did so a little later than did M.

For in 1984, ex-IBMer Ning Nan of CADI in San Jose, whose tiny company had just been acquired by MGC, urged three additional talented IBM engineers (John Cooper, Bob Vincent & John Isaac by name) to leave IBM and the dreary confines of the Northeast for sunny CA to join Ning’s San Jose MGC satellite operation. (Cooper, Vincent & Isaac had been instrumental in developing the IBM Federal Systems Division in-house PCB system, for which IBM had issued a rare couple of Outstanding Achievement Awards). With these additional resources, MGC San Jose switched to a PCB focus and its previous IC work was moved to Oregon. [Note: Remember these three names: Cooper, Vincent, & Isaac); these folks were to play significant roles in the MGC PCB saga for years to come].

Messrs. Cooper and Vincent immediately rolled up their sleeves and started from scratch on the development of MGC Board Station, which would become Mentor Graphics’ first entry into the PCB market in 1987. [Note: Thanks to ongoing updates and rewrites, MGC Board Station is still in use today by many users worldwide as their primary board design solution].

As other EDA vendors entered the automated board design market in the late 80’s, intense competition was generated among Mentor and its new board rivals, all fighting for fresh shares of this new market segment. All these vendors grew as the market rapidly expanded, until the typical merger mania cycle started.

[Note: In another 80’s move that will pop up later, we note that John Cooper (and David Chyan) left Mentor Graphics during 1989 to form Cooper & Chyan Technologies (CCT) to create independently the next generation of printed circuit board routing technology.]

A New GM for the PCB Division

In late 1989, a new General Manager was recruited from outside MGC whose name may be familiar to the readers of the EDA WEEKLY.

That’s right, c’est moi! Yours truly was on the job in early January 1990 in time to attend the annual Mentor Graphics Worldwide Sales Kickoff in Oregon.

Dr. Henke (circa 1989)

Thus began the four consecutive years of PCB Division progress briefly described in paragraph two of the Prologue. During these years, the PCB Division succeeded in achieving the leading worldwide PCB market share in both 1992 and 1993.

Appendix I contains a list of some the Division’s specific 1990 – 1993 accomplishments, recalled to the writer’s mind via the assistance of one John Isaac (yes, the very same person who joined MGC PCB from IBM in 1984, and the person that the fresh-in-1990 PCB GM named as his official Director of Marketing at the earliest opportunity).

As Appendix I states, the MGC PCB Division subsequently changed to a different general manager in 1994.

The MGC PCB Story 1995 -1999

Not surprisingly, MGC competitors ignored MGC’s internal 1993 corporate changes and 1994 PCB Division changes, with the printed circuit board market share dogfight continuing with even more intensity. Cadence and Racal Redac (bought by Zuken in 1994) started to gain market share.

Then, in 1997, a pivotal moment arrived. CCT went public and soon after was purchased by Cadence. Recall that John Cooper and David Chyan had left MGC in 1989 to develop a new autorouter. Once introduced to the market by CCT a few years later, the latest CCT router proved to be excellent and the MGC PCB Division OEM’d it.

By 1995, other MGC PCB competitors also began to OEM and integrate the CCT router within their layout solutions, although Mentor remained CCT’s largest OEM benefactor (e.g. MGC paid CCT some $7 million in OEM royalties in 1997 alone).

When CCT began to entertain bids to be acquired, MGC reportedly participated in the bidding to buy CCT the company, but MGC ultimately was unwilling to match the bid level Cadence had reached.

Cadence’s subsequent purchase of CCT changed the ball game. It left Mentor at the mercy of a strong competitor for the key piece of PCB functionality (interactive and automatic routing). It also gave Cadence direct access to Mentor’s installed PCB base via customer support for the CCT router. Cadence soon surpassed Mentor in PCB market share, according to reports at the time.

It’s fair to say that the 1995 through 1998 period was not one of progress for Mentor’s PCB business.

A Game Changer

While Mentor Graphics led the world in PCB market share in 1992 and 1993, its years of relative inattention to that market from 1995 to 1998 proved costly.

By 1999, Mentor top management finally decided once again to reach outside for a new PCB Division GM.

In March of 1999, Mentor hired Henry Potts as VP and GM of the PCB Division. Henry came to Mentor with an extensive resume of IC and Systems development management experience at Hitachi, Motorola, VLSI Technology, Schlumberger and Texas Instruments.

Henry Potts joined Mentor Graphics in March of 1999 as Vice President and General Manager of the Systems Design Division. Potts brought more than 33 years of experience in the electronics industry to his role at Mentor Graphics, including experience in IC & Systems development to serving as President and CEO of a venture capital funded startup. He served as a Senior Vice President for Hitachi Semiconductor where he oversaw all marketing and product development activities for microprocessor and embedded products for the US markets. He had also held senior management positions at Motorola, VLSI Technology, Schlumberger and Texas Instruments. Potts has a BS degree in Electrical Engineering from University of Southwestern Louisiana.

Potts knew from his experience that there was far more to designing an electronic system than simply laying out the PCB grid. He also realized, perhaps ahead of his peers, that developing an advanced electronic product was a collaborative team effort. Not only does a customer design team need high levels of productivity and the ability to handle the most advanced technologies in the PCB design process, but also (as Potts theorized early on) that the customers would need to implement concurrency and co-design among the entire systems development parts: PCB, IC/Package, FPGA, MCAD, procurement and manufacturing. Note that these “C” terms: collaboration, co-design, concurrency ... were seldom found in the vocabularies of EDA executives at the Millennium.

Potts also patiently set about gradually persuading Mentor’s top management that offering PCB systems design software was a very good business to pursue and should not be treated as a “cash cow”, but rather that it should be and must be suitably supported with substantial R&D and strategic acquisitions. Bravo!

But first things first. As the new person in charge, Potts had inherited a PCB product line whose key component (the interactive and autorouting technology) was then owned by an arch rival. According to an article by Richard Goering of EE|Times dated November 2, 1999, Potts said at the time, “By not having the ability to offer one continuous flow, we were not able to satisfy all the requirements of our customers.”

The good news for Mentor was that the EDA vendor Veribest was having difficulty, was available, and possessed world class routing technology. By November 1999, Potts had driven Mentor’s acquisition of Veribest to a successful close. While terms were not disclosed at the time, the price was very attractive [2].

Moreover, there were other parts of the Veribest product line acquired by Mentor that later proved to be jewels in the rough:

The acquisition of Veribest relieved Mentor of its dependence on Cadence for routing, and soon the acquired Expedition router was replacing that of Cadence (CCT) in the marketplace.

The Veribest acquisition also added skilled headcount to the MGC PCB Division, and of course its Colorado location proved irresistible as a Division HQ.

As Potts continued the division’s own R&D, he remained persistently watchful for strategic acquisitions to fill other gaps in Mentor’s total PCB solution.

Indeed, the ink was hardly dry on the Veribest deal, when Potts’ eyes fell on Innoveda, Inc., then a public company based in Marlboro, MA.

Innoveda had been created by the merger of Viewlogic Systems, Inc. and Summit Design, Inc., and then the subsequent merger of that Innoveda and PADS Software, Inc. These unions formed the foundation of a comprehensive electronic product line for system level design, design capture, board design and electromechanical design that could help engineers visualize, design and build advanced electronic systems for customers participating in the telecommunications, transportation, computers and consumer electronics markets – all the words that were interesting to Henry Potts.

The April 2002 price paid by Mentor for Innoveda ($160 million in cash) [3] was somewhat more dear than the bargain-basement $19 million paid for Veribest, but consider what Mentor realized from the Innoveda deal:

PADS—A Desktop PCB Design System:

At this juncture, Mentor already possessed world-class mid- to high-end enterprise systems in Board Station and Enterprise Expedition, but in 2002 Mentor could offer no low cost system. Competition was attacking Mentor from the bottom with their low end systems. Mentor could definitely benefit by offering its own low-end alternative as well as expand its revenue potential by addressing small companies that could use a system like PADS, which offered good technology but without the need for the infrastructure system and large-team design capabilities.

HyperLynx--for Signal Integrity:

Now the world’s most popular simulation & analysis system for high speed net design. Mentor already had a signal integrity offering, but HyperLynx was much easier to learn and use, and it was already installed in many Mentor competitors’ accounts.

DxDesigner – An excellent Design Entry System:

Same reasons as HyperLynx. Excellent technology plus it was also already installed in many competitors’ accounts. DxDesigner would redefine front-end design engineering through a process of "design definition" that combines four key process technologies: component information systems; design entry and sharing; simulation and planning; and enterprise connectivity within a single, comprehensive solution. This enables better communication among geographically dispersed engineering and manufacturing teams, resulting in more efficient component selection, less post-layout re-work, fewer design defects, and shorter prototype-debugging cycles.

Still, the Veribest and Innoveda acquisitions could be viewed mostly as catch-up actions, necessary to restore Mentor’s ability to compete in the market niche it once led.

But Potts knew better. He already had articulated his vision of “collaboration, co-design, concurrency” in words, and then he had made two acquisitions that he knew would further his goals. At this juncture he started using visuals to punctuate his points, such as the last two panels on the right side of this illustration:

Concurrency and Collaboration

But Pott’s vision went further than adding productivity and additional functionality to the PCB core design process. When one can turn serial processes into parallel processes, it’s like turning lead into gold, since designers can make significant gains in design cycle reduction and time to market improvements.

In 2004, the Systems Design Division (renamed from PCB Division) delivered one of the most significant breakthrough technologies to the industry addressing the design cycle reduction issue, in the form of “XtremePCB!”

XtremePCB allowed multiple layout designers (up to 15) to simultaneously edit the same database (without any database partitioning) and view each other’s edits in real time on a LAN or WAN network. Sort of like a video game for CAD designers. This enabled designers to reduce their layout design cycle times by up to 70%.

“By using XtremePCB, we reduced our layout time from 13 to 5 weeks. We more than doubled our design productivity.” – Alcatel Shanghai Bell

This technology was patented by Mentor and has not been duplicated.

But the concurrency did not stop at the layout process. In the same fashion, Mentor supplied true concurrent design (no partitioning, real time viewing of peers’ edits) into schematic and high speed constraint entry. This not only improved design cycle time but improved quality and reduced changes. Engineers could instantly see their peers’ edits and thus stay more in sync with the rest of the design, than if they each operated separate workstations and had to periodically re-synchronize the design database.

Combining ECAD with MCAD

As previously stated, designing a product these days is usually more than an ECAD challenge. Other disciplines such as MCAD are equally as important. But for years, these two domains had grown up as separate silos of design technology. Interfaces have existed that were able to transfer databases between the respective design domains, but these were en masse transfers and did not really enable real time collaboration.

In 2005, Potts initiated a task force, with the cooperation of key European users and of the ProSTEP standards organization, to define an interface standard that could communicate incremental change proposals between the ECAD and MCAD systems. This standard was developed, approved and then published by ProSTEP in the spring of 2008.

In 2008 Mentor Graphics and Parametric Technology Corporation (PTC) were the first vendors in their respective domains to implement the standard. It allowed a proposed change to originate in either domain and be communicated to the other electronically. A negotiation process can follow and once agreed upon, each database updated to reflect the agreed-to change. True incremental collaboration between ECAD and MCAD! If you would like to see a 15 minute demo of this capability by PTC and Mentor, go to ECAD/MCAD.

Other Potts’ Acquisitions

Potts didn’t stop there in his determination to improve the entire PCB development process. As mentioned earlier, in 2008 he persuaded MGC to acquire the 74% of Flomerics plc that MGC didn’t already own, for about $60 million. Finally MGC had access to Flomerics’ IC package, its PCB and systems level thermal analysis, and its general purpose Computational Fluid Dynamics (CFD) technology. Potts named this business unit the Mechanical Analysis Division, making a clear statement that electronics do not live in a vacuum. Again this brought the mechanical and electrical co-dependencies to light and provided users with yet another bridge between the two domains. For more details, see the EDA WEEKLY of December 2009:

http://www10.edacafe.com/nbc/articles/view_weekly.php?articleid=764356

... and on to Manufacturing

The next major step was to extend support beyond the design of the PCB and into manufacturing. With the 2010 $50 million acquisition of Valor Computerized Systems (and Frontline, a 50% joint venture with Orbotech), Mentor became the first (and so far only) supplier to be able to support a Design-through-Manufacturing process.

Important pieces of these products include the ability during the PCB design process to do extensive design for manufacturability (DFM) checks. Such checks ensure that the PCB once designed can in fact be manufactured (both bare board fabrication and assembly).

Other Valor products actually optimize the manufacturing line setup and then monitor it during operation for efficiency and reduced down time.

Again, the goal is to cut time to target volume production as well as to optimize the profits of the manufacturer and reduce product costs for the OEM.

Epilogue

So, as Mentor added needed capabilities to its portfolio, Mentor’s market share started to take off again, surpassing all other competitors and finally reaching the 50% mark in 2010. See bar chart below (Source: EDA Consortium, March 2011):

To which the writer, overjoyed but hiding it, meekly and obligingly asked, “So, this all seems really great for Mentor, but what does a 50% market share and increasing revenues mean to Mentor’s customers?”

The Mentor spokesperson patiently answered, “Basically, it means that as Mentor increases revenues and market share, Mentor will be able to continue and even increase its high level of investment in PCB systems design. Mentor understands that getting a more competitive electronic product to market faster and at reduced cost, requires more than a great PCB place-and-route capability. Product development requires the efficient collaboration of many disciplines, extensive virtual prototyping, a full design through manufacturing supporting flow, and functionality to address the most advanced IC and PCB fabrication technologies.”

The spokesperson went even further, “Mentor offers what may be the most advanced PCB Design through Manufacturing system today and as investment continues, Mentor should be able to provide its customers with whatever it takes to meet their most aggressive business goals and beat their competition.”

The “PCB Daddy from the 90’s” is very proud of his offspring!

##########

[1] Footnote:

Besides Mentor Graphics, the other two members of today’s EDA Big 3 are (1) Synopsys (founded by Aart de Geus among others in 1986; Dr. de Geus is Synopsys CEO in 2011):

Aart de Geus

And (2) Cadence (formed initially by the merger of ECAD and SDA Systems in 1988). The CEO of Cadence from 1988 to 1997 was Joe Costello. Others who held that position thereafter for relatively long periods included Ray Bingham (1999 – 2004) and Mike Fister (2004 – 2008).

Lip-Bu Tan has been CEO of Cadence since January 2009:

Lip-Bu Tan

Dr. Walden Rhines has been CEO of Mentor Graphics since late 1993:

Walden Rhines

[2] Footnote:

The following is from a MENTOR GRAPHICS company report at the time:

On October 31, 1999, the Company (MGC) purchased certain assets and all liabilities of Veribest for cash, a warrant, and assumed net liabilities with a total value of $19.1 million. The purchase accounting allocations resulted in a charge for in-process R&D of $5.2 million, capitalized goodwill of $7.5 million, and capitalized technology of $6.4 million.

[3] Footnote:

Wednesday April 24, 2002 12:19 am Eastern Time

Mentor Graphics Corporation Agrees to Acquire Innoveda, Inc.

WILSONVILLE, Ore. -(Dow Jones)- Mentor Graphics Corp. (MENT) signed a definitive agreement to acquire Innoveda Inc. (INOV) for $3.95 a share cash, or about $160 million.

##########

Special thanks for assistance with this article goes out to John (Ike) Isaac, Director of Market Development of the Mentor Graphics SDD Longmont CO, and friend extraordinaire of 21 years

John provided the illustration below that represents technologies contained in Mentor’s industry-unique Design-through-Manufacturing PCB systems design solution:

Mentor’s Design-through Manufacturing Technologies Wheel

#########

Appendix I

The PCB Division of 1990 through 1993

For several months in late 1989 the writer had been repeatedly contacted by recruiter Dan Mirich of Korn Ferry. Mr. Mirich had been retained by MGC’s Beaverton, OR-based Gerry Langeler and Marv Wolfson in the autumn of 1989 to identify a series of candidates for a new General Manager of the young MGC PCB Division.

Not yet nine years old, Mentor Graphics itself remained in the hands of the original founders Bruggere, Langeler, and Moffenbeier, all three of whom were determined and aggressive, with a strong vision for Mentor’s future.

In late 1989, however, the writer was briefly pre-occupied with the sale of his Bay Area-based MCAD/MCAE company to Morgan Stanley, and he resisted Dan Mirich’s entreaties until that sale was successfully completed. (The recruiting process adopted by MGC for this new PCB GM position was unusual, in the sense that the key people at the PCB Division were allowed to choose their new general manager from a series of interviews held with multiple candidates presented by Dan Mirich. This approach had the twin benefit of the GM candidates learning directly the issues he or she would face on day one).

Finally, the writer agreed to meet with the employee interview team of the MGC PCB Division on Zanker Road in mid-December 1989. An offer was extended between Christmas and New Year’s Day, and yours truly was on the job in early January 1990 in time to attend the annual Mentor Graphics Worldwide Sales Kickoff in Oregon.

Dr. Henke (1989)

Thus began the four consecutive years of PCB Division progress briefly described in paragraph two of the Prologue. During those years, the PCB Division succeeded in achieving the worldwide leading market share in both 1992 and 1993.

Some of the PCB Division’s 1990 – 1993 accomplishments:

The PCB Division team actively supported the San Jose Symphony Orchestra, initiating the annual Silicon Valley CEO NIGHT at the Symphony on behalf of Mentor Graphics. Early 1990's guest conductors for CEO Nights at the Symphony included, among others, composers and artists Bert Bacharach (below left), Peter Nero, and Henri Mancini (below right).

#########

Appendix II

S I A

by Email Contact

On July 5, 2011 the Semiconductor Industry Association (SIA), representing U.S. leadership in semiconductor manufacturing and design, announced that worldwide sales of semiconductors were $25 billion for the month of May 2011, a (mere) 1.8% increase from the prior month when sales were $24.6 billion, and a 1.3% growth from May 2010. All monthly sales numbers represent a three-month moving average.

"Taking into consideration macroeconomic factors impacting consumer confidence, the steady but modest growth that the industry demonstrated in May is encouraging,” said Brian Toohey, president, Semiconductor Industry Association. “Global demand for high-end electronics, the continuing proliferation of semiconductor technology into a wider range of products, growth in emerging economies and better than expected recovery from the Japan earthquake will be continued drivers of industry growth in 2011."

The industry continues to see increasing demand for tablets and e-readers, as well as increased demand for industrial processors that enable devices to harness renewable energy like solar panels and e-meters. Additionally, the industry has seen strong demand for electronic systems included across all ranges of vehicles.

Economic uncertainty both in the U.S. and abroad bears close watching, while further opportunities for semiconductor sales growth will be concentrated in emerging markets like China and India. Year-to-date results are in line with projections recently reported in the Spring Semiconductor Sales Forecast from WSTS that indicate global industry sales will increase 5.4% for 2011, 7.6% in 2012 and 5.4% in 2013, with a 3-year compound annual growth rate of 6.13% from 2010 to 2013.

To learn more about SIA visit,

www.sia-online.org.

############

Appendix III

On July 18, 2011 the EDA Consortium (EDAC) Market Statistics Service (MSS) announced that the Electronic Design Automation (EDA) industry revenue increased 16.0% for Q1 2011 to $1446.4 million, compared to $1247.0 million in Q1 2010. Sequential EDA revenue for Q1 2011 decreased 4.1% compared to Q4 2010.